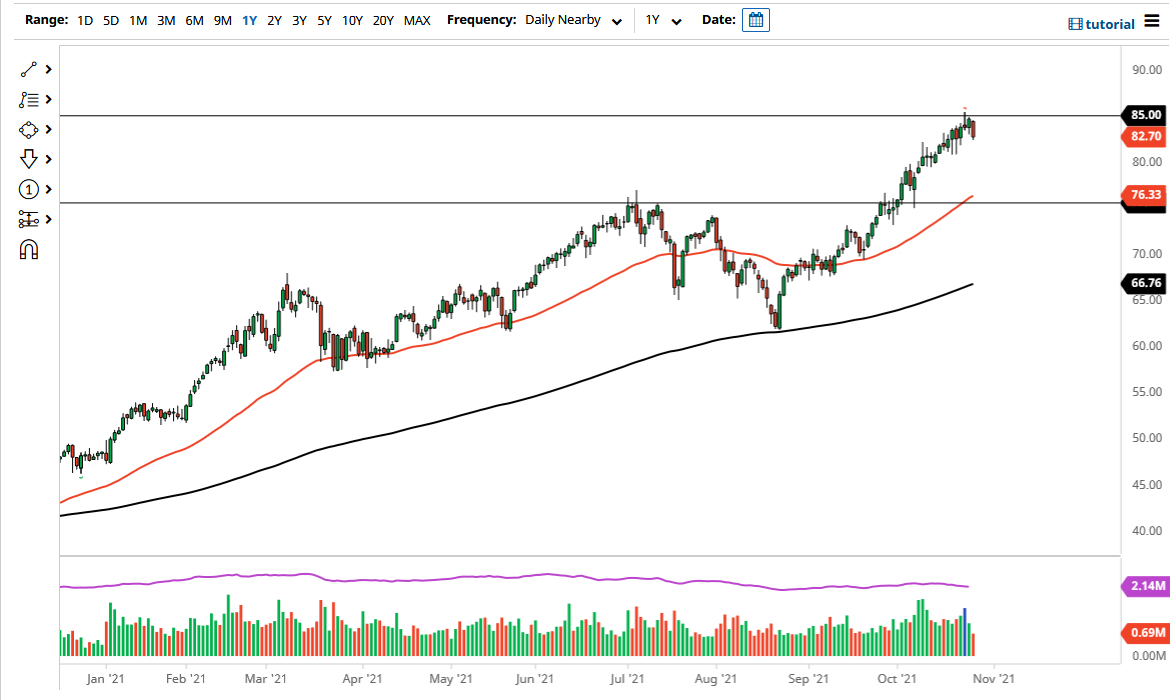

The West Texas Intermediate Crude Oil market showed itself to be somewhat resistant to break above the $85 level, but it is probably only a matter of time before we clear that psychologically important figure. We formed a shooting star on Monday, and since then it has held true. That being said, I think the real signal is either going to be on a pullback that shows signs of support, or a move above the shooting star that shows a blowout of the resistance.

We are in an uptrend, and for good reason. After all, we have the lack of drilling last year that has dwindled supplies. The lack of capital expenditure in this market means that not as much fresh oil has been found, and therefore supply continues to tighten. The members of OPEC all seem to be very comfortable with high pricing, so you need to be aware the fact that OPEC is not going to increase production in order to drive down price, despite what Joe Biden asks of the cartel. Furthermore, the United States is not in the position to expand production at the moment, not with the current administration.

The US dollar has been drifting a bit lower as well, and that works for the value of crude oil as the contract is priced in that very same currency. Ultimately, it takes more of those dollars to pick up a barrel of oil. At this juncture, it looks as if any pullback will be bought into based upon the idea of value, especially near the $80 level, followed by the 50-day EMA which sits just above the $75 handle. The $75 handle has been massive resistance in the past, so it is worth noting that it should be supportive based upon “market memory.” If we were to break down below that level, then I would anticipate that the overall trend will change. Right now, it does not look very likely to make that type of move, at least not without some type of major “risk off catalyst.” As the world wakes up from the pandemic lockdown, demand for energy will continue to increase, thereby forming a bit of a feedback loop for higher pricing over the next several months.