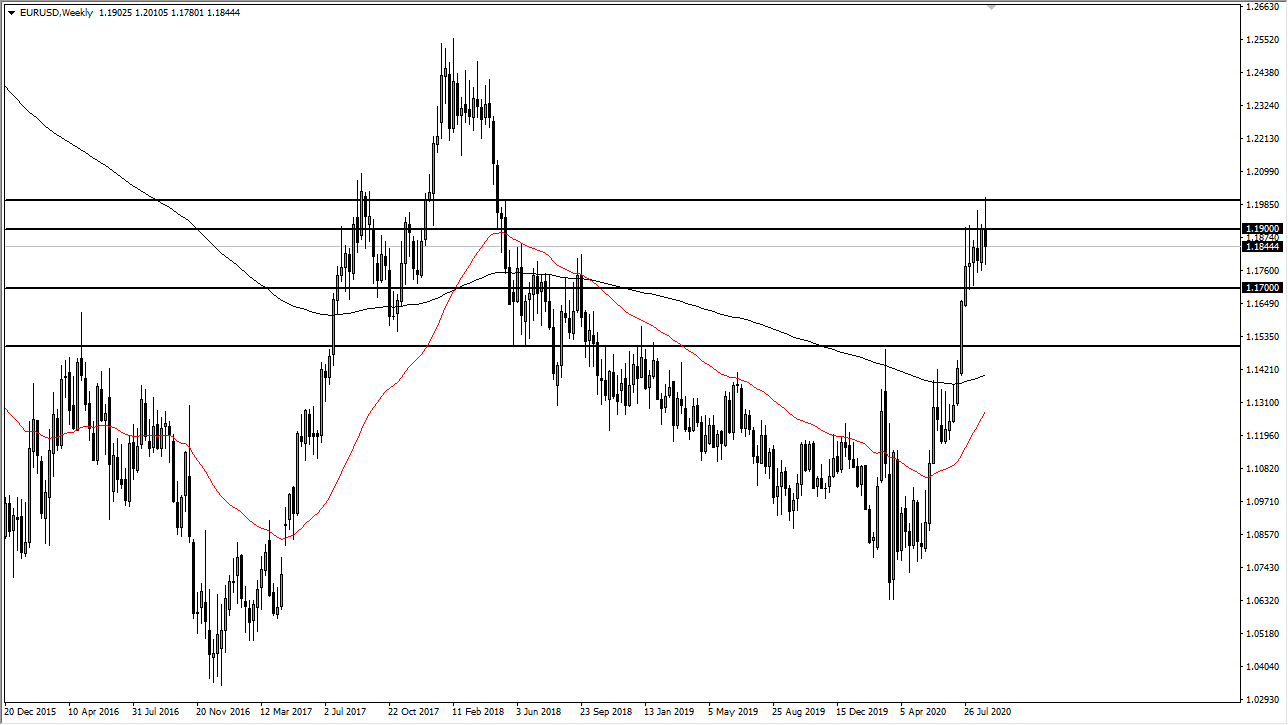

EUR/USD

The Euro has been all over the place during the previous week, as we reached towards the 1.20 level, down towards the 1.18 level, and bounced again during the trading session on Thursday, only to fall right back down on Friday and turn right back around again by the end of the day. In other words, we are seeing a lot of volatility, but at this point, I think we continue to see buyers come in based upon the way the market saved itself on Friday. I think there is massive support at the 1.17 level, and I do believe that we are going to make another attempt at the 1.20 level above. This does not mean that we get there easily, but I still believe in “buying on the dips.”

