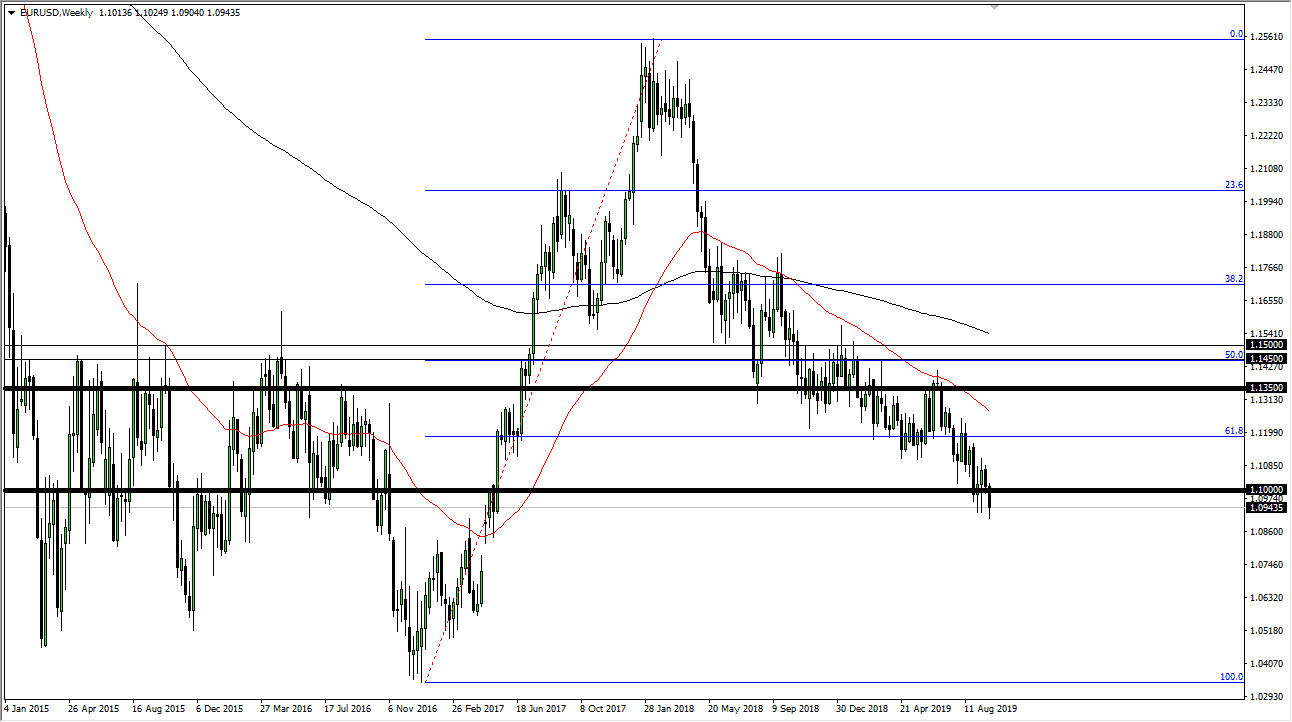

The Euro has fallen again during the month of September, as we now find ourselves solidly below the 1.10 level. Quite frankly, if we can make a fresh, new low, meaning breaking below the 1.09 level, then the pair is set to go much lower. There is a gap underneath that is closer to the 1.07 level that has yet to be filled, and that might be the moves we are trying to make.

If we were to break above the 1.10 level, it’s very likely that there should be plenty of resistance above. In fact, I don’t necessarily have a scenario in which a willing to start buying this pair from a longer-term move as it has been so negative for so long. You can see that it has been a slow grind lower overall, and I think that is probably going to continue to be the same. Rallies at this point offer selling opportunities on long wicks to the upside, as it would show a failure to turn things around.

The European Union heading into recession overall is going to continue to work against the value of the Euro, not to mention the fact that the strength of the US Treasury markets should continue this move lower as you get yield in the United States, and more than likely going to find negative rates in the European Union. Simply put, money is treated better in the United States that it is in continental Europe.

Now that we are significantly below the 61.8% Fibonacci retracement level, I typically start looking for the 100% Fibonacci retracement level which is closer to the 1.04 handle. Granted, that is a long term call, and we could be talking about a move that last months, if not a couple of years at the rate this pair moves. I have no interest in buying this pair until we break above the 1.12 handle, and even then I would still be a little bit cautious about how the market moves. If we were to break out above there, then we have to have a serious look at the fundamentals underneath but right now it still looks very negative in this pair and not much has changed. It’s a slow and painful grind lower, and with the European Central Bank now looking to loosen monetary policy even further, it makes sense that we continue more of the same.