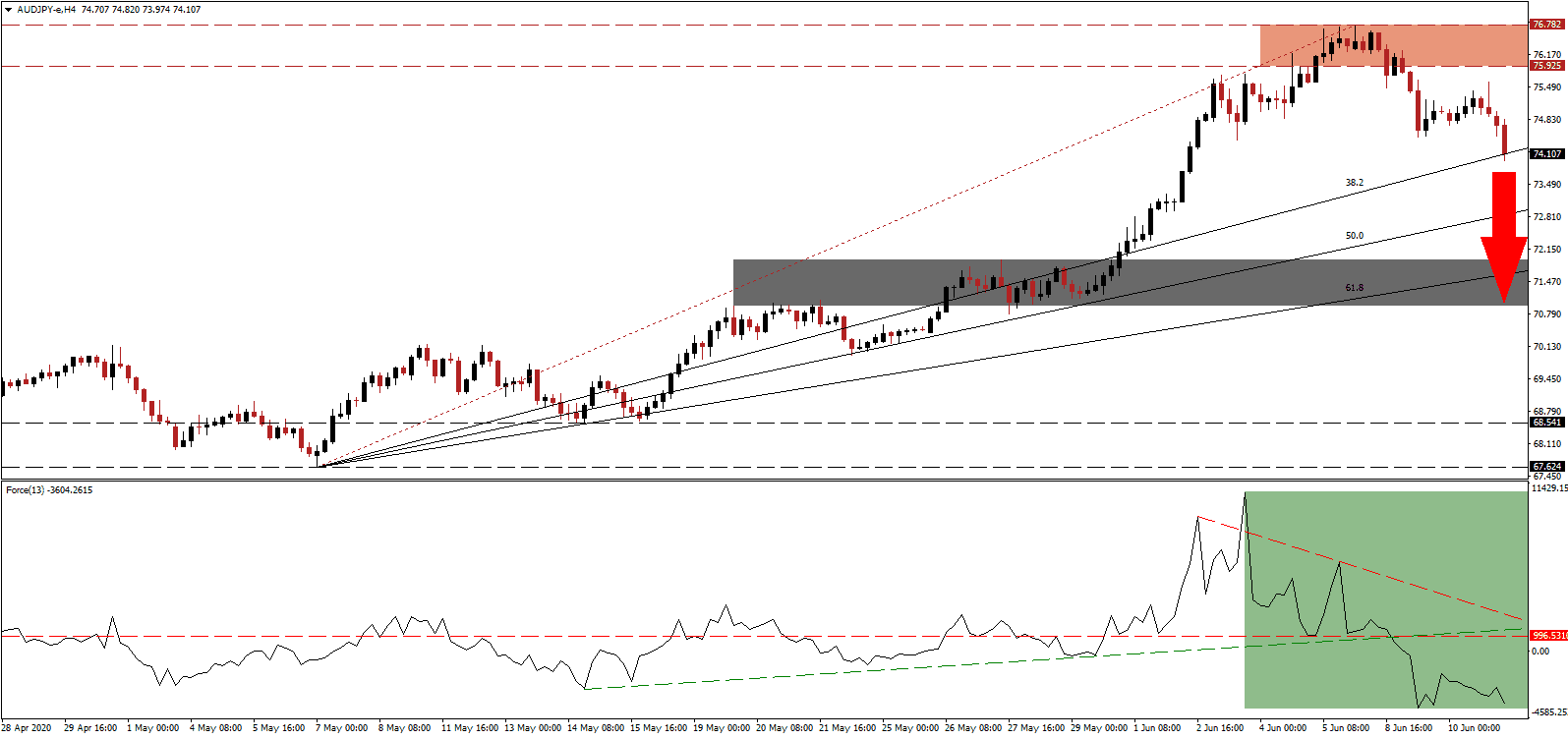

A second Covid-19 infection wave will derail the fragile Australian economy, new research by the Organisation for Economic Co-operation and Development (OECD) revealed. While a 5.0% GDP contraction is forecast for 2020, the largest one since the Great Depression, the economy is poised to outperform developed competitors. It favors more monetary support into 2021 by the Morrison government, contradicting claims of a sound recovery, and confirming structural weakness. The OECD identified the high debt level of Australians as a risk moving forward. Rapid accumulation of bearish momentum resulted in a breakdown in the AUD/JPY below its resistance zone, interrupting the massive advance.

The Force Index, a next-generation technical indicator, suggests more downside potential after reversing from a new multi-month peak. Bearish pressures expanded following the conversion of its horizontal support level into resistance, as marked by the green rectangle, and the subsequent collapse below its ascending support level. Bears regained complete control over the AUD/JPY with this technical indicator in negative territory. The descending resistance level is likely to keep downside pressure elevated.

Over the past few weeks, commodity currencies led by the Australian Dollar rallied on misplaced optimism about a swift global economic recovery. Yesterday’s post-FOMC press conference held by US Federal Reserve Chairman Powell pointed towards a cautious outlook with no interest rate hikes throughout 2022. It added to capital inflows into the safe-haven Japanese Yen, which was strengthening since the beginning of the week. The breakdown in the AUD/JPY below its resistance zone located between 75.925 and 76.782, as marked by the red rectangle, sparked a profit-taking sell-off.

Australia decided to take steps to deteriorate its relationship with China, the country’s most important trading partner. Retaliatory measures have been adopted. Simon Birmingham, Australia’s Minister for Trade, Tourism, and Investment, did confirm the absence of Chinese students will harm the economy. Education accounts for A$38 billion in revenues annually and is the fourth-biggest Forex earner. China advised students to avoid Australia, citing incidents of racism during the Covid-19 pandemic. The AUD/JPY is presently challenging its ascending 38.2 Fibonacci Retracement Fan Support Level. A breakdown is anticipated to lead to an accelerated sell-off into its short-term support zone located between 70.955 and 71.918, as identified by the grey rectangle. More downside cannot be excluded.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.100

Take Profit @ 71.000

Stop Loss @ 75.100

Downside Potential: 310 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 3.10

In the event the Force Index spikes above its descending resistance level, the AUD/JPY could push into its resistance zone. Given Australia’s worsening relationship with China, the outlook remains bearish. Forex traders are recommended to take advantage of any price spike with new net sell positions, with the upside potential confined to the top range of its resistance zone.

AUD/JPY Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 75.700

Take Profit @ 76.700

Stop Loss @ 75.300

Upside Potential: 100 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.50