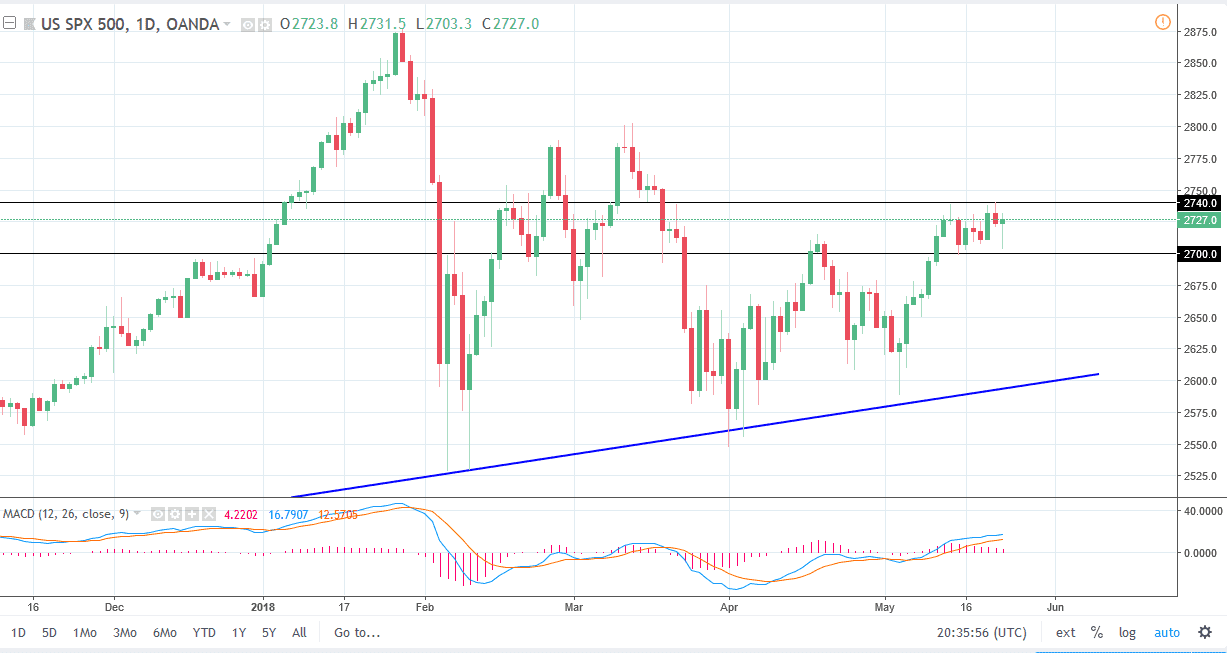

S&P 500

The S&P 500 initially fell during the day on Wednesday, reaching towards the 2700 level before bouncing significantly to form a massive hammer. This tells me that the market is ready to continue going higher, and that we will eventually break above the 2740 level, sending the market towards the 2800 level after that. I believe that short-term pullbacks continue to offer buying opportunities, as the 2700 level has started to act as a major “floor” in the market. I believe that a lot of the negativity was due to statements made by Donald Trump about the potential of talks between the Americans and the Chinese, and that of course the Americans and the North Koreans, but that is conjecture and simply a negotiation tactic that people are reacting to. I think people came in to pick up value, and not only that traders may have reacted to a less bullish minutes coming out of the Fed than anticipated.

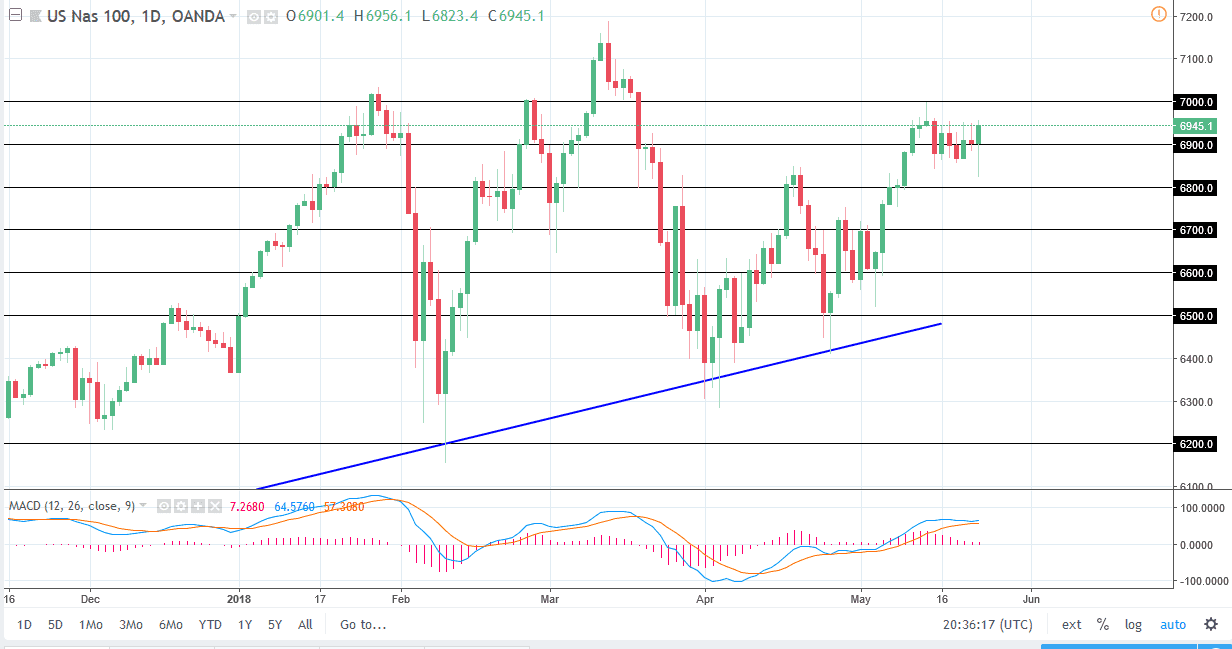

NASDAQ 100

The NASDAQ 100 initially fell during the trading session on Wednesday but found enough support above the 6800 level to turn things around and then rally significantly towards the 6950 level. We have formed a massive hammer, and it looks as if we are going to go looking towards the 7000-level bone, which has been significant resistance more than once. If we can clear the 7000 handle, the market then goes looking towards the 7200 level again, and perhaps beyond. I look at short-term pullbacks as buying opportunities as a market has certainly shown a proclivity to recover every time we pull back, and of course US stock market should outperform many of the other stock markets around the world as the US economy is stronger than most others.