This morning’s Australian economic data showed an unexpected contraction in private capital expenditure for Q3, and Q2 was revised down to show a bigger contraction. The Australian Dollar faced mild selling pressure, but bullish momentum in the AUD/NZD is on the rise. Price action is challenging the bottom range of its support zone and while it may grind slightly lower, the long-term outlook favors an increase in this currency pair. Adding temporarily to the downside move was better-than-expected economic data out of New Zealand as the ANZ Activity Outlook rebounded. The current technical picture suggests that a short-covering rally could develop.

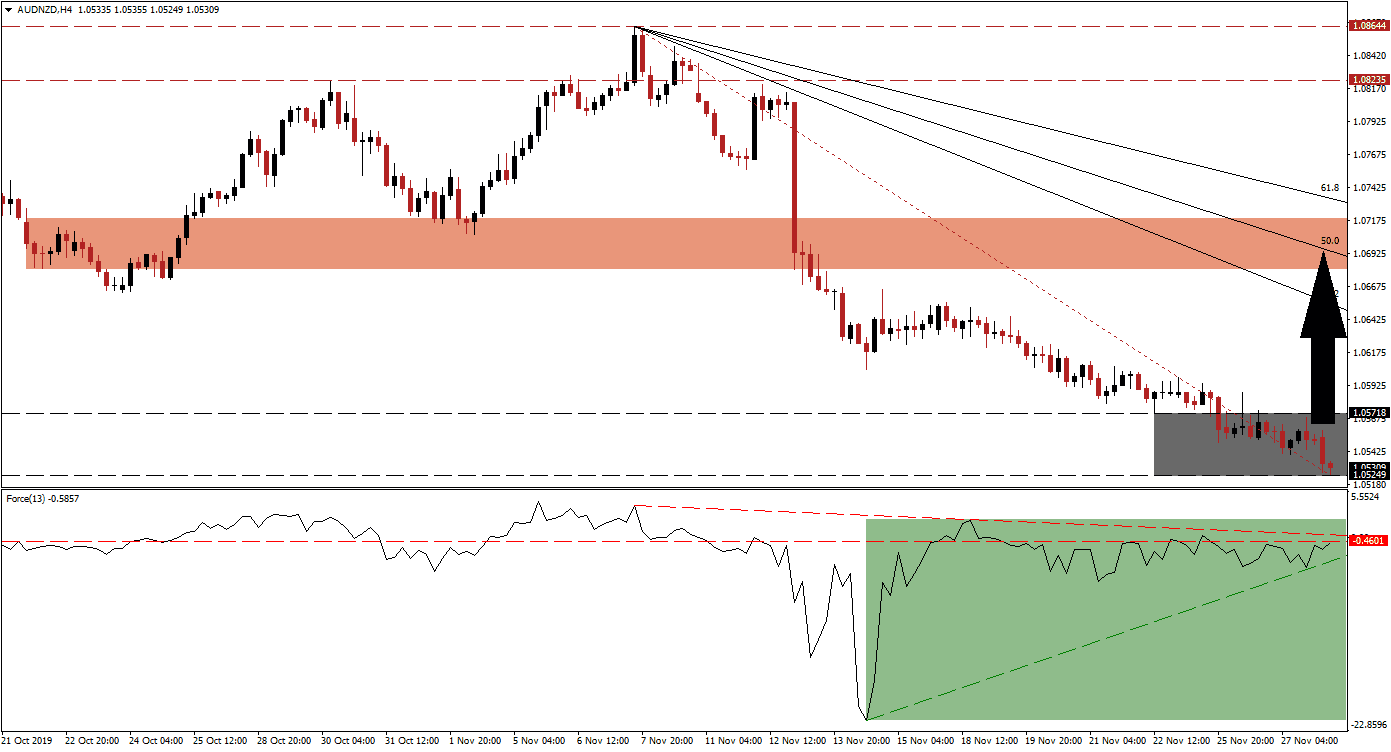

The Force Index, a next-generation technical indicator, indicates the formation of a positive divergence. This bullish trading signal started to form after the AUD/NZD broke down below its short-term support zone that was converted into resistance. As this currency pair extended its sell-off, the Force Index started to advance. It has now approached its horizontal resistance level, as marked by the green rectangle, and the rise in bullish momentum is expected to lead to a breakout above it. This technical indicator is additionally expected to push above its descending resistance level and into positive territory, placing bulls in charge of price action. You can learn more about the Force Index here.

Due to the solid corrective phase, a gap has developed between price action and its Fibonacci Retracement Fan. A crossover above the 0 centerline by the Force Index is likely to trigger a short-covering rally and elevate the AUD/NZD out of its support zone, located between 1.05249 and 1.05718 as marked by the grey rectangle. This should provide enough bullish momentum to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Another bullish development materialized as this currency pair moved above its Fibonacci Retracement Fan trendline.

Forex traders are advised to monitor the intra-day high of 1.05872 which marks the peak of a failed breakout attempt and led to a marginally lower low. A sustained move above this level is expected to result in the addition of new net long positions and increase buying pressure from the anticipated short-covering rally. The AUD/NZD is expected to advance into its next short-term resistance zone located between 1.06806 and 1.07191 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through this zone. A breakout above it would require a fresh fundamental catalyst. You can learn more about a resistance zone here.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 1.05300

⦁ Take Profit @ 1.06900

⦁ Stop Loss @ 1.04900

⦁ Upside Potential: 160 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 4.00

Should the Force Index fail to push above its double resistance level and complete a breakdown below its ascending support level, the AUD/NZD may follow with a breakdown of its own. This currency pair is fundamentally oversold and the long-term outlook remains bullish, supported by the technical scenario. Any breakdown should be considered an excellent buying opportunity and price action will be faced with its next support zone between 1.03851 and 1.04271.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 1.04700

⦁ Take Profit @ 1.04900

⦁ Stop Loss @ 1.05000

⦁ Downside Potential: 80 pips

⦁ Upside Risk: 30 pips

⦁ Risk/Reward Ratio: 2.67