The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

There are a some strong valid long-term trends in the market right now, so it is a good time to be trading to take advantage of that.

Big Picture 10th October 2021

Last week’s Forex market partially moved in line with prevailing trends, excepting the Canadian and Australian dollars which showed relative strength. The Canadian dollar was the strongest major currency, while the Japanese yen was the weakest. Crude oil moved firmly higher to a new multi-year high price.

I wrote in my previous piece last week that the best trades were likely to be short in the EUR/USD currency pair and long in WTI Crude Oil following a daily closing price above $76.36. EUR/USD ended the week 0.19% lower while WTI Crude Oil rose by 2.46% after closing at $77.59 on Monday. This produced an averaged win of 1.33%.

Fundamental Analysis & Market Sentiment

The headline takeaways from last week were the continuing rise in the price of crude oil in the face of increased demand and continuing supply chain problems, a worse than expected US NFP jobs report, and the Reserve Bank of New Zealand’s first rate hike in many years to a new rate of 0.50%. The Bank of England also warned of an earlier than expected rate hike on the way and if recent inflation proves to be persistent, we may see more central banks hiking rates in the near term. Stock markets dipped early in the week before recovering towards the end of the week after the US Congress raised the debt ceiling and averted a crisis.

Last week saw the global number of confirmed new coronavirus cases fall for the seventh consecutive week after previously rising for more than two months, with deaths lower for the sixth consecutive week. Approximately 46.4% of the global population has now received at least one vaccination.

The strongest growths in new confirmed coronavirus cases right now are happening in Armenia, Australia, Bulgaria, Croatia, Dominican Republic, Egypt, Estonia, Latvia, Lithuania, Moldova, New Zealand, Romania, Russia, Singapore, Slovakia, and the Ukraine.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed an indecisive doji candlestick last week after having earlier rejected the zone of support which I had identified between 11899 and 11833. The price is above the levels from 3 and 6 months ago, which shows that the long-term bullish trend in the greenback is still valid. However, the short-term momentum is unclear in the USD right now. This suggests that trades in the USD look better on the long rather than short side right, so the best strategy in the Forex market over the coming week will probably be to look for long trades in US dollar currency pairs but only once the short-term momentum turns from bearish to bullish.

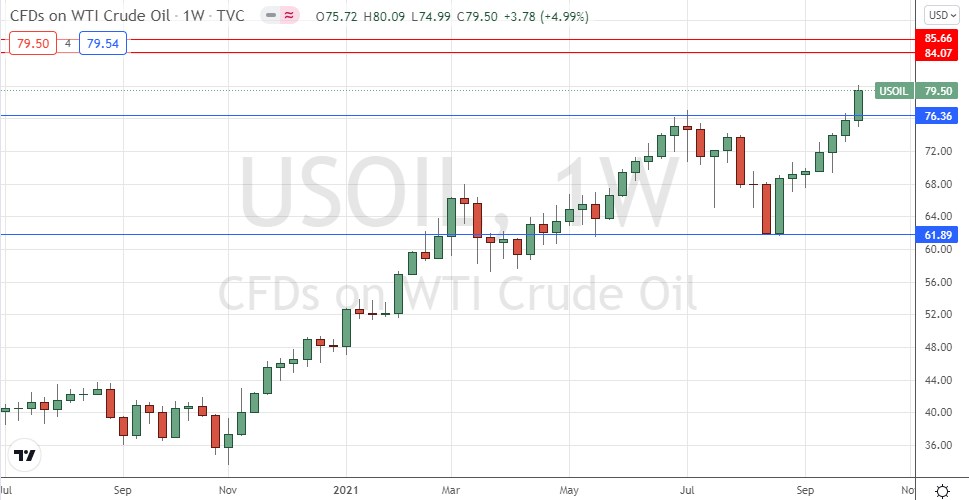

WTI Crude Oil

WTI Crude Oil closed Friday at a new 6-year high weekly closing price for the second consecutive week. This is a very bullish sign. The price is likely to continue rising over the short term as the global energy supply crisis continues. Bulls should be aware of the potential resistance level shown in the price chart below just above $84.

