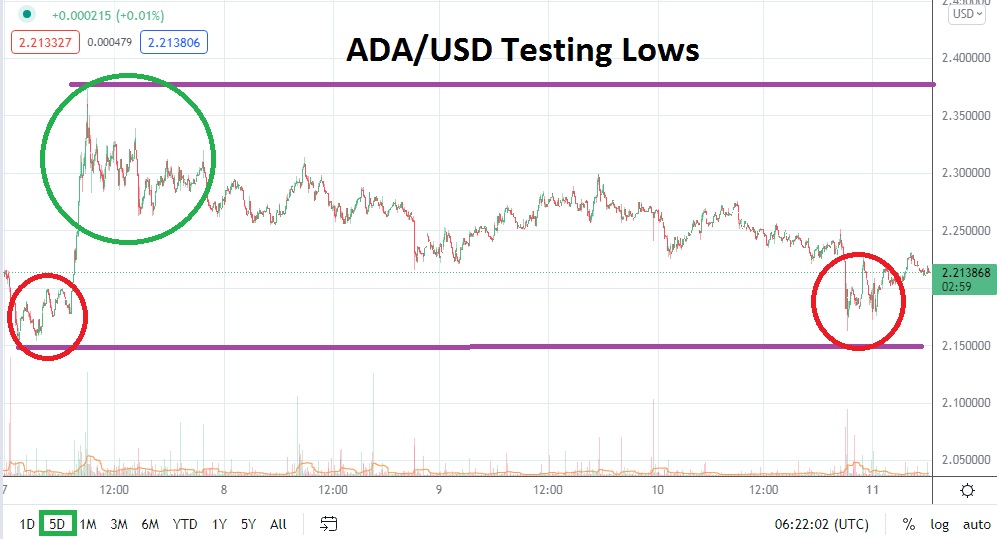

The past few days of trading for ADA/USD have seen a decline in value starting to dominate its trading realm. After falling to a low of nearly 2.133000 on the 7th of October and suddenly spiking higher toward the 2.378000 level, ADA/USD has incrementally lowered. As of this writing, ADA/USD is near the 2.210000 juncture and it continues to signal that downside pressure may remain the outstanding feature near term.

On the 11th of September, ADA/USD was trading near the 2.800000 mark, but its trading efforts since then have created a choppy road lower. ADA/USD has correlated well with most of its major counterparts in cryptocurrency, except for Bitcoin, which has outperformed the marketplace the past month. If current support for ADA/USD falters below the 2.210000 and the 2.200000 is seriously challenged and prices are sustained below these depths short term, Cardano could test the 2.180000 to 2.160000 marks it traversed the past couple of days rather easily.

Speculators, however, should always be on the lookout for sudden spikes to emerge and they should particularly be ready for moves that go against their chosen positions. ADA/USD has a habit of producing fast moves which can cause havoc on unprotected trades. While wagering on downside momentum may look attractive, traders need to have stop loss orders working to protect their accounts.

Since reaching an all-time high of nearly 3.100000 on the 2nd of September, ADA/USD has seen rather steady headwinds produced. Like all cryptocurrencies, these apex values and the declines which have come afterwards can and will likely be shrugged off by many speculators and thought of as typical volatility within the digital asset world. Traders who remain optimistic are certain to believe sunnier days will be produced again shortly and that gains will eventually outweigh declines.

However, the trend in the short term and actually mid-term for ADA/USD has been rather bearish. Betting on sudden reversals higher may prove to be correct, but this would be wagering against the incremental declines in value which have been exhibited for nearly a month-and-a-half. Current support levels do look vulnerable and selling ADA/USD while aiming for values below may be the logical speculative choice near term.

Cardano Short-Term Outlook

Current Resistance: 2.236000

Current Support: 2.193000

High Target: 2.298000

Low Target: 2.090400