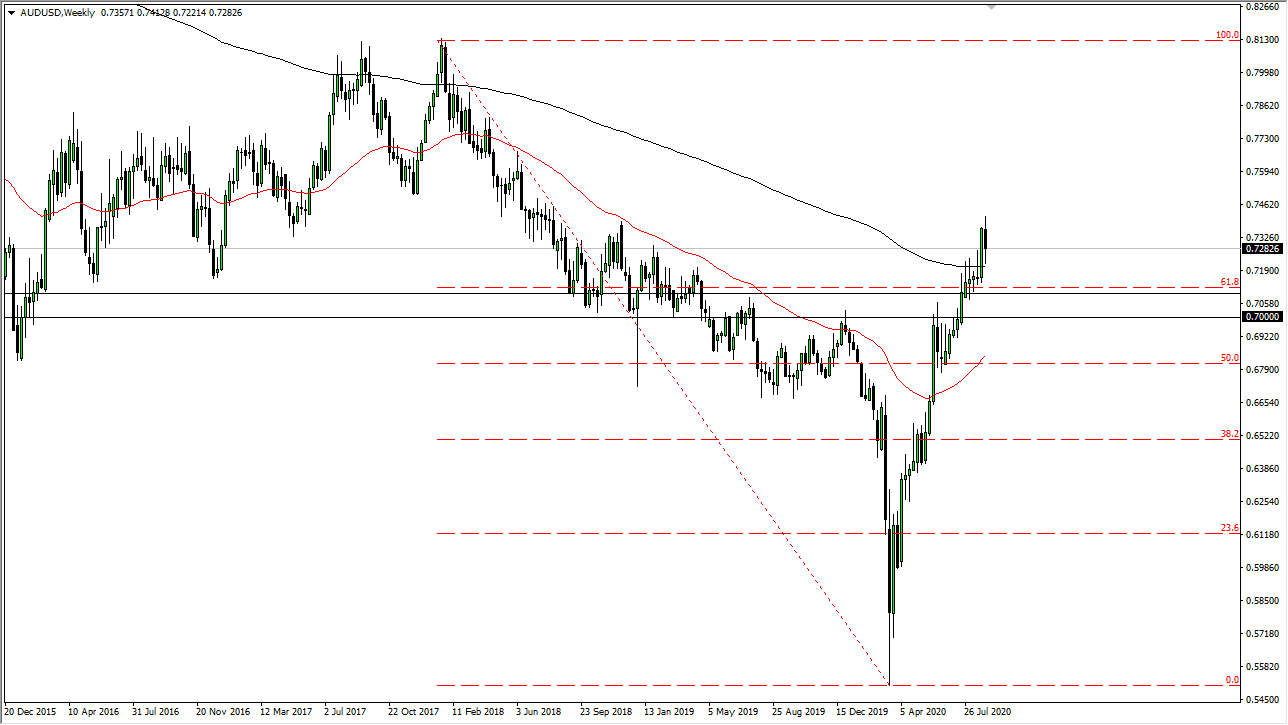

AUD/USD

The Australian dollar has fallen after initially trying to break higher during the week, but it now looks as if the market is finding a bit of support near the 0.72 level. That is an area that extends down to the 0.71 level, and then to the 0.70 level for support. I think if you continue to buy short-term dips in the Australian dollar, but as far as breaking out is concerned it may take some type of major shift in the attitude of traders.

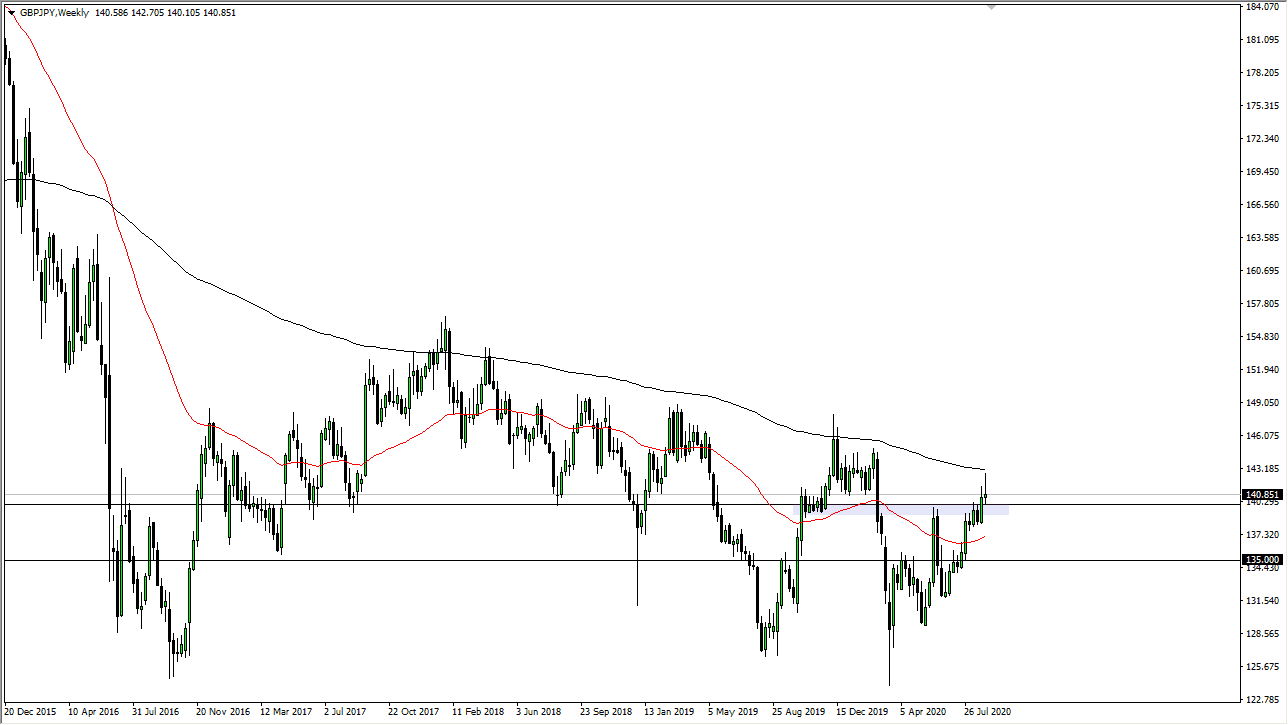

GBP/JPY

The British pound initially rallied during the week, breaking much higher to show signs of resiliency yet again. However, we have pulled back rather drastically from the 200 week EMA, or the ¥142.50 level. At this point, if we break down below the ¥140 level, then it is likely that we could go to the ¥138 level. On the other hand, if we do not break down below the ¥140 level, then I think a lot of back and forth sideways trading is likely to be the scenario that we see for the majority of the week.

USD/CNH

The US dollar continues to fall against the Chinese Yuan, which is something worth paying attention to due to the fact that the Chinese economy is opening up and it should show plenty of strength. However, if the market turns around and rallies to break above the weekly candlestick, then we could have a big move to the upside. Breaking down below the 6.80 CNH level means that we will go lower to fill the gap closer to the 6.72 CNH level. If for no other reason, you should be watching this to see where risk appetite is going.