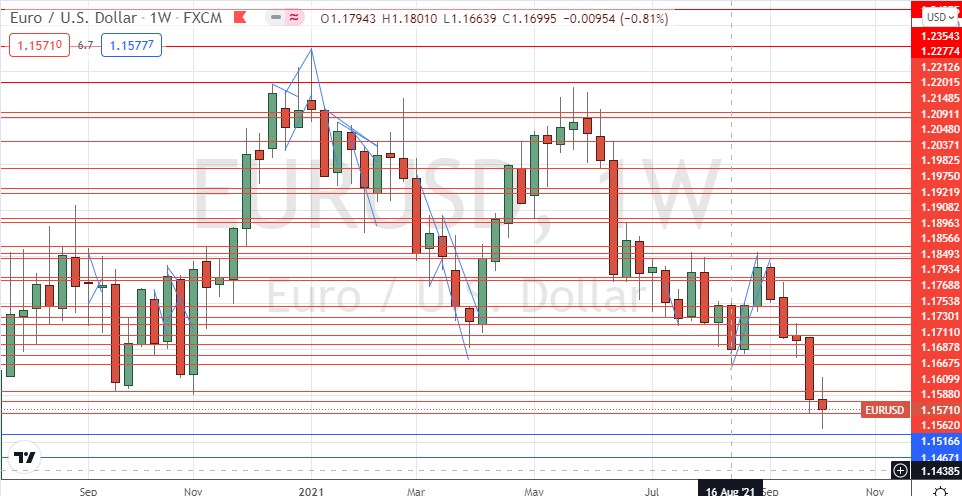

EUR/USD

The EUR/USD currency pair broke to a new 14-month low price for the second consecutive week but made a significant bullish retracement as can be seen from the fact that the weekly candlestick is almost a doji. The Euro has the steadiest long-term weakness of any major currency, but it is trending slowly with deep retracements, like the EUR/USD tends to. It is likely that the price will continue to move lower over the coming days once the short-term momentum turns bearish again, although the medium-term downside may be limited by the big psychological round number below at 1.1500, which is confluent with a long-term pivotal horizontal level at 1.1517 which could halt the drop.

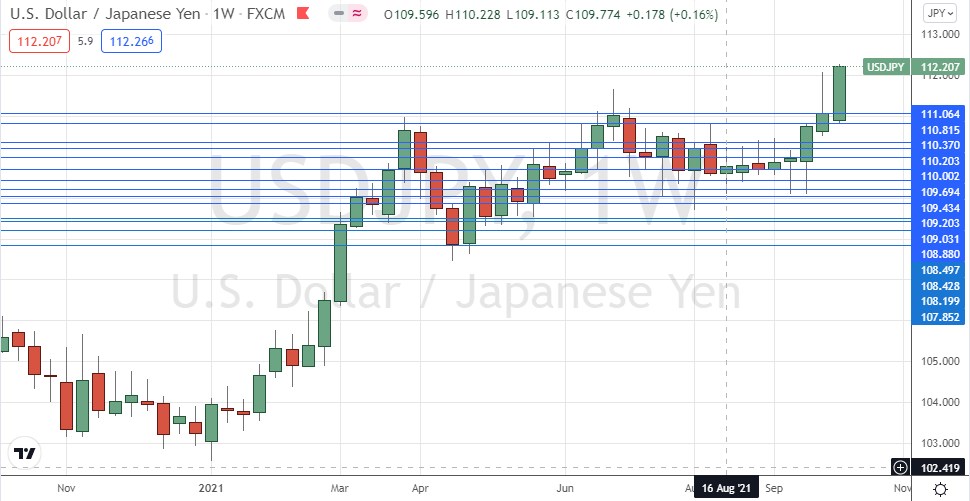

USD/JPY

The USD/JPY currency pair made a strong and dramatic bullish breakout last week beyond its recent multi-month range. The range of the weekly candlestick was unusually large, and the price closed near the top of that range. These are bullish signs which suggest trading this pair long is likely to be a good opportunity to make some profit, especially as there are no key resistance levels until 115.45. One word of caution: the breakout price action recently has included deep retracements.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short EUR/USD and long WTI Crude Oil in US dollar terms, and long USD/JPY.