The formation of a flag is becoming clearer for the GBP/USD, amid a neutral performance for several consecutive trading sessions. The pound is looking for catalysts to strengthen the bullish channel that it formed recently, and the pair settled around the 1.3665 level. The economic output of the United Kingdom has fallen by more than 20% in the first half of 2020 as a result of the COVID-19 pandemic and measures to contain its spread, which led to an increase in unemployment and thus an increase in the amount of spare capacity available.

Although activity has recovered somewhat, the Bank of England said on October 12, 2020 that it expects the economy's output to remain below its potential level "for some time". But fast forward a year and upward pressure on wages suggests that this spare capacity is now limited, so more economic growth could drive up wages and inflation.

Under these circumstances, the British central bank tends to act with rate hikes and explains why markets now expect a rate hike of 10 basis points in November and another three in 2022. UK GDP grew 0.4% month-on-month in August 2021 as the economy begins to grow again after a 0.1% decline in July, but some economists warn that growth has almost certainly slowed since then. However, the 0.4% growth figure disappoints slightly against market expectations of 0.5% GDP growth.

The British economy grew by 6.9% on an annual basis in August, according to the Office for National Statistics, exceeding expectations of 6.7%, but it came in less than the 7.5% growth published in July, and the UK's gross domestic product now remains 0.8% below the pre-coronavirus pandemic level.

The jump in UK GDP is likely to be short-lived. "The improvement in August may have played a major role in the fading of restrictions from the 'July epidemic', which at one time meant more than a million people self-isolated," says Paul Dills, chief UK economist at Capital Economics.

The country's distinct vaccination system has helped the economic recovery grow in the service sector, which accounts for more than 80% of economic activity in the UK. The Office for National Statistics says services production grew 0.3% in August, a rebound from the 0.1% decline recorded in July.

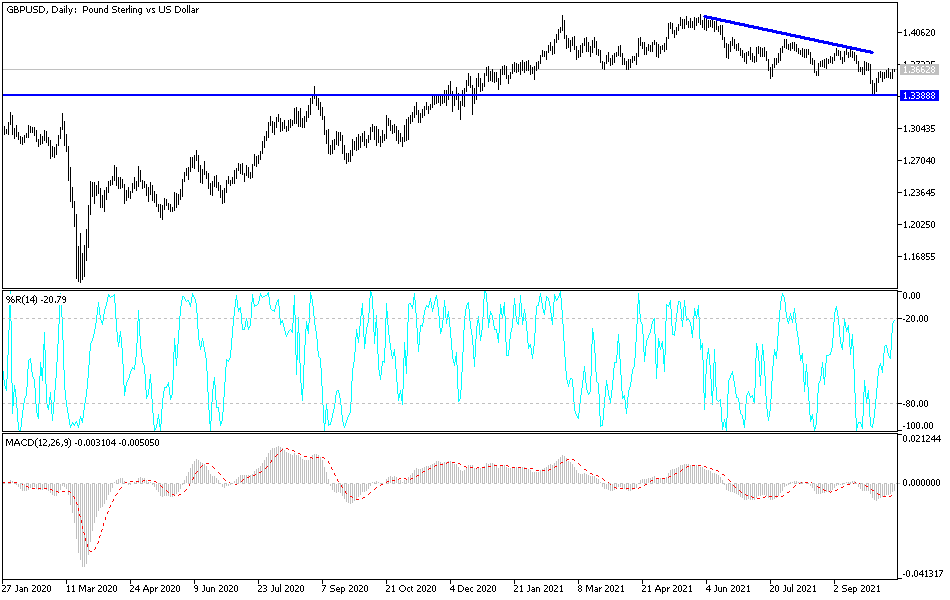

Technical analysis of the pair

On the daily chart, the GBP/USD is trying to break out of the upside flag formation range due to the British economic performance and an expected tightening of the BoE policy in the near future. But at the same time, the US dollar has the same factors, which explains the secret of the neutral performance of the currency pair recently. In general, the resistance levels 1.3740 and 1.3860 are important for the bulls because they open a move towards the psychological resistance level of 1.4000 again.

The bearish outlook for the currency pair will be strengthened if the currency pair settles below the 1.3550 support level, which was the catalyst for the currency pair to move towards its lowest level of 2021.

The pound is not expected to announce any important British economic data today. From the United States, a reading of the number of jobless claims and a reading of the Producer Price Index will be announced, one of the factors of inflation in the country.