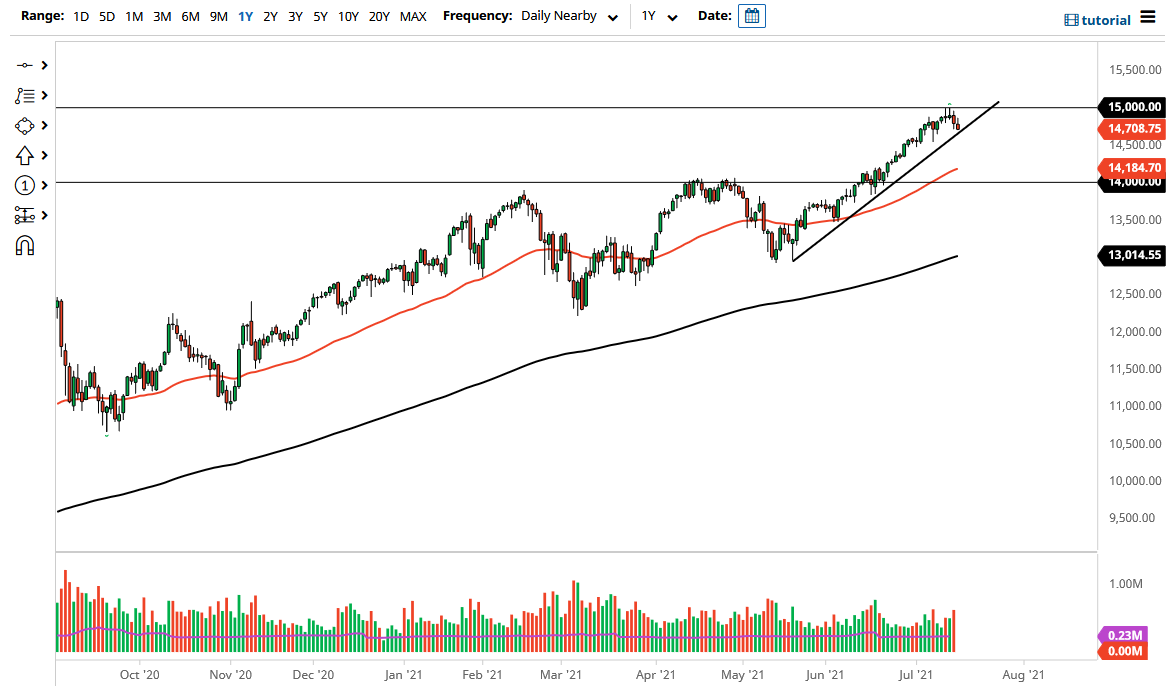

The NASDAQ 100 initially tried to rally during the trading session on Friday, but then pulled back towards the 14,700 level. By doing so, we are testing an uptrend line that has been important since the beginning of the summer. Ultimately, we ended up forming a bit of a shooting star-shaped candlestick, which suggests negativity. Looking at this chart, if we were to break down below this trend line, it is likely that we could go looking towards the 14,500 level.

If we were to break down below there, then it is likely that we could go looking towards the 50-day EMA and the 14,000 level. The 14,000 level is an area of previous resistance, and it should now be support. The 50-day EMA is sitting just above there, and it is likely that we will find plenty of value hunting in that general vicinity. Keep in mind that lower yields will probably attract money back into the higher growth stocks that lead the NASDAQ 100 higher over the longer term, so it makes sense that we would see the NASDAQ 100 follow right along with those low yields.

This is a market that I think will continue to go higher over the longer term, but we may be ready for some type of correction which is desperately needed. This market will be difficult to sell, but if we were to break down below the 14,000 level, then we would be likely to go much lower, but at that point the only thing I would do is buy puts, mainly due to the fact that the Federal Reserve will do whatever it can to lift the markets, given enough time. That being said, it does not necessarily mean that we will get the occasional buying opportunity, and I think that is what we are about to see. If we were to turn around and break above the 15,000 level, then we will more than likely start working our way towards the 15,500 level, but you could also make an argument that the market is a little overextended. In general, this is a market in which you cannot be a seller.