SP 500

The S&P 500 tried to rally during the day on Tuesday but found enough resistance above to turn the market around at the 2740 handle. By doing so, we ended up forming a bit of shooting star and it looks as if we are ready to continue consolidating. I believe that we have plenty of support below the 2700 level though, and that this is simply the market trying to build up enough momentum to go higher. Even if we did break down below the 2700 level, we have recently made a couple of “higher highs”, and that tells me that the momentum is starting to shift to the upside again. I don’t have any interest in shorting this market, and I look at short-term pullbacks as potential buying opportunities as they offer value.

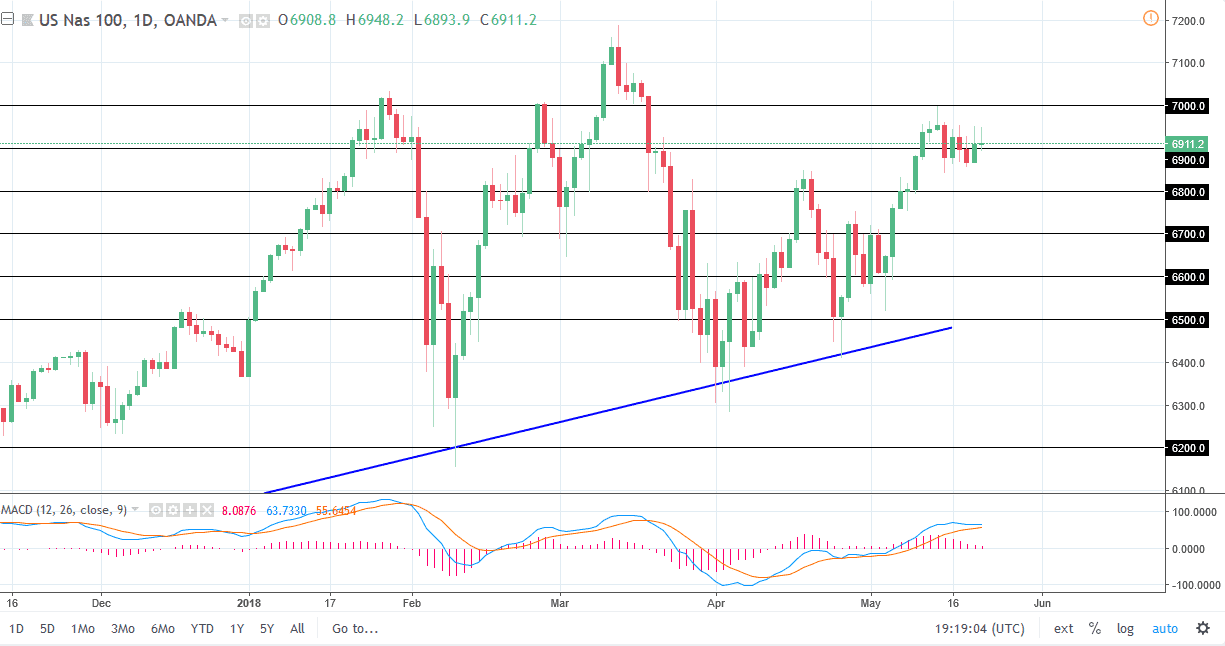

NASDAQ 100

The NASDAQ 100 also tried to rally during the day on Tuesday but turned around form a shooting star as we sit on top of the 6900 level. If we can break below that level, the market could go to the 6850 level, but is going to take a significant amount of momentum to finally break higher. That’s because we had recently tested the 7000 level, which of course is a major psychological barrier. I anticipate that pullbacks will also be buying opportunities over here as well, with the 6800 level being massive support. The markets are concerned by higher interest rates in the United States, but I think in the end that will only end up being a sideshow, as overall economic growth should continue to push this market to the upside longer-term. I don’t have any interest in shorting, I see far too many support levels below.