This environment was enough to push the price of an ounce of gold to the resistance level of 1833 dollars, its best level in six weeks. Gold closed the week's trading stable around the level of $ 1814 an ounce. Nevertheless, the gold price succeeded in achieving a weekly gain of 0.83%, and a monthly rise of 1.64%, which is an annual decline since the beginning of the year 2021 until now by 4.45%. As for silver, the sister commodity to gold, it failed to court $26 an ounce again. An ounce of silver fell to $25.53 an ounce. Nevertheless, the price of gold achieved a weekly gain of 1.15%, but suffered a monthly loss of 4%. Since the beginning of the year 2021 until now, the price of silver has decreased by 3.75%.

In general, the price of gold rose due to various factors, which is likely to help gold to move towards the next psychological resistance of $1900 sometime in the second half of 2021.

With the US annual inflation rate high at 5% and producer prices in excess of 7%, investors are keeping the bullish outlook for gold once again. Meanwhile, the US Dollar Index (DXY), which assesses the performance of the US dollar against a basket of six major rival currencies, rose to 92.13, and experienced a weekly decline of 0.85% and a monthly gain of 0.11%. A weak dollar is good for dollar-denominated commodities because it makes it more expensive for foreign investors to buy. There is also a factor influencing the price of gold, which is the US bond market, which was in most of the trading amid a decline. Last Friday, the benchmark 10-year Treasury yield fell 0.037% to 1.232%. The yield on the one-year bond was unchanged at 0.066%, while the yield on the 30-year bond slipped to 1.904%. As is well known, lower bonds are good for the commodity market as it reduces the opportunity cost of holding bullion.

For other metal markets, copper futures fell to $4.48 per pound. Platinum futures fell to $1045.90 an ounce. Palladium futures fell to $2,664 an ounce.

On the economic side, the XAU/USD gold price is trading affected by the dollar's level after the recent announcement of the monetary policy decisions of the US Federal Reserve. The FOMC said it plans to start discussions about a potential easing in its $120 billion monthly bond-buying program. It also kept the base interest rate unchanged at 0.25%. After that, the US preliminary GDP growth rate for Q2 was announced, with a change of 5.4%, and expectations were pointing to 6.1%, and the expected annual GDP rate was 8.5%, and it was recorded at 6.5%. On the other hand, initial jobless claims last week missed all expectations.

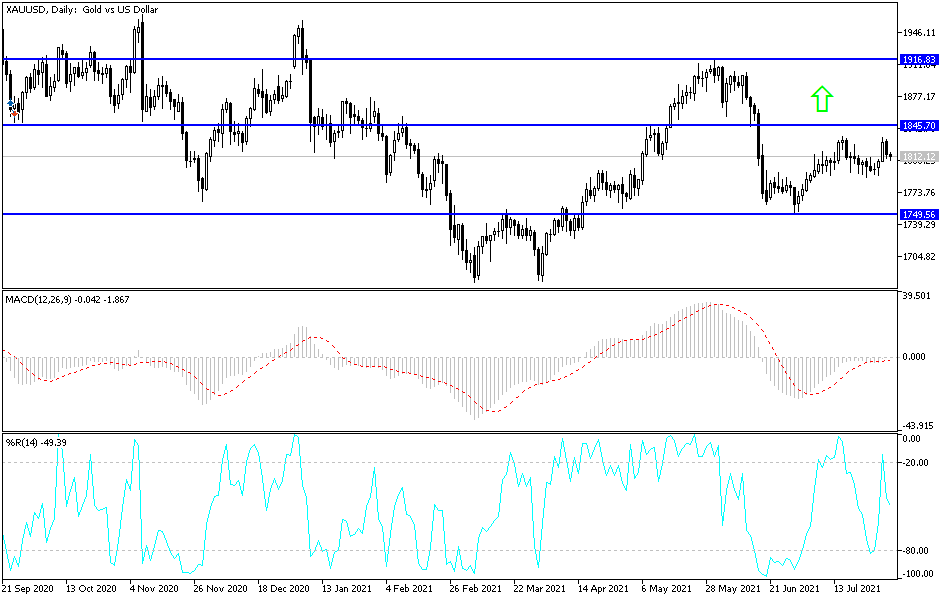

According to the technical analysis of gold prices: In the near term and according to the performance of the hourly chart, it appears that the price of XAU/USD has recently pulled back from a sharp rally. However, the pullback from the 100-hour moving average was halted after the price of gold moved closer to oversold areas. Accordingly, the bears will look to extend the current pullback towards $1805 or lower at $1796. On the other hand, bulls will look ready to pounce on further bounce around $1,822 or higher at $180 an ounce.

In the long term, and according to the performance on the daily time frame, it appears that the price of gold rebounded recently from the 100-day moving average after crossing the indicator. Gold also continues to trade central in the 14-day RSI. Therefore, bulls will be looking to ride the current bounce towards $1,858 or higher to $1,906 an ounce. On the other hand, the bears will target a potential pullback to around $1,771 or lower at $1,726 an ounce.

The price of gold will be affected today by the extent to which investors take risks or not, as well as the level of the dollar and the reaction from the announcement of the manufacturing purchasing managers index readings from China, the eurozone, Britain and the United States of America.