August inflation increased more than forecast in Brazil, and President Jair Bolsonaro appealed to the patriotism of vendors during the Covid-19 crisis. Brazil remains the third-most infected country globally with the second-highest death toll, trailing only the US. Brazil is in negotiations with Russia for 100 million doses of the Sputnik V vaccine, which has a production agreement with AstraZeneca and Oxford. The state of Bahia awaits government approval to import 50 million by March 2021. The USD/BRL remains in a bearish chart pattern but briefly paused its breakdown sequence.

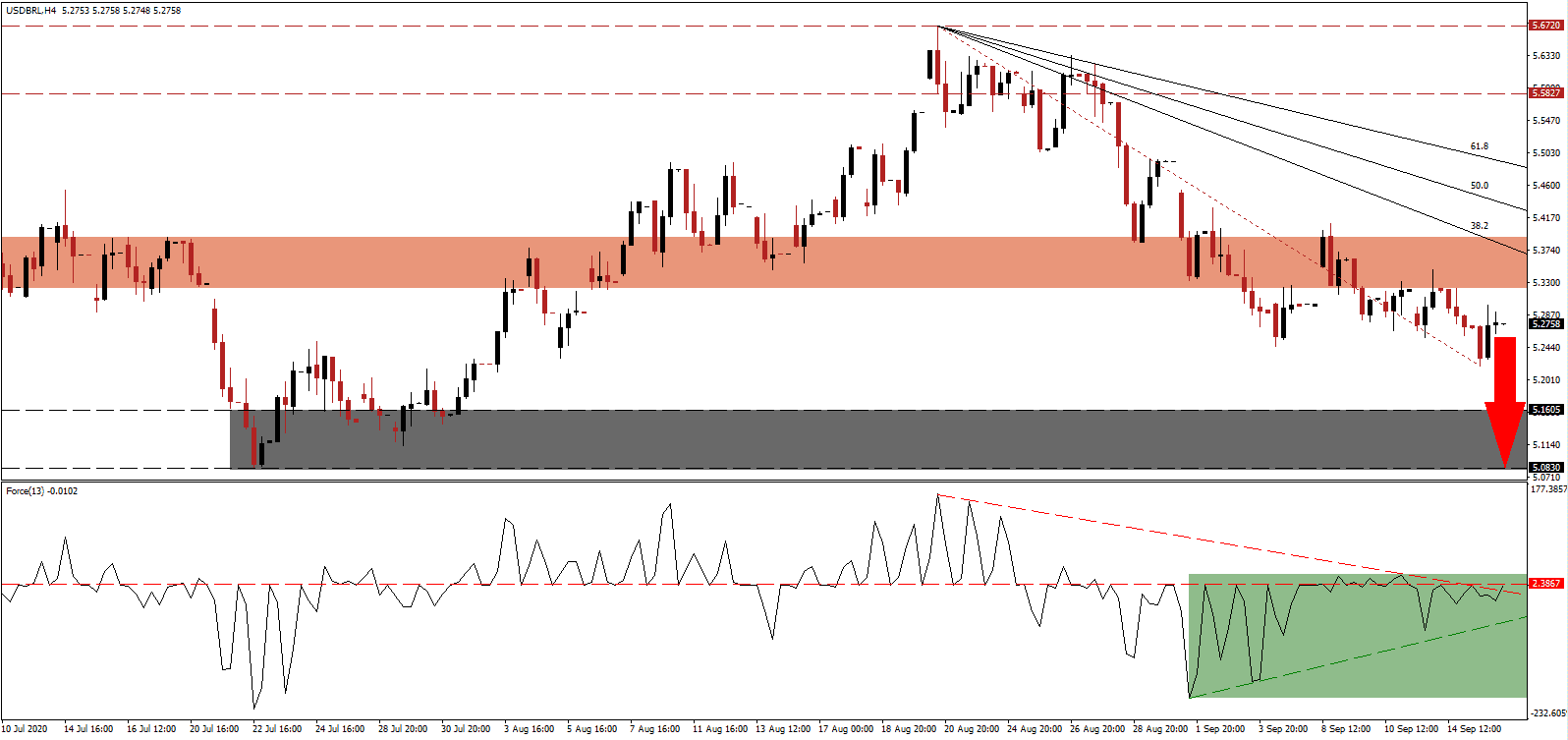

The Force Index, a next-generation technical indicator, created a series of higher lows and eclipsed its descending resistance level, as marked by the green rectangle. Bullish momentum continues its general weakness and is unlikely to suffice for a conversion of its horizontal resistance level into support. This technical indicator maintains its position below the 0 center-line and risks a new collapse below its ascending support level with bears in control of the USD/BRL.

Following disagreements with his Minister of the Economy, Paulo Guedes, President Bolsonaro scrapped his plans to launch a new welfare program labeled Renda Brasil. It formed part of his 2020 re-election bid, but he could not agree on funding and announced the current program Bolsa Familia, would remain in place until 2022. After the USD/BRL pierced its short-term resistance zone located between 5.3222 and 5.3907, as marked by the red rectangle, it quickly resumed its corrective phase, assisted by a weak US Dollar.

Brazil additionally battles fires in the Amazon and the Pantanal, the world’s largest rainforest and largest wetland, which lost nearly 16% due to the blazes. The US is facing similar issues from California stretching to Washington. Both countries suffer from a combination of arson, deforestation, and climate change. Containing the disasters will be essential to the post-Covid-19 recovery. The descending Fibonacci Retracement Fan sequence is favored to keep the sell-off intact, pushing the USD/BRL back into its support zone located between 5.0803 and 5.1605, as identified by the grey rectangle.

USD/BRL Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5.2750

Take Profit @ 5.0850

Stop Loss @ 5.3300

Downside Potential: 1,900 pips

Upside Risk: 550 pips

Risk/Reward Ratio: 3.46

Should the Force Index resume its advance, with the descending resistance level providing temporary support, the USD/BRL could attempt to extend its reversal. Any advance from present levels will grant Forex traders a secondary selling opportunity. The US economy shows signs of exhaustion from its post-lockdown recovery, with distinct weakness ahead. The upside potential is limited to its 61.8 Fibonacci Retracement Fan Resistance Level.

USD/BRL Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 5.3950

Take Profit @ 5.4800

Stop Loss @ 5.3300

Upside Potential: 850 pips

Downside Risk: 650 pips

Risk/Reward Ratio: 1.31