Since the beginning of this week's trading, the EUR/USD is still stable around the 1.1600 level, looking for catalysts to get out of the general bearish trend. The trend is supported by the strong expectations of an imminent date for raising US interest rates, and supported by the distinguished results of the recent US economic releases. This morning, the EUR/USD pair fell to the support level at 1.1584, near its lowest in years. Euro exchange rates will find the potential for recovery limited by the European Central Bank determined to ensure that interest rate hike expectations remain low, while studies also suggest that the single European currency is becoming increasingly sensitive to broader risk sentiment in 2021.

Therefore, Forex analysts say that the potential for the euro's recovery will be challenged by the European Central Bank (ECB) which is determined to ensure that the cost of financing in the Eurozone remains as low as possible, even in the face of mounting inflationary pressures. The expectation that the European Central Bank would be one of the last major central banks to raise interest rates was a major driver of the poor performance in the euro, not only in 2021, but in previous years.

“The cautious stance on policy guidance from the central bank suggests that the scope for a coordinated recovery for the euro remains limited,” says Jane Foley, chief FX analyst at Rabobank. Rabobank maintains its three-month forecast at 1.15 for the EUR/USD pair. She adds that the recent sell-off in the euro suggests that it may be more sensitive to any "hawkish" statements from ECB members in preparation for upcoming ECB meetings.

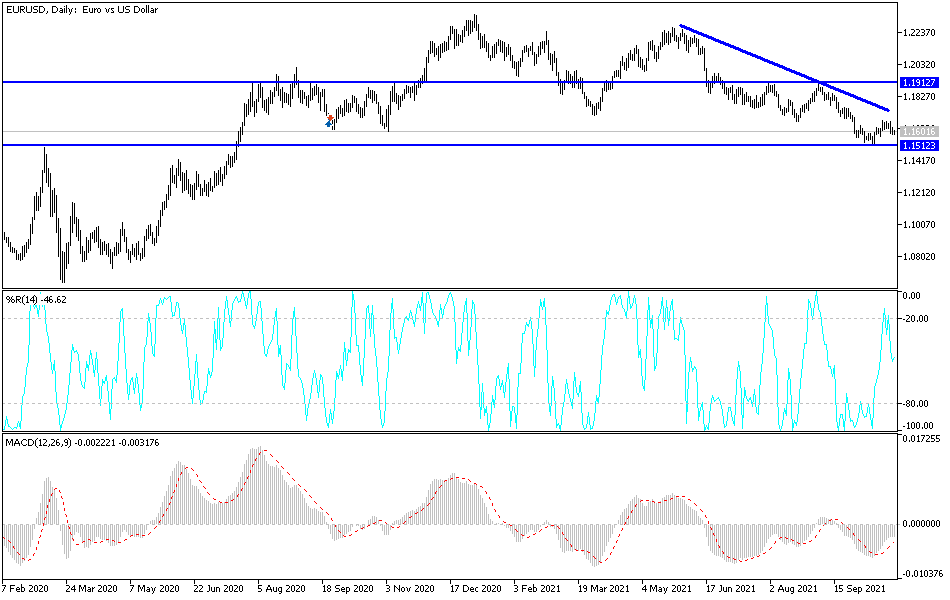

This call comes at a time when the EUR/USD rose from its lowest level in several months at 1.1524 to trade at 1.1600 at the time of writing this report.

The euro's recovery in October still looks flat on the daily chart, and the bulls found little support from the European Central Bank's chief economist, Philip Lane, who said on Tuesday that the market was wrong in delivering the expected timing of the central bank's first rate hike. He said that it is difficult to reconcile between market price pricing and future directives issued by the European Central Bank continuously, meaning that prices will remain fixed until at least 2024.

"The markets may not have fully grasped the ECB's future guidance," he said at an online event. "When you look at market rates for the forward rate curve, I think it's difficult to reconcile some of the market's views with our clear and direct guidance," he added. By declaring that there is no intention to raise interest rates in the near future, the ECB and its members are helping to ensure that market expectations and funding costs remain at very low levels.

Technical Analysis

On the daily chart, the stability of the EUR/USD below the support level 1.1600 will increase the opportunity for the bears to hold on to the trend and move towards stronger support levels, the closest of which are currently 1.1545 and 1.1480. These will push the technical indicators towards strong oversold levels. On the upside, to bring about a strong shift in the trend, the bulls will have to move towards the psychological resistance level of 1.2000, and this will not happen without breaching the 1.1850 resistance over the same period of time. The general trend of the EUR/USD pair so far is still bearish.

The GFK index of German consumer climate and money supply for the Eurozone will be announced. From the United States of America, the most important durable goods orders will be announced.