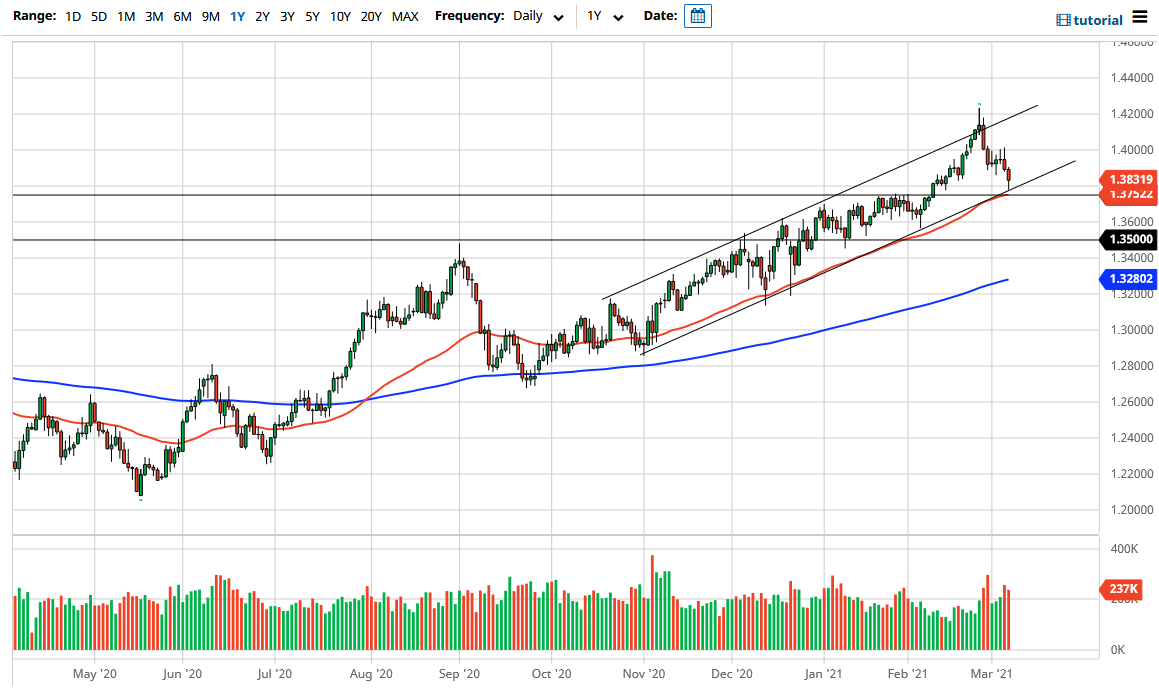

The British pound has initially fallen during the trading session on Friday to reach down towards the uptrend line in the massive channel that we have been in. At this point, the market looks like it is going to continue to find buyers underneath, and as a result the 1.3750 level looks to be even more supportive after the action on Friday. The area had previously been a major breakout point, so the fact that we have the uptrend line and the 50 day EMA sitting there tells me that it should continue to be rather important.

The candlestick looks a little bit like a hammer, and I do think that it is only a matter of time before the market bounces again. However, one of the things that have been driving the currency markets as of late has been the interest rates in America rising. As long as that continues to be the case, it should drive up the value of the greenback. In other words, we need to see interest rates, down a bit before this uptrend continues. If and when we get that the market is likely to go looking towards 1.40 level.

If we do break down below the 1.3750 level, then we should see significant support at the 1.35 level as well. In general, I think it is more likely that we break above the 1.40 level though and go looking towards the 1.42 level that had been so massive in its resistance. It is the high of the most recent one, and it is of course resistance on the weekly chart that is obvious as well. Because of this, it is not a huge surprise that we have had to pullback in order to find more momentum to finally break out. If and when we can break above the 1.42 level it will open up a move towards the 1.45 handle.

If we did break down below the 1.35 handle, it is likely that the market could fall apart and go looking towards the 1.30 level. At that point I would be interested in shorting if we break below the 1.35 handle, but right now I think the only thing you can do is look for dips to move offer value like we had seen during the trading session on Friday.