The S&P 500 rallied a little bit during the training session on Thursday, but we are all waiting for the jobs figure to come out. At this point, you should keep in mind that any type of need to trade should be shot, as the jobs figure will have a massive influence on the S&P 500 as well the stock markets in general. Overall, this is a market that is very bullish and certainly has a proclivity to go higher so I think that if the jobs figure makes the market drop rather drastically in the short term, I would be more than willing to step in and pick up a long position. Granted, you will have to be very cautious about your position size but quite often the jobs figure will cause some type of knee-jerk reaction that can sometimes be anti-trend. Those moves almost always get turned around by the end of the day, and I also see several reasons to think that there is in fact support underneath.

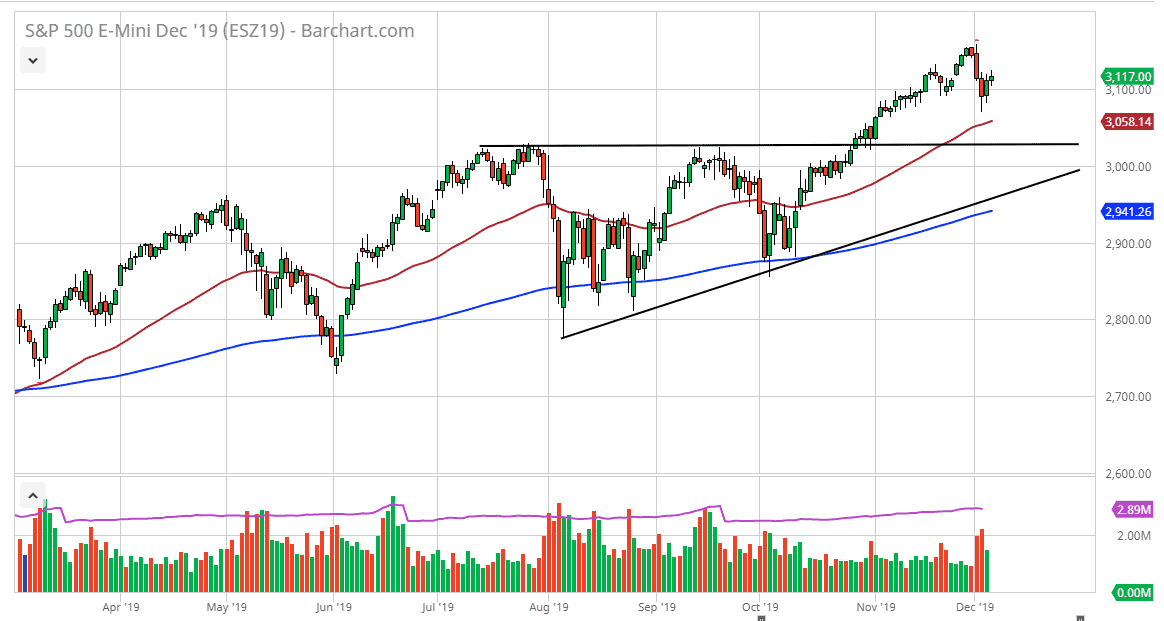

Going forward, the 50 day EMA underneath at the 3058 level should be paid attention to, because it shows a clear uptrend in the market, and of course we also have support underneath that the 3000 level that extends to at least the 3030 level. At this point, the market will find a lot of traders willing to step in as it had been significant resistance.

To the upside, the market is more likely to find easier movement. Longer-term, it’s very likely that the market will continue to go towards the 3200 level based upon the ascending triangle underneath that had been broken to the upside. Overall, the measurement suggests that level should be targeted relatively quickly, and I do think that we will get there between now and the end of the year without too many issues. The recent pullback has been rather strong, but quite frankly this is a blip on the radar when it comes to the longer-term trend, it should be thought of as a potential value proposition. I certainly believe that any reaction to the jobs figure on Friday will also be thought of in the same vein. I have no interest in shorting the S&P 500, it is far too strong. We also have the “Santa Claus rally” that is likely to come as well, so keep that in mind.