The NASDAQ 100 got absolutely hammered during the trading session on Friday for several different reasons. From the headline part of the equation, we have the Jerome Powell press conference in Wyoming that wasn’t as dovish as traders would have liked, but we also have bigger issues. For example, the Chinese have retaliated in a “tit-for-tat” tariff situation with the Americans. Because they are raising a 5% tariff on September 1 against soybeans and looking to add 25% tariffs on US automobiles on December 15, markets have gotten concerned about and accelerating trade war.

As the NASDAQ 100 is highly levered to technology companies, people worry about whether or not these companies can withstand the various tariffs that are going to be thrown around out there. It causes a lot of concerns when it comes to supply chains, as the Chinese are major manufacturers when it comes to electronics, but let’s not forget the fact that global growth is slowing down at the same time. In other words, I can’t necessarily say that the trade war is the reason we are falling, but it might just be the excuse.

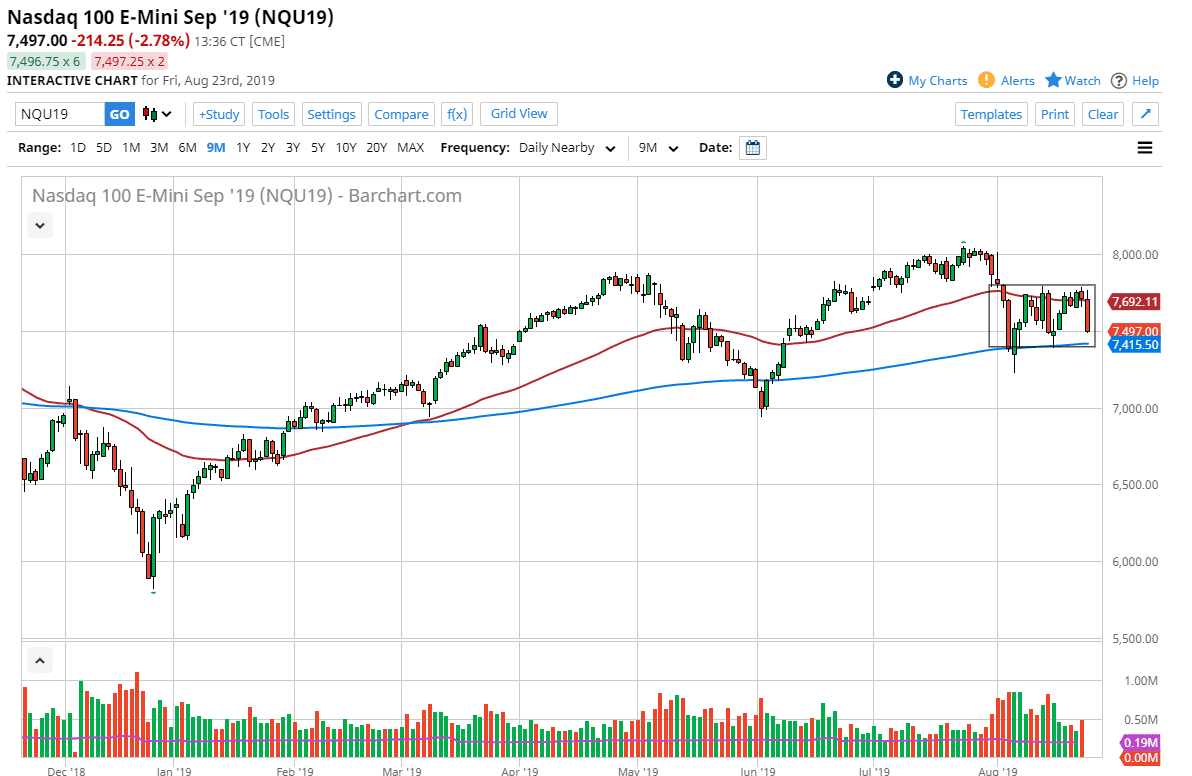

From the technical standpoint, you can see that the 50 day EMA has offered resistance above, just as the 200 day EMA underneath has offered support. It certainly looks as if we are trying to break down towards the 200 day EMA, and with the ferocity that we are doing so late during the Friday session, this may end up being the one time where we finally do. If we break down below the 7400 level, then I think that this market has the ability to go down towards the 7000 level given enough time. Rallies at this point are probably not to be trusted but could be taken advantage of it as long as we stay within the box that I have drawn on the chart attached to this article. If we somehow got above the 7700 level, then it’s obviously very bullish sign but things have taken a very ominous turn on Friday and it looks as if selling pressure will continue going forward. This has been a rough couple of weeks, and quite frankly when you see this type of volatility is almost never a good thing longer term. I do believe at this point that we are going to start selling off rather soon. Low volumes will continue to be a bit of an issue as well.