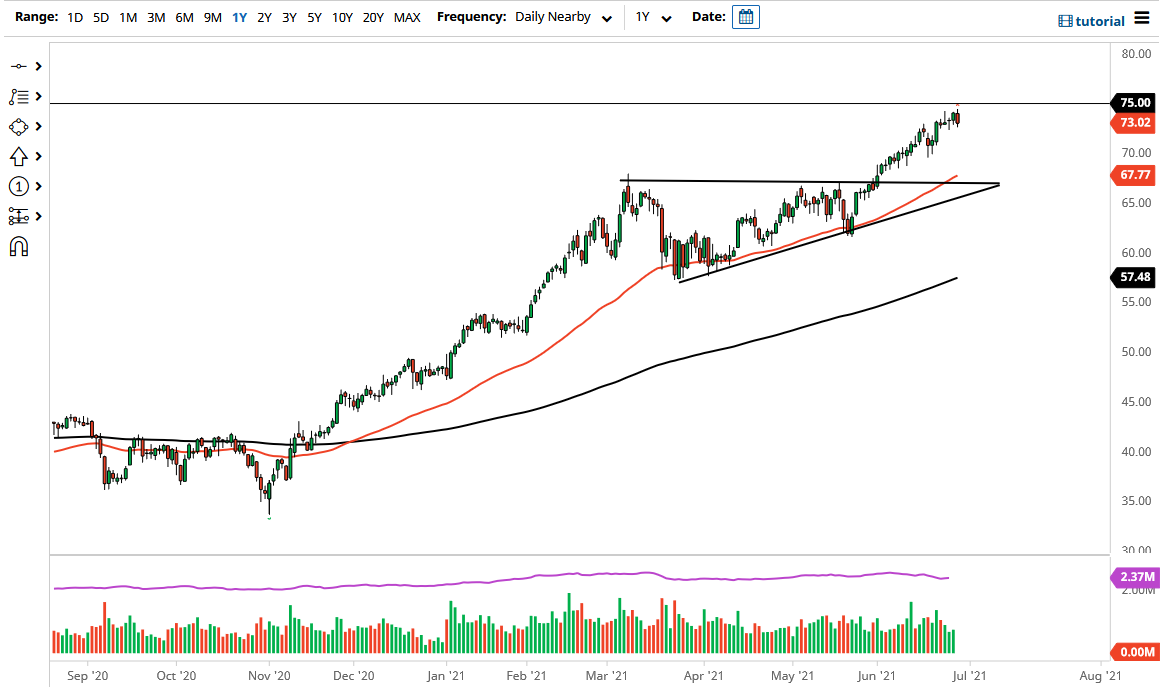

The West Texas Intermediate Crude Oil market pulled back just a bit during the trading session on Monday, but I think a lot of this probably has more to do with the fact that the $75 level is a large, round, psychologically significant figure, and the market may have gotten a little bit overdone. Nonetheless, we are still very much in an uptrend, and that is the most important thing you should pay attention to. I think that if you give it enough time, there should be plenty of buyers underneath.

The market has multiple support levels underneath, especially near the $70 level. The large, round, psychological aspect of that figure should be rather important, but we also have the 50-day EMA sitting at the $67.76 level, so that should continue to grind higher and offer support as well. Beyond that, the market has support at the top of the previous ascending triangle, which has the $67.50 level as support due to the fact that it was the top of the triangle itself. It is not until we break down below the bottom of the triangle that I would look at this as a market that might fall apart. That means that we need to break down below the $65 level.

Until that happens, this is a situation where I am a buyer only and look at these dips as value. I suspect that the rest of the market does as well, so it is only a matter of time before we would see the market continue the overall attitude. The demand for crude oil should continue to be a major driver of the crude oil market as economies around the world continue to open up. Summer driving season is starting in North America as well, which generally means good things for the price. With this, I continue to anticipate that dips will be bought into, and there is no reason to short the market anytime soon. Based upon the previous ascending triangle, there is a bit of a “measured move” to the $77.50 level. Ultimately, there is only one way to trade this market, and that is for a move towards the upside.