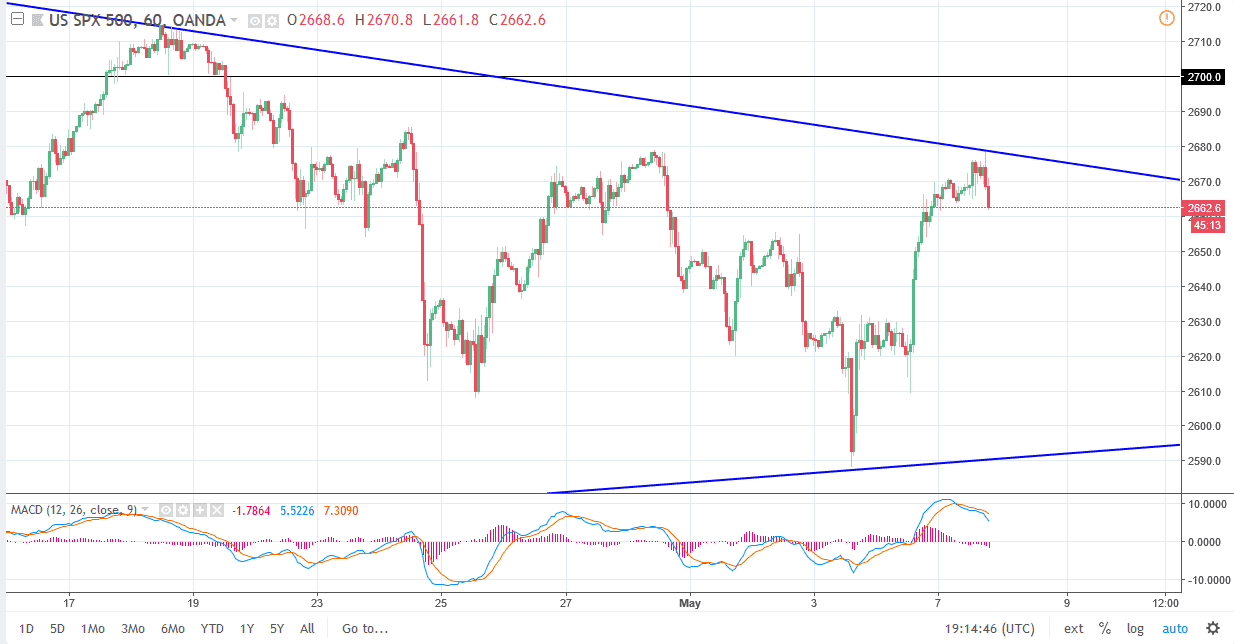

S&P 500

The S&P 500 initially tried to rally during the day on Monday but found the downtrend line from the larger wedge to be major resistance. If we can break above the 2680 handle, we will then break out to the upside, perhaps reaching towards the 2700 level. A break above the 2700 level should 3 this market to go much higher. In the short term, I think it’s likely that there will be pullbacks, but those pullbacks should continue to be thought of as value. I think that the value of course will continue to attract a lot of traders, especially as the economic numbers of the United States are stronger than they are in places like Europe or Asia. I believe that the market will continue to look for little dips as value, with 2650 being a prime level where we may see buyers come into the market.

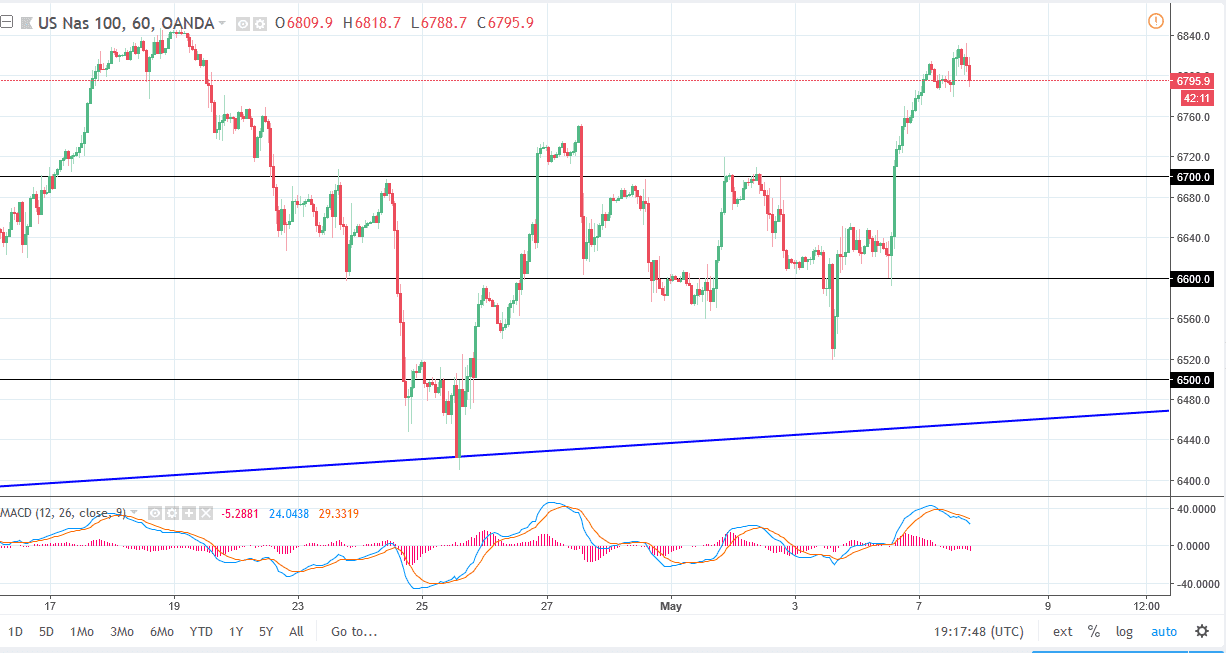

NASDAQ 100

The NASDAQ 100 also started out rather positive during the day on Monday but found the 6840 level to be a bit resistive. As we saw that resistance, it looks like the market could go lower, with the 6800 level obviously being a major focal for price. The 6700-level underneath would be massive support as well, so I think it’s only a matter of time before we go higher on these dips. These dips should offer value, and I believe that the NASDAQ 100 will move right along with the Russell 2000, the S&P 500, and of course the Dow Jones 30. I believe that the US stock markets will continue to be where people go to put money to work, as growth in America is stronger than other parts of the world.