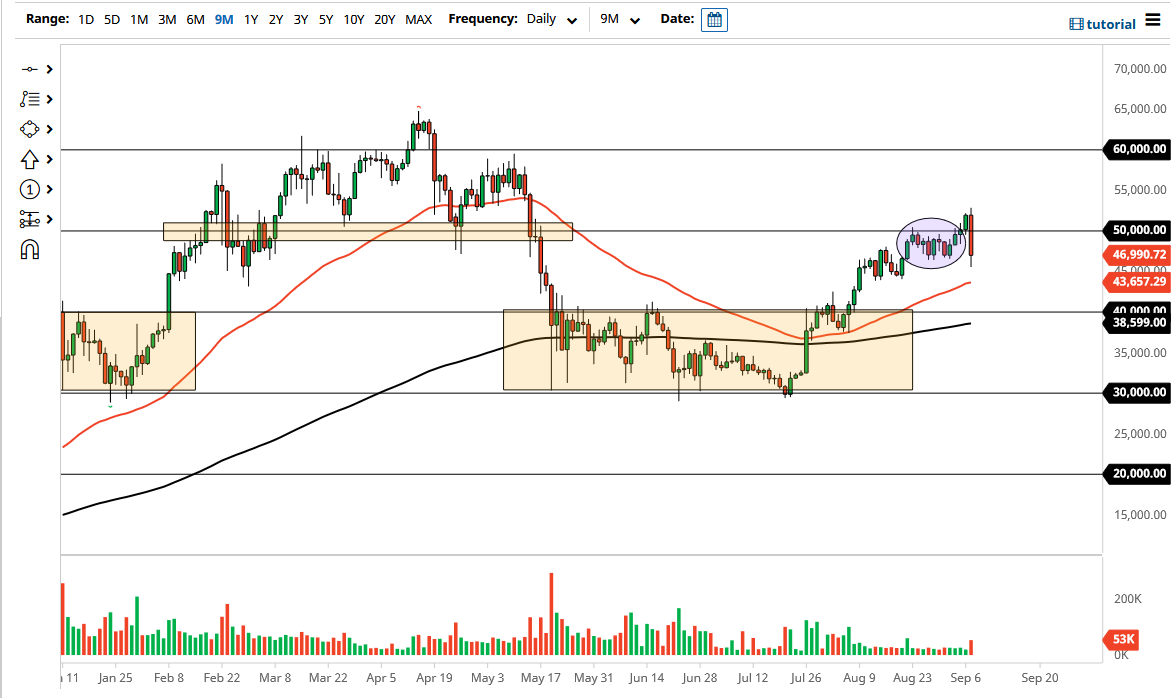

The Bitcoin market has broken significantly to the downside to slice through the $50,000 level on Tuesday, apparently out of the blue. There have been rumors of “whales” for selling Bitcoin, just as El Salvador was buying Bitcoin, but that is a narrative that has nothing to do with anything provable. Quite frankly, this is a candlestick that does solidify the idea of $50,000 being important and therefore I think at this point in time the game just got quite a bit murkier.

If we break down below the bottom of the candlestick, then I believe that the market is going to continue going lower, perhaps reaching towards the 50 day EMA, and then down to the $40,000 level. That of course is an area that would come into the picture as the 200 day EMA sits just below there. We do have the 50 day EMA that a lot of people pay attention to between now and then, so do not be overly surprised to see some type of supportive candlestick. Regardless, I would not be a short-term buyer, because quite frankly if we get an opportunity to go long, it will present itself on a daily candle that shows stabilization.

If we were to turn around and take out the nasty candlestick that made up the Tuesday session, that would be an extraordinarily bullish sign, especially if we do it rather quickly. That does not look likely to be the case, but if it were to happen that opens up the possibility of a move to the $55,000 level, and then eventually the $60,000 level. That being said, I think that the Tuesday session was a perfect example of why it is so difficult to trade Bitcoin or any other crypto for that matter, because quite frankly it is extraordinarily volatile. It does not behave like other assets, so while a lot of people have made good money simply buying and holding, have to deal with these 10% losses popping up randomly like we saw during the trading session. If we break down below the $40,000 level though, I think that would signify something much more significant, but one thing is for sure: candlesticks like this very rarely happen in a vacuum, so I would anticipate that we should see a little bit of follow-through going forward.