At the same time, he stressed that the US economy is on the right track. Without setting a date for tightening, the dollar weakened, and therefore the opportunity was stronger for the EUR/USD currency pair. Despite this, the euro is still under pressure from the increase in European infections with the Corona Delta variable, in addition to excluding the date for tightening the European Central Bank’s policy.

After a two-day meeting, the US central bank kept the target range for the federal funds rate unchanged at 0 to 0.25 percent, and said it would continue its $120 billion monthly bond purchase program. The central bank's move is in line with expectations. The Federal Reserve, which said that the economy is strengthening despite fears of the spread of the Corona virus, stressed that progress in vaccinations is likely to continue to limit the effects of the public health crisis on the economy. However, he added that risks to the economic outlook remain.

The US central bank statement after the meeting indicated that “the sectors most affected by the epidemic showed improvement, but they did not fully recover.” “Inflation has risen, largely reflecting transitional factors. Public financial conditions remain favorable, in part reflecting policy measures to support the economy and the flow of credit to US households and businesses.”

Indicating that progress has been made towards the bank's goals relating to employment and inflation, the bank's statement said changes in policy regarding monthly bond purchases may be on the way. Central bank policy makers agreed to create a permanent bond market repurchase facility where institutions go to exchange high-quality collateral for cash.

The Fed said the FOMC will continue to assess progress at upcoming meetings.

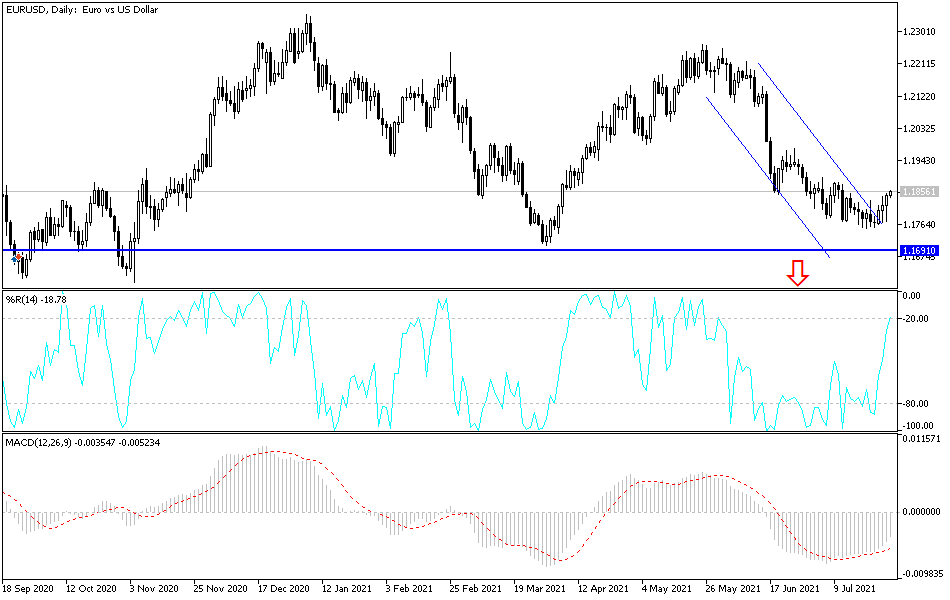

According to the technical analysis of the pair: The current correction of the EUR/USD currency pair still needs more stimulus to confirm the strength of the new trend. On the chart on the daily time frame, the currency pair is still under bearish pressure and the real breakout will be by moving towards and above the psychological resistance 1.2000. In the meantime, returning to the support area of 1.1775 will restore the bears' control to move within the descending channel range again. I still see that the pair’s gains face threats to not continue, as the discrepancy in economic performance and monetary policy between the Federal Reserve and the European Central Bank, and the risks of an outbreak of the Corona Delta variable, is in favor of the dollar’s strength in the end.

As for the economic calendar data today: Inflation and unemployment readings will be announced for both Germany and Spain. From the United States of America, the most important reading of the growth of the US economy will be announced, along with the number of weekly jobless claims and the number of pending home sales.