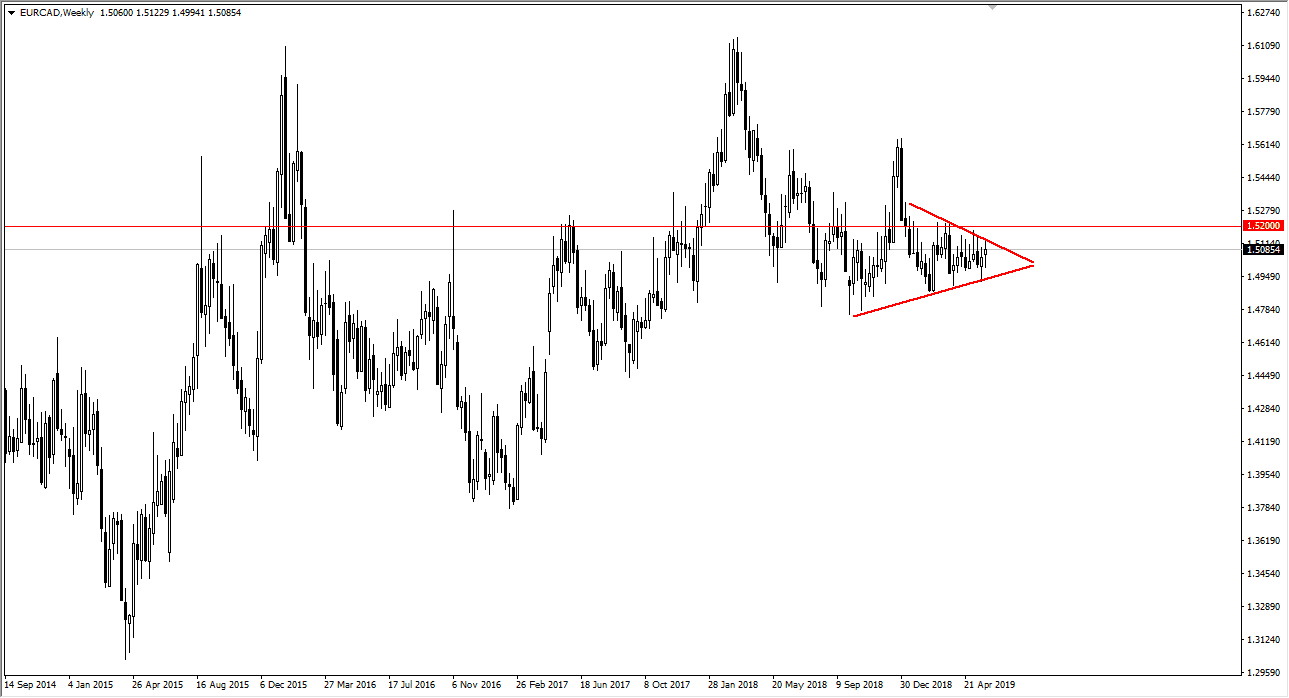

The Euro against the Canadian dollar is a pair that has been shopping around for some time. When you look at the weekly chart though, you can see we are trying to form a bit of a symmetrical triangle, and now I think that we are getting ready to see some type of serious move in this marketplace, one that you are probably not even paying attention to.

The 1.52 level has been resistance as of late, so we can break above there it’s likely that the pair will go much higher. You could also try to aim for about 400 pips or so, as it opens up the door to the 1.56 level. To the downside, we could be looking at a move towards the 1.45 level, which of course is a major round number that will attract a lot of attention. With the way this pair has been acting lately, sooner or later we need some type of resolution to the inertia that’s building up.

Keep in mind that the Canadian dollar is highly sensitive to the crude oil markets, and they are getting hammered. That’s why I believe that this pair will probably break out to the upside and as you can see I have the 1.52 level Mark clearly on the chart. A move above that level has me buying this market and aiming for those 400 pips. As things stand right now, I believe that is more likely to happen than some type of selloff. However, if we do break down, there are other trades to be had.

The market breaking down below the 1.49 level would be a very negative sign, and I think at that point we would probably see some type of fallout that is being reflected from the EUR/USD pair. If we were to see the EUR/USD pair break down below the 1.10 level, that would probably be simultaneous to this move. I don’t think that’s going to happen, so I do believe this pair is bullish over the next several weeks.