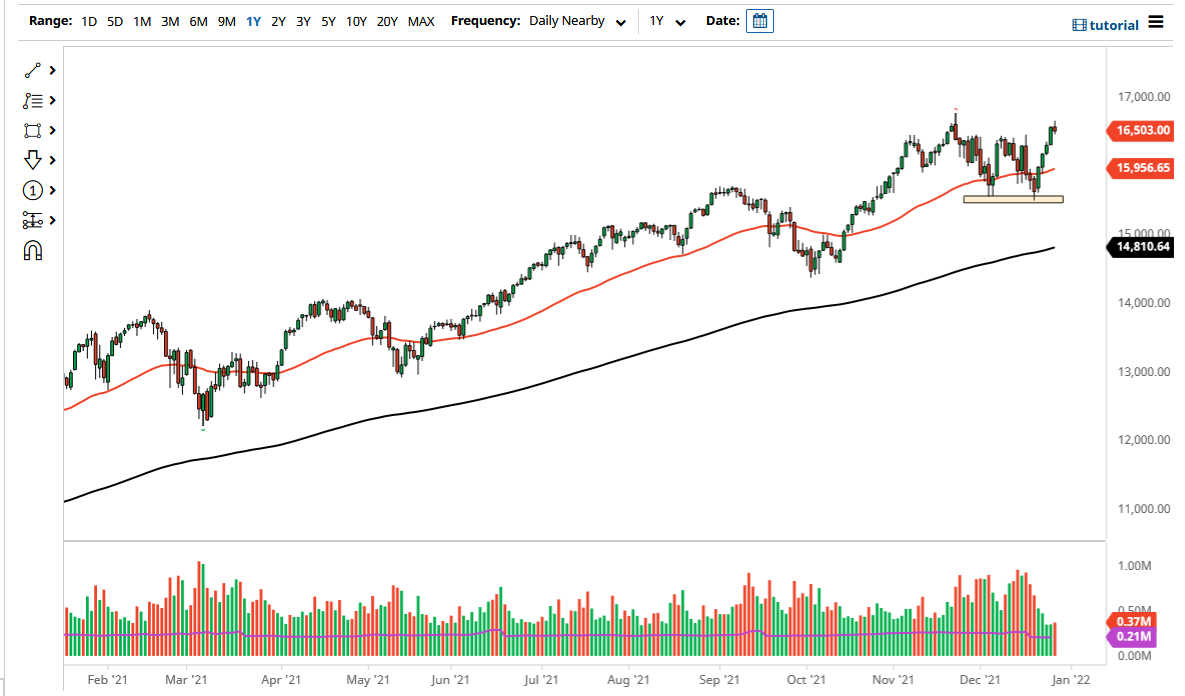

The NASDAQ 100 fell quite a bit to kick off the trading session on Tuesday to reach down towards the uptrend line. The uptrend line is something that the market has been paying attention to, so it makes sense that we would continue to go higher. The market has closed at the top of the range for the day, and that is a very bullish sign. At this point, the market has closed above the 15,000 level for the first time in a couple of sessions, so it certainly looks as if we are going to continue to see the general upside.

Furthermore, you should pay close attention to the fact that the interest rates in America are low, and it is likely that we would continue to see money flowing into “growth stocks”, which make up the NASDAQ 100. With that being the case, I think we will continue to see more of this action, opening up the possibility of a continued longer-term move to the upside. However, you also have to keep in mind that the market will continue to hear a lot of noise heading towards the end of the week, when we expect the jobs number.

If we were to break down below the uptrend line, then it is possible that we could go looking towards the 50-day EMA, reaching down towards the 14,500 level. The 14,500 level has offered support in the past, and I think as long as we continue to see the market move in 500-point increments, it makes sense that it would offer support again if we do break down. I think it is probably easier for this market to go looking towards the 15,500 level then it is the 14,500 level, but it is also possible that we are simply noisy in the interim. We are in an uptrend, and that is the only thing they really need to pay attention to at this point. Earnings season is all but over, so that will not necessarily interfere very much as well. Buying on the dips has worked for months, and I do not see that changing anytime soon as simple momentum continues to push us higher.