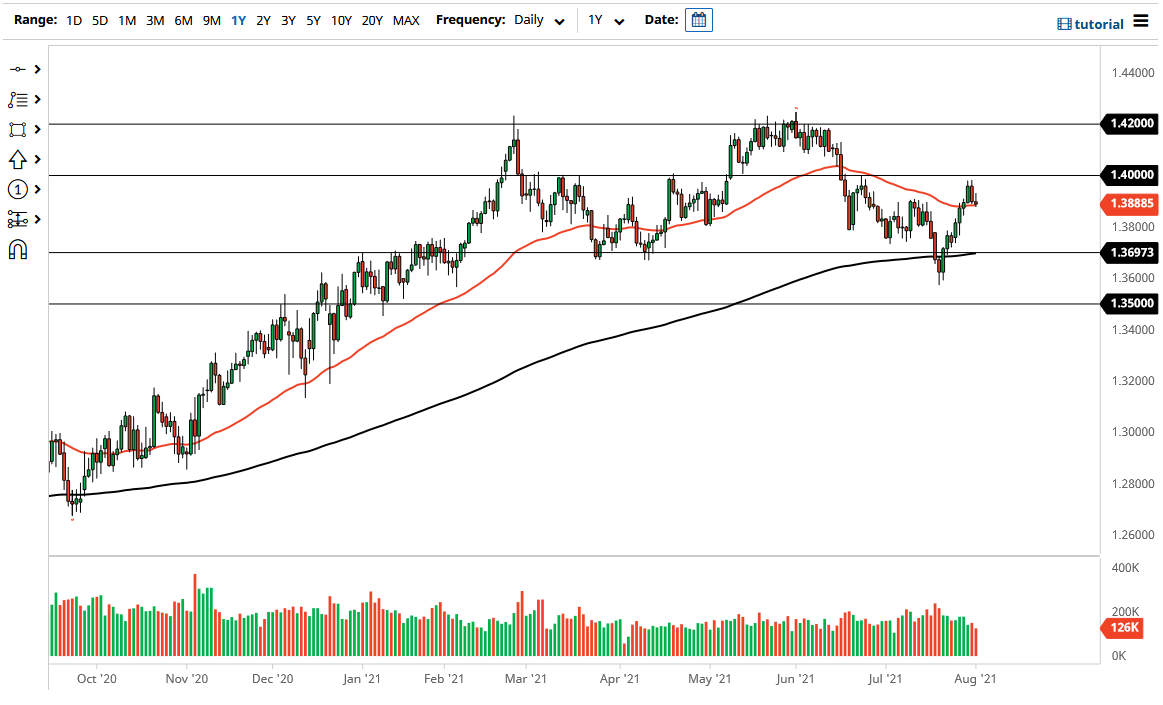

The British pound initially rallied during the trading session on Monday but then gave up early gains to start falling. At this point, the market is sitting right at the 50-day EMA, which is an indicator that has attracted a lot of attention more than once. Ultimately, this is a market that I think should continue to see a lot of noise, mainly due to the fact that the US dollar is a main driver of the Forex markets in general. The US dollar will be paid close attention to by traders around the world, as we trying to figure out what the next move will be as far as risk appetite is concerned.

The 1.40 handle above is going to offer significant resistance from a psychological standpoint as well as a physical one, as we have seen it tested multiple times in both directions. Because of this, I think we will continue to keep a close eye on the 1.40 handle, which I think will tell us longer term as to where the pair is going. If we do break down below the 50-day EMA, then we could go looking towards the 1.37 level underneath where the 200-day EMA currently sits. Furthermore, it is also an area where the market has bounced from previously and I believe that the support at the 1.37 level extends all the way down to the 1.35 handle. If we break down below the 1.35 handle, then it opens up the trapdoor for a much bigger move to the downside.

At this point, we have to question whether or not the bond differential will favor the United States going forward. It clearly looks as if there are a lot of people jumping into the bond market, so it makes sense that people would have a desire to own greenbacks in order to get into the market. Because of this chart, it looks as if we are going to continue to drop instead of trying to rally. The market will continue to be very noisy, but it certainly looks as if we are going to struggle to maintain any type of upward momentum. This is a market that I believe eventually will test the 200-day EMA again.