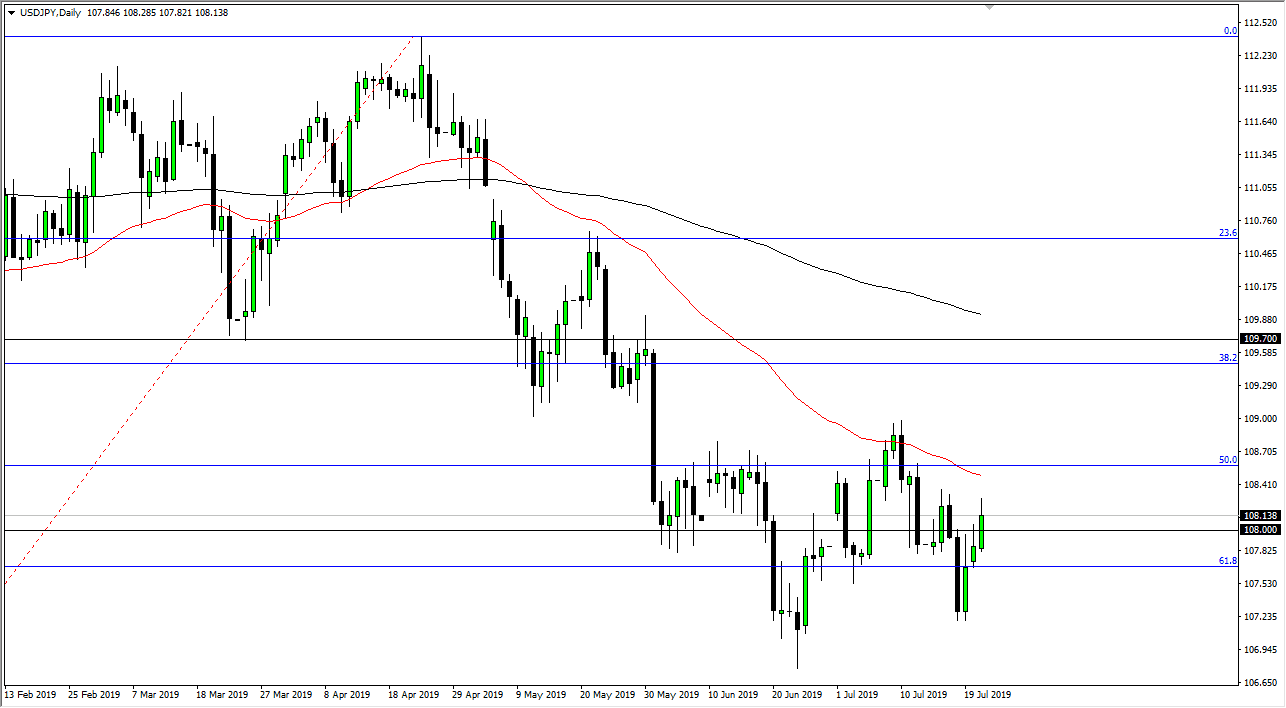

The US dollar rallied a bit during the trading session on Tuesday, breaking above the crucial ¥180 level, which I considered to be “fair value” when it comes to the recent consolidation area. This is a market that has broken above the top of the shooting star from the Monday session, so that show signs of strength, and therefore it’s likely that we could go higher. Short-term pullbacks should be thought of as potential buying opportunities now that we have made this move, so that of course is a good sign.

Looking at the chart, if we do reach towards the 50 day EMA which is pictured in red on the chart, there could be short-term selling in order to bounce back and forth in this range that we have been in for some time. However, if we can break above the 50 day EMA, then we could test the ¥109 level above, which is a scene of selling pressure. Ultimately, moving above that level does open up the door to the “wipeout candle” that starts at the ¥109.65 level. At that point, then we could be looking at a major trend change.

To the downside, there is significant support at the ¥109 level, which should be paid close attention to. If we can break down below there, then the market is very likely to go down to the ¥105 level, which would send this market down to the 100% Fibonacci retracement level. Overall, I think at this point in time it’s very likely that we will see some type of move, but in the short term we continue to bounce around in this general vicinity. This is an area that is very similar to what we are seeing in the S&P 500 which I typically use as a proxy for this currency pair. This is mainly because the Japanese yen is considered to be a major “safety currency”, therefore it makes sense that if the stock markets break down then this pair will fall not necessarily due to the dollar, but for people looking to get involved in that Japanese yen.

All things being equal, I think the market chops around in general in the near term as we go through earnings season in the United States and of course there are a lot of questions when it comes to global growth and economic expansion.