As previously forecasted, the EUR/USD has been in a narrow range ahead of the Federal Reserve FOMC meeting minutes release today. Since the start of this week's trading, the EUR/USD pair has been stable in a range between the support level of 1.1700 and 1.1748, settling around 1.1724 as of this writing. The sell-off increased in the market, which was partly driven by concerns about debt-laden Chinese property developers and the damage they could cause if they defaulted, sending ripple effects across the markets. That has added to a wide range of concerns swirling around investors, including a highly contagious delta variant as well as price hikes that are putting pressure on businesses and consumers.

Wall Street is also measuring how the slowdown in the recovery will affect the Fed's policies that helped support the market and the economy. The central bank will release a policy statement today, which will be closely watched for any clues on how to eventually reduce its bond purchases that helped keep interest rates low.

The Fed is expected to send the clearest signal yet that it will begin to rein in ultra-low interest rate policies later this year, a first step toward undoing the exceptional support it has provided to the US economy since the pandemic hit 18 months ago. Many economists believe the Fed will formally announce a drawdown in November, in response to a steady recovery from the pandemic recession and accelerating inflation that has raised widespread concerns. Today's Fed policy meeting could lay the groundwork for that announcement.

When their meeting ends on Wednesday, Fed officials are set to keep the benchmark short-term interest rate, which affects many consumer and business loans, near zero. They are also likely to maintain $120 billion in monthly bond purchases, which are aimed at lowering long-term loan rates.

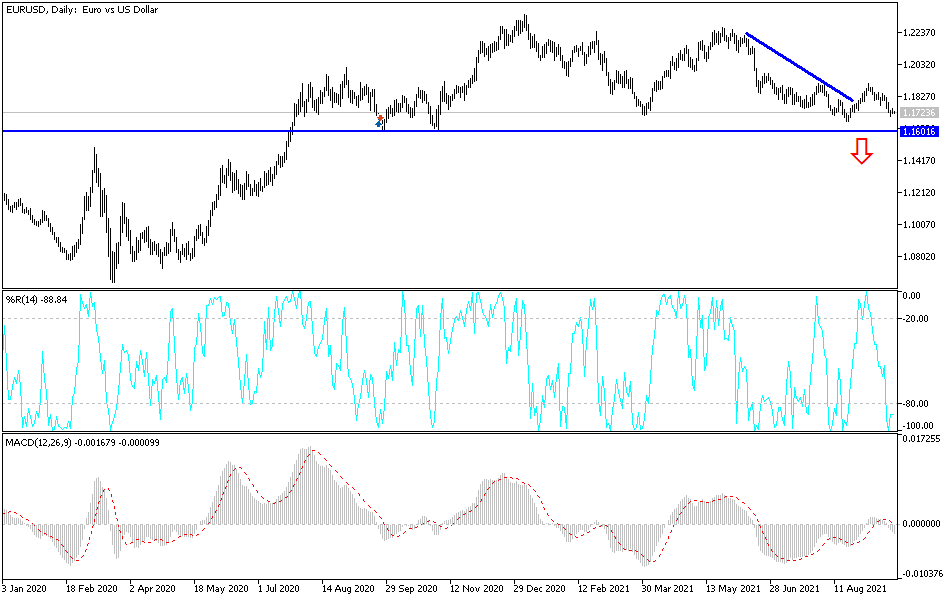

Technical analysis of the pair

The bearish momentum of the EUR/USD is still valid, and breaking through the 1.1700 support - as attempted at the beginning of this week - will be a catalyst for the bears to move towards the next support levels at 1.1660 and 1.1580. The last level is sufficient to push the technical indicators on the daily chart to oversold levels. On the upside, the psychological resistance at 1.2000 will remain crucial for bullish dominance and change the current bearish outlook. The currency pair will be affected today by the updated monetary policy decisions of the US Federal Reserve, its update of its forecasts, and then the statements of its chairman, Jerome Powell.

This is in addition to risk appetite, the Chinese financial crisis, and the effects of the coronavirus.