The NASDAQ 100 rallied ever so slightly on Wednesday but gave back the early gains to turn things around and show signs of hesitation. This is not a huge surprise considering that the market has to look forward to the jobs figure on Friday, and that in and of itself will cause a certain amount of noise. All that being said, the market continues to be in an uptrend, and I simply do not see a scenario in which you should be shorting the NASDAQ 100 or any other US indices for that matter.

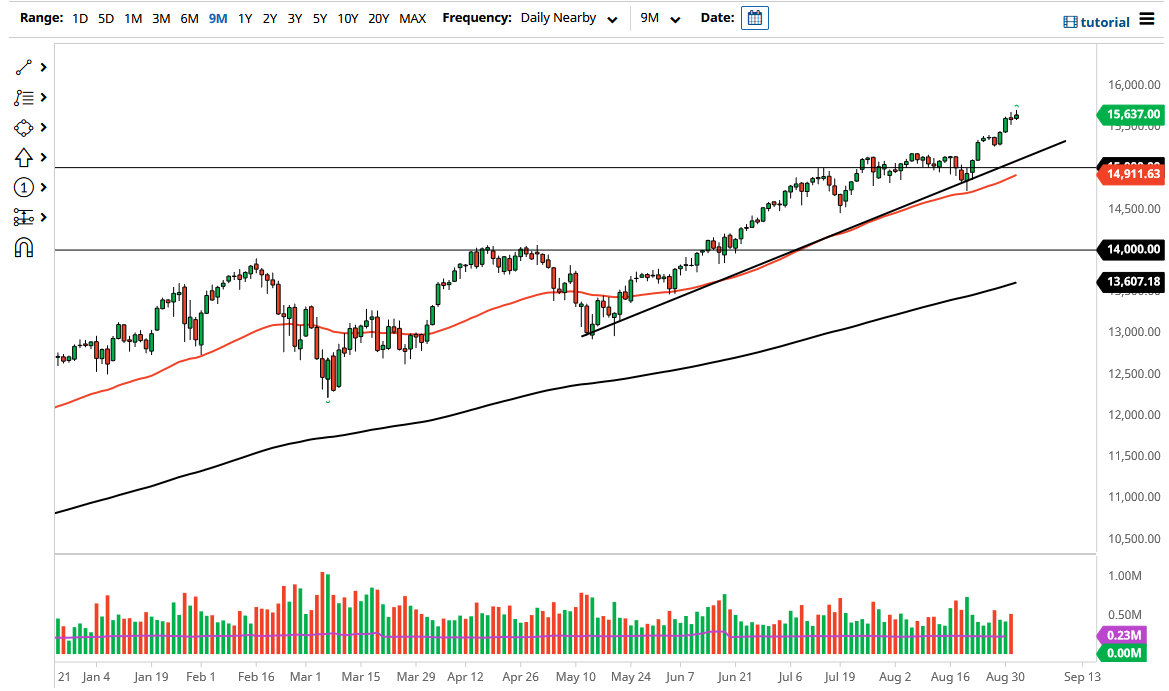

If we do pull back, there are plenty of areas underneath that would offer support, not the least of which would be the 15,500 level. After that, we also have the uptrend line that comes into the picture, with the 50-day EMA sitting underneath there to offer support, and finally the 15,000 level. At this juncture, I believe that the 15,000 level is essentially your “floor in the market” in the short term, and it is not until we break through that area that I would be a buyer of puts. Nonetheless, I do not see that happening anytime soon, so I think this is a scenario in which we are looking for a dip to start buying.

Interest rates falling will help the NASDAQ 100, because the typical growth stocks continue to be what everybody wants. That being said, the Thursday session might be a little bit difficult, simply grinding sideways just as the Wednesday candlestick showed. However, if we get some type of pullback, I will be looking for signs of support to get involved, because that is the only thing you can do in this market. The Federal Reserve will make sure that interest rates remain low enough to keep the NASDAQ 100 going higher, so as long as that is going to be the case, I just do not see the catalyst to start selling. Any pullback will have plenty of buyers underneath waiting to get involved as they may have missed out on some of the profit over the last couple of weeks. This market is in a perfect 45° uptrend channel, and I think the market is very comfortable going higher over the longer term and I suspect that people will be adding to positions every time they get an opportunity.