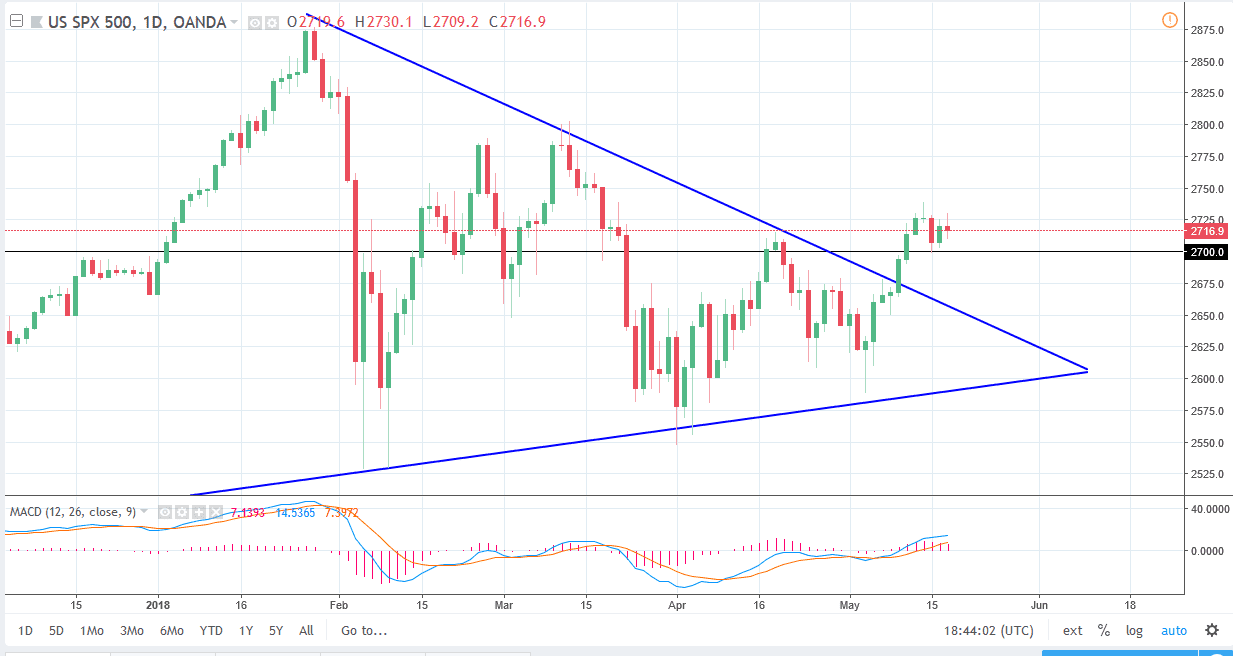

S&P 500

The S&P 500 has gone back and forth during the day on Thursday, forming a neutral candle. The market has recently trying to rally, but it also pulled back a little bit. It looks as if the 2700 level is offering a significant “floor” at the short-term interval, and we have recently made a “higher high” at this point. Beyond that, the downtrend line underneath should be supported. I believe it’s only a matter time for the buyers get involved though, so if we can break above the 2740 handle, the top of the shooting star from a couple of trading session to go, that would be a very bullish sign it should free this market to go much higher. I believe eventually the buyers return and pick up a bit of value as it presents itself.

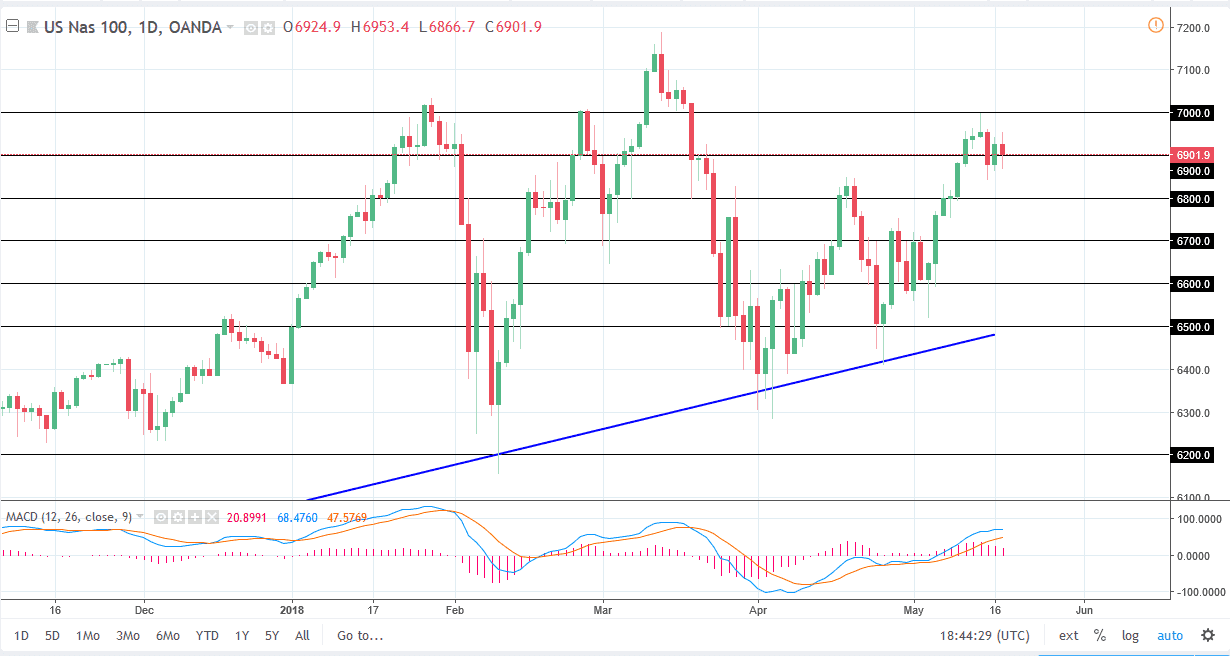

NASDAQ 100

The NASDAQ 100 has gone back and forth during the trading session on Thursday, using the 6900 level as a bit of support. I think that the 7000 level above is massive resistance though, and if we can break above there I feel that this market should continue to go much higher, perhaps reaching towards the 7200 level. Ultimately, we break down below the bottom of the range for the Thursday session, it’s possible that we will probably find support at the 6800-level underneath. Ultimately, this is a market that I think will continue to find buyers based upon value, as we have seen a complete turnaround in the attitude of the stock markets over the last couple of weeks. While we are a bit more volatile these days, it still looks as if it is a bullish market overall and as a result I think it’s easier to buy this market then try to find selling opportunities.