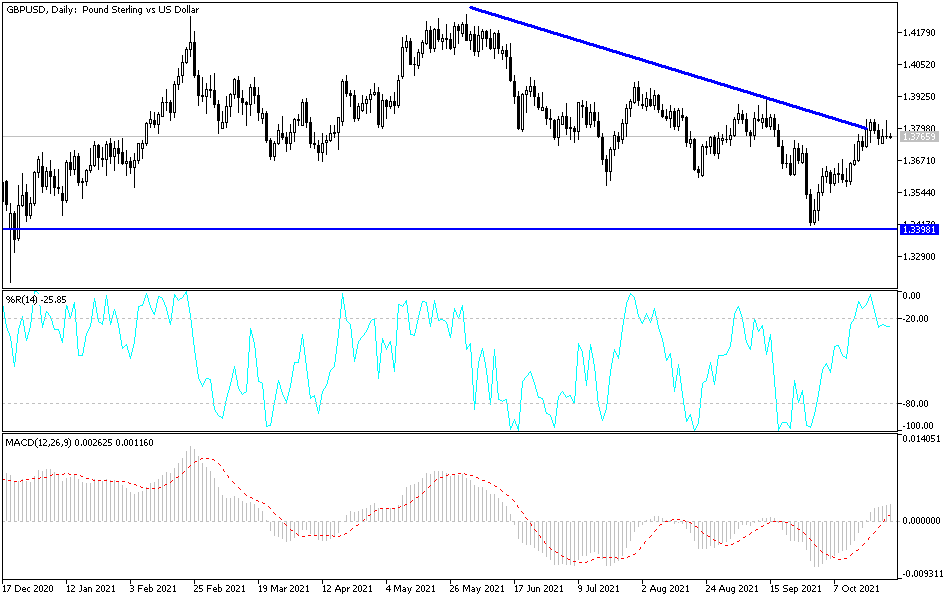

The British pound has initially rallied during the trading session on Tuesday but gave back gains at the same level yet again. The 1.3840 level is a significant resistance barrier, as we have seen multiple days in a row. That being said, the market is likely to see that barrier as being crucial, and as long as we stay below there it is likely that we will continue to see back-and-forth behavior in general, and therefore I think you will continue to see more sideways action than anything else. Quite frankly, the fact that we cannot break above that area suggests that we are trying to build up momentum, but we have still yet to see a massive breakdown. In other words, it is almost like holding a beach ball under water.

Underneath, the 1.37 level is a significant support level, where the 50 day EMA currently resides, right along with the 200 day EMA. That is a significant indicator that most traders will continue to pay close attention to. As long as we can stay above there, then I think we are still bullish, but if we were to break down below both of those moving averages, it is very likely that we would go seeking the 1.36 handle for signs of support. After that, the market very well could go looking towards the 1.35 handle.

If we do break out to the upside, the 1.39 level would be a target, followed by the 1.40 level. The 1.40 level is of course a major area that people have been paying close attention to, so I do think that we are in a scenario where we should see quite a bit of bullish pressure come into the picture once we get above there. If we break above the 1.40 handle, then I think we go looking towards much higher levels, as it is a signal that the trend is going to pick up momentum to the upside. The market has recently broken above a downtrend line, so that something that should be kept in the back of your mind as well, but the British pound has had to digest the massive gains that were realized during the pandemic. It will be interesting to see whether or not we can break out to the upside, but at this point in time it is likely that we would see yet another attempt to do so.