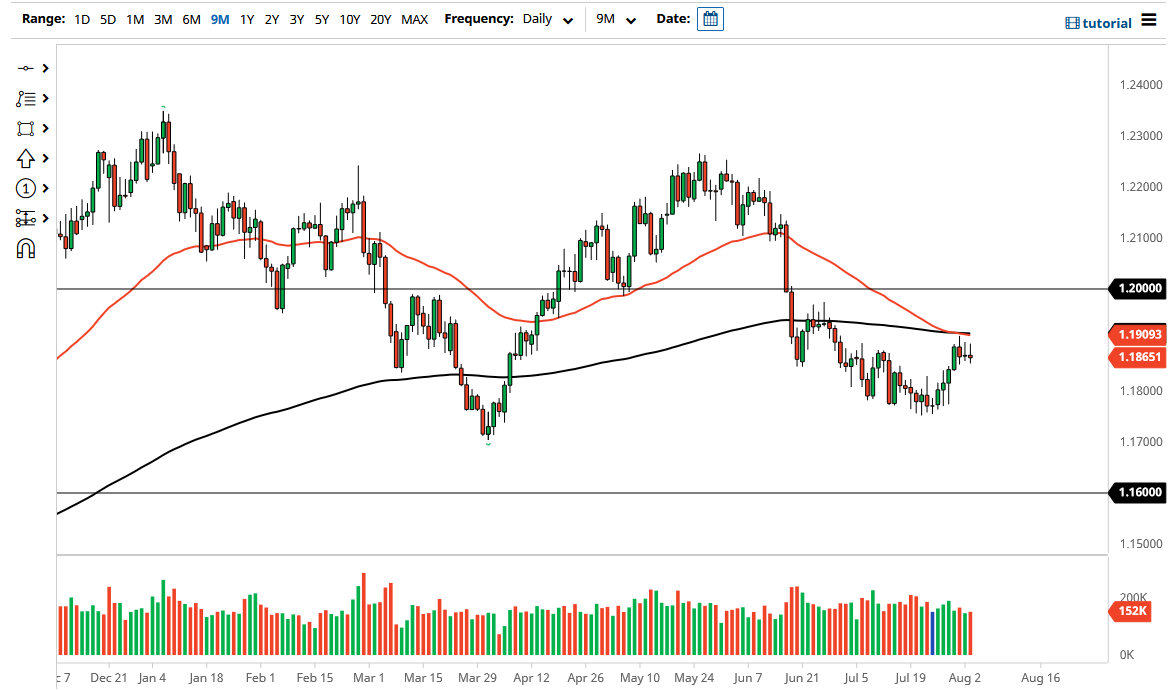

The euro initially tried to rally during the trading session on Tuesday but gave back the gains again as we approached the 1.19 handle. As this market shows, it looks as if the 50-day EMA and the 200-day EMA both are sitting just above and causing quite a bit of resistance, so I think at this point we are more likely than not to see a little bit of a selloff. Granted, you could make an argument that there is a little bit of a bullish flag being formed, but we would need to close above both of those moving averages in order to get towards the 1.20 handle.

Looking at the chart, I think it is likely that we will probably reach towards the 1.18 level, possibly even down to the 1.1750 level. If we break down below there, then it is likely that we will go much lower, perhaps sending this market down towards the 1.16 level over the longer term. Granted, I think we will see that in the short term and most certainly not before the jobs number comes out on Friday. The jobs number will cause a lot of noise, but the interest rate differential between the United States and Germany continues to weigh upon this market. In other words, I do think that if we break down below the bottom of the candlestick on Tuesday, that will also clearly break down below the Monday candlestick, thereby creating a sell signal.

I would anticipate that there will more than likely be a lot of noisy action over the next couple of days, so I am probably going to focus more on the 15-minute chart, perhaps even lower time frames than that. If we break down below the bottom of the daily candlestick, then I will look for short-term selling opportunities, but I probably will not “go home short” at the end of the day, as we continue to see a lot of potential headaches. Overall, I do not like big positions in this market, but I think you could use it for day trading over the next several days, at least until we get the jobs announcement out of the way. Perhaps even more than importantly, we could get a reaction that we can trade with.