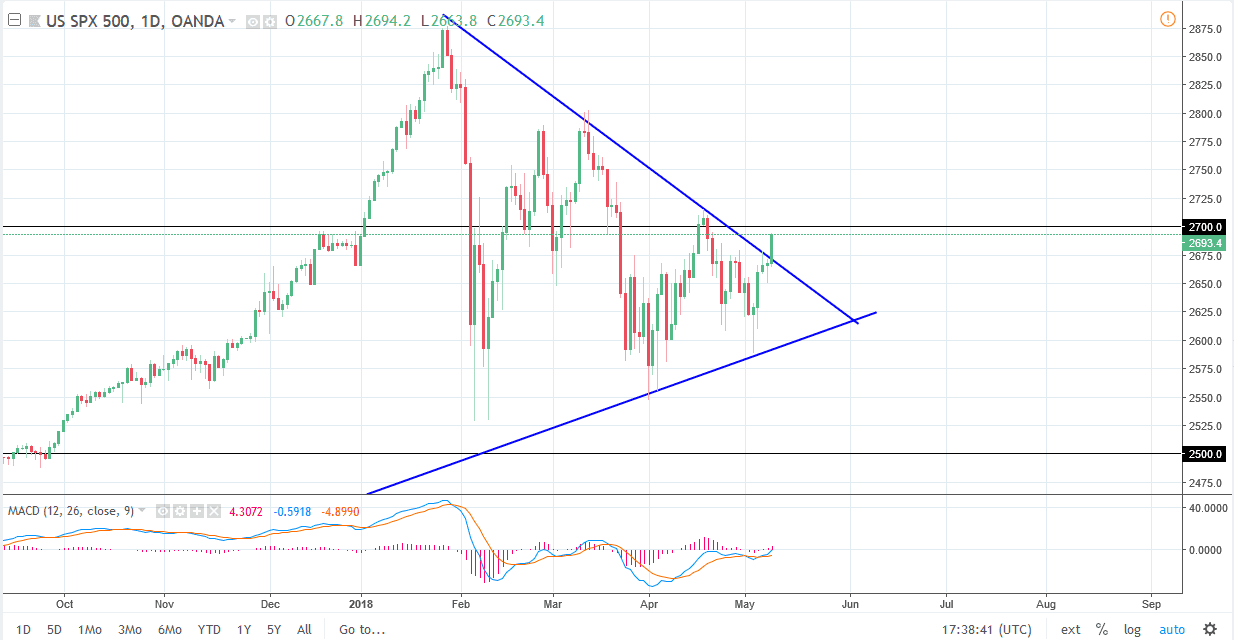

S&P 500

The S&P 500 rallied rather extensively during the trading session on Wednesday, breaking the major downtrend line that has been so negatively influential in this market. We are approaching the 2700 level quite rapidly, and of course the day is closing out at the top of the range, which is a very bullish sign. I believe that the market will eventually take that level out, but we may need to pull back to build up the necessary momentum to go higher. Those short-term pullbacks will more than likely be thought of as value and buying opportunities, and I think that the market will eventually reach towards the highs again. I think that the summer is going to be good for the stock market now that we have shaken a lot of weak money out of the market, but obviously volatility has picked up in general.

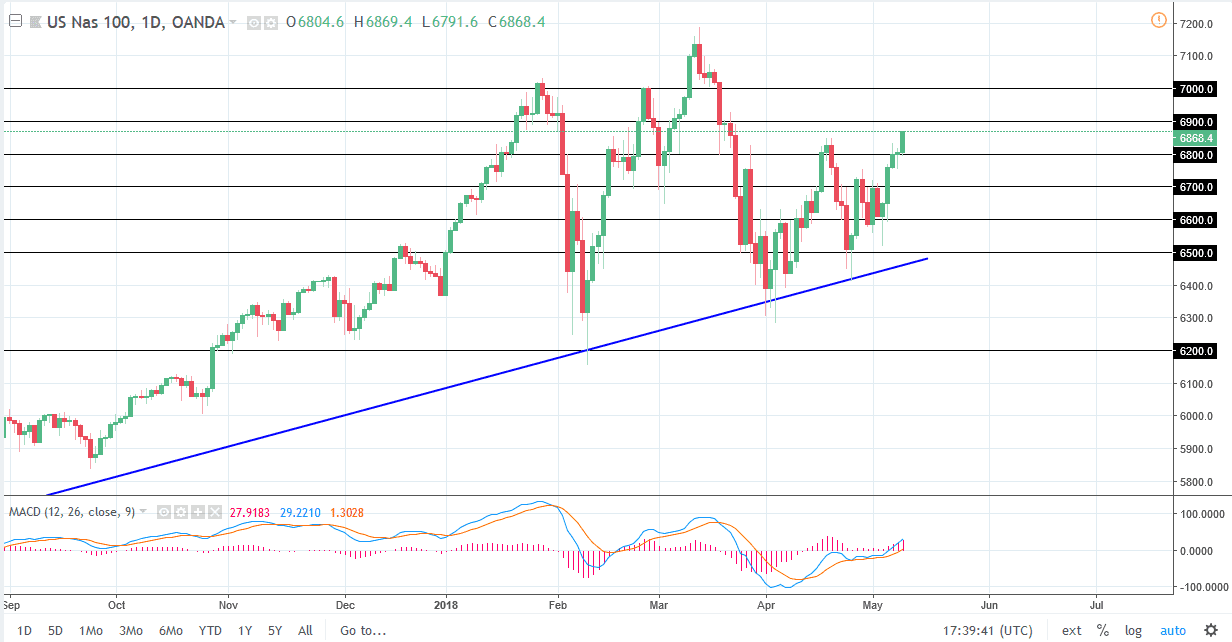

NASDAQ 100

The NASDAQ 100 broke higher during the session on Wednesday, clearing the top of the hammer from the previous session, showing that we are increasing the bullish pressure. Now that we have made a fresh, new high, the market looks likely that we are ready to go to the 6900 level, and then even break above there to reach 7000 again. I don’t have any interest in shorting this market, the uptrend has held several times as we have tested the major uptrend line, and of course the S&P 500 has broken above the top of a major wedge which is also very positive. Ultimately, there is no reason to think about shorting this market quite yet, and I think that pullbacks will be opportunities to pick up value in a market that has held up quite nicely.