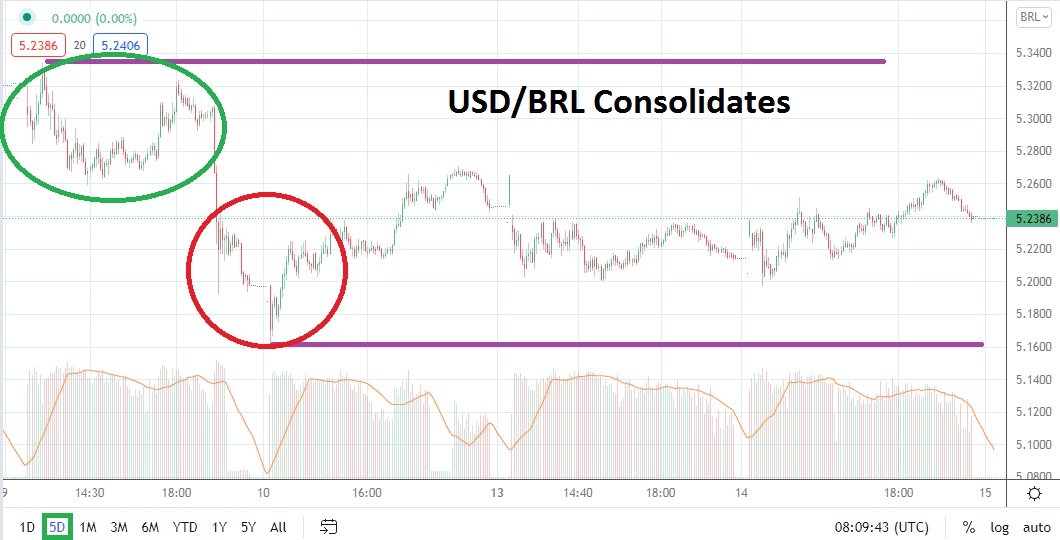

As of this writing, the USD/BRL is near the 5.2380 level and it finished yesterday’s trading with a slight selloff. The USD/BRL has also been able to produce a slight lowering of resistance levels the past couple of days and speculators may be tempted into believing bearish momentum is showing signs of increasing. However, while higher prices in the USD/BRL have not been sincerely challenged, intriguingly support levels have remained rather durable.

Consolidation in the USD/BRL is rather tight and traders may be anticipating some type of breakout. While the global equity indices have been showing signs of nervousness the past couple of weeks, the USD/BRL has maintained a rather steady pace and not seen a significant amount of volatility. Speculators may be wondering when the USD/BRL will suddenly break free of its tight range and perhaps demonstrate a spike.

Technically, the 5.2000 to 5.3000 range can certainly be said to be the current range for the USD/BRL, but that is too easy. Yesterday’s early low for the Forex pair was near 5.1950 which tested lower levels seen the past couple of days, but on the 10th of September, the USD/BRL did trade near the 5.1600 juncture. This low on the 10th created a strong reversal higher which traced the 5.2700 mark.

Until consolidation erodes in the USD/BRL, traders may be tempted to continue to place trades which seek quick results based on support and resistance levels. Traders should wait for the USD/BRL to open today and then put entry orders into the market, so they are not given price fills which do not meet their expectations. Equity futures indices in the U.S are indicating a positive opening, which may prove beneficial for bearish positions early today in the USD/BRL, but that cannot be guaranteed. While the USD/BRL has incrementally seen resistance lower, it still has not been proven a strong selling trend has emerged.

Cautious traders may want to wait for slight movements higher in the USD/BRL and sell the Forex pair while seeking nearby support levels as a target to try and cash in take profit positions. The consolidated range of the USD/BRL is interesting, but it is also potentially dangerous and traders should use their risk-taking tactics carefully near term as the broad markets await a lynchpin which could ignite sudden volatility.

Brazilian Real Short-Term Outlook

Current Resistance: 5.2530

Current Support: 5.2220

High Target: 5.2900

Low Target: 5.1600