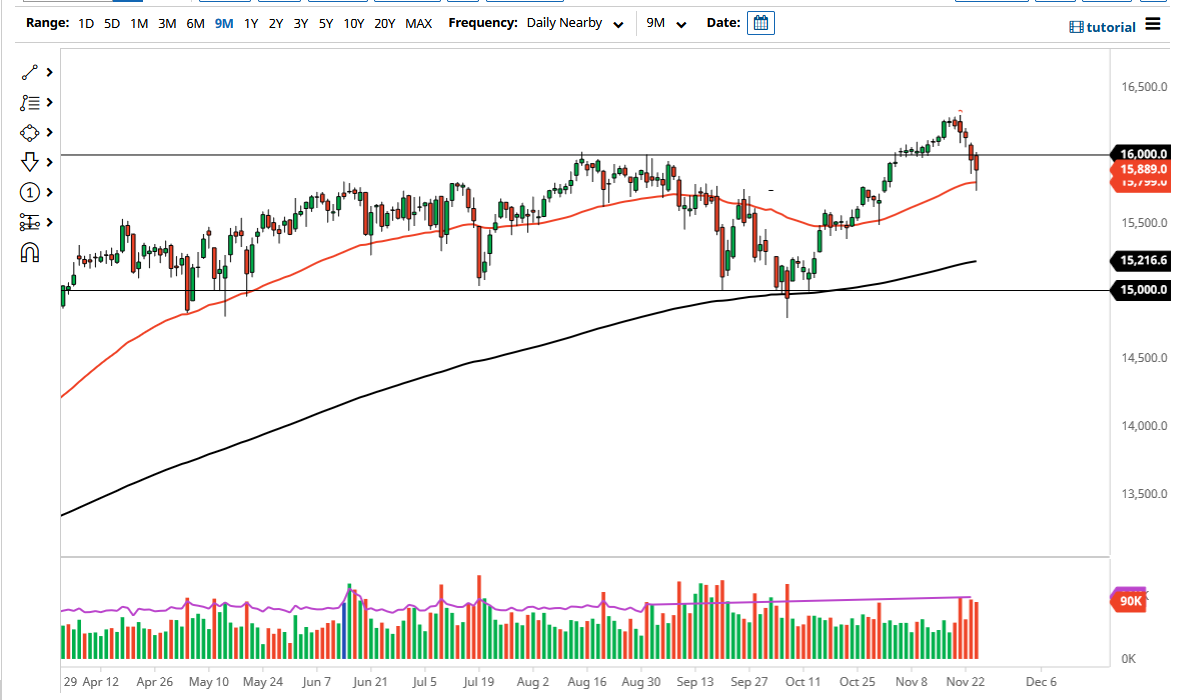

The DAX fell rather significantly on Wednesday, reaching down below the 50-day EMA. However, by the end of the day we turned around to show signs of life and form a nice-looking hammer. At this point, it is only a matter of time before the buyers come in and pick up the DAX from what I can see, and it certainly makes sense that a bit of value hunting has come back into the picture. After all, Germany is the stalwart when it comes to the European Union, so what happens in Germany is a major influence on the EU itself. There are concerns about Germany locking itself back down, but as you can see traders got involved again in order to pick up gains.

The DAX has been in an uptrend for quite a while, and now I think the next signal would be whether or not we can break above the €16,000 level. If we can, then the market is likely to go back towards the all-time highs. Breaking down below the bottom of the candlestick for the trading session on Wednesday would be a negative sign, but I just do not see the point of shorting the DAX, because given enough time we will continue to see buyers. The market has been in an uptrend for ages, and unless we see some type of major attitude shift in risk appetite, which is something that I do not see happening quite yet, we could get another negative day on Thursday. But if we turn around and show signs of recovery again, I think that would be an opportunity to pick up the dip.

Underneath that, then we have the €15,500 level, and then the 200-day EMA which is closer to the €15,216 level. The absolute “bottom of the trend” is closer to the €15,000 level underneath, which is where the most recent bounce had come from, so one would have to think that there is a lot of “FOMO” coming into the picture in the last couple weeks that could be thought of as a potential buying opportunity based upon value. Anything below there would have the DAX entering a very bearish market.