Before the European Central Bank announced an update of its monetary policy, the EUR/USD currency pair is trying to correct upwards, settling around the 1.1800 resistance. This is after strong selling operations in the pair, reaching the 1.1755 support level, the lowest in three months. All in all, EURUSD may take cues from today's ECB decision, as the central bank can clarify its monetary policy plans. Remember, the European Central Bank has raised its inflation target, which gives it more reason to keep interest rates negative for longer.

Regardless, the end of PEPP next year may follow regular asset purchases, which many may see as an extension of quantitative easing. ECB President Lagarde's press conference could contain some future indicative updates that euro traders are hoping to get. The pessimistic statements may drag the European currency further down, while the lack of clarity may lead to the continuation of the consolidation.

The European Central Bank completed its last review in 2003, and nearly two decades later, it recently released the results of its 18-month monetary policy strategy review. In an effort to provide more clarity, the European Central Bank has adjusted its inflation target to be more in line with the global benchmark at a flat 2% level. Unlike the Fed's average target of 2%, which allows inflation overruns, the ECB does not appear to be accommodating deviations outside its target, at least not in the long run.

With the strategy review now complete and a new inflation target set, it will be interesting to see how the ECB adjusts its forward guidance at today's policy meeting. After a shift in rhetoric from the Federal Reserve last month, central banks around the world have been active in discussions or working on gradual strategies as seen by the Bank of Canada, the Reserve Bank of New Zealand, the Reserve Bank of Australia, and the Bank of Norway.

Meanwhile, the dollar has been relying on safe haven flows as investors become increasingly concerned about the spread of the variable delta virus of COVID-19. Although vaccination efforts are hitting snags in some parts of the US, other economies are looking worse off and may be due to another set of lockdown measures in the near term.

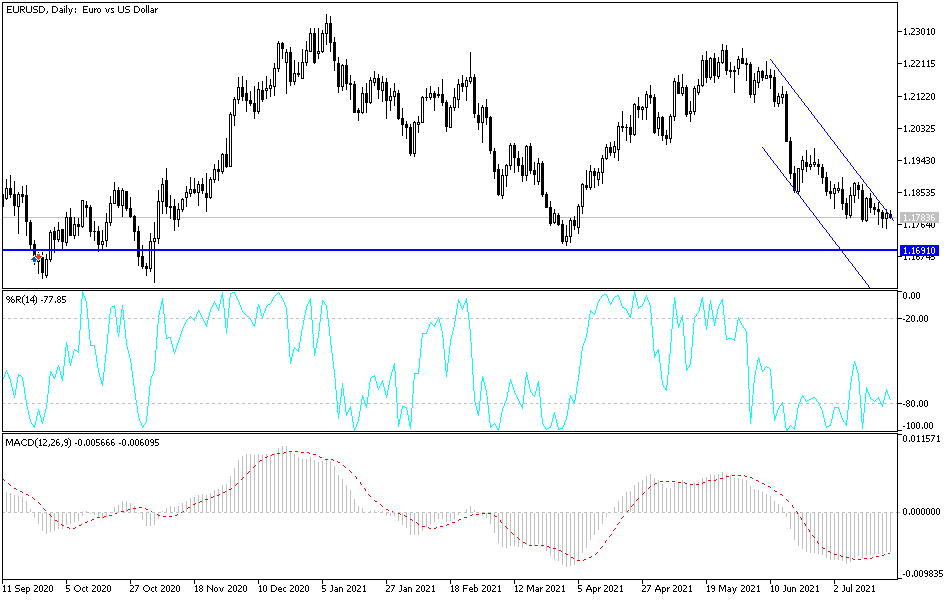

According to the technical analysis of the pair: The EUR/USD may be in the case of a long-term reversal from its rise as the price is forming a head and shoulders pattern on the daily chart and the neckline support is currently being tested. A break below this level could trigger a drop that is the same height as the chart figure or around 700 pips. The 100 SMA begins to cross below the 200 SMA to confirm the recovery of selling pressure. The price is also below both moving averages, so it can hold as the dynamic resistance moves forward.

However, the stochastic is indicating oversold or exhausted areas among the bears. Going back to the top means that buyers are taking over. The RSI is also in oversold territory to indicate exhaustion and a possible return of upward pressure.