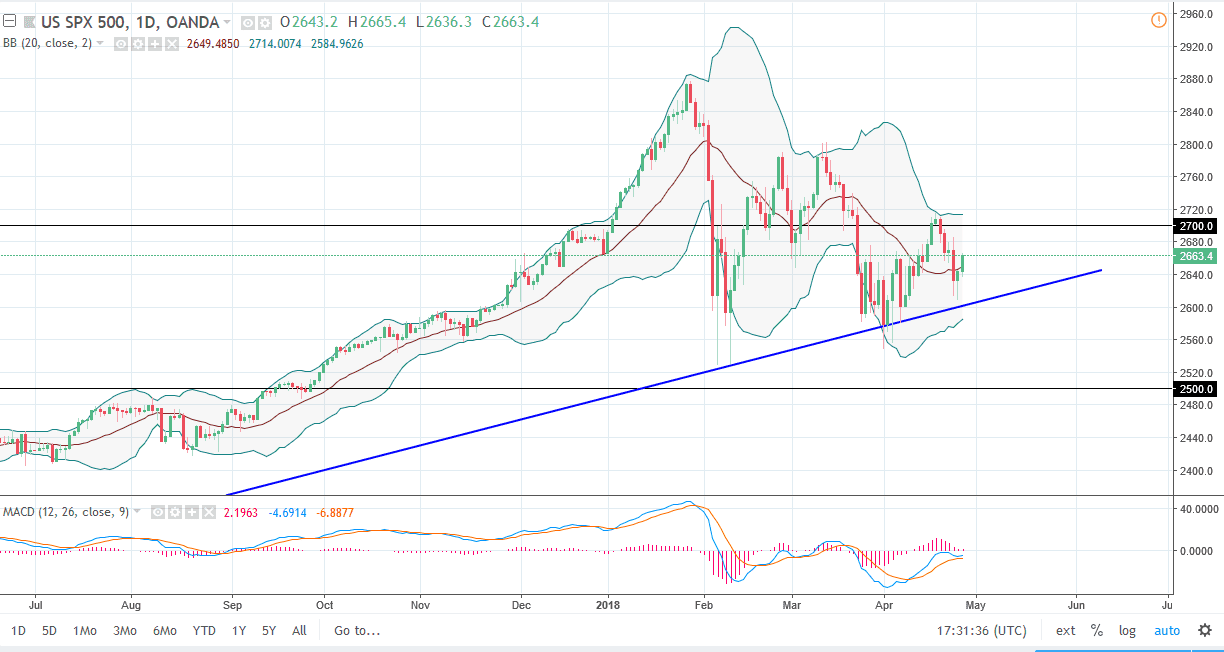

S&P 500

The S&P 500 rallied significantly during the trading session on Thursday, breaking above the 2660 handle. I believe that the 2700 level above is an area of resistance, but I think it’s also a bit of a magnet for price. The uptrend line underneath should continue to keep this market higher, and if we can stay above that trend line, then I think buying on dips will continue to be a way to trade this market. If we were to break down below the uptrend line, I think the market should then go down to the 2550 handle, perhaps even the 2500 level after that. If we were to break above the 2700 level, then I think the market will go to the 2800 level. This is a market that I think will continue to be very noisy, but earnings season has been quite decent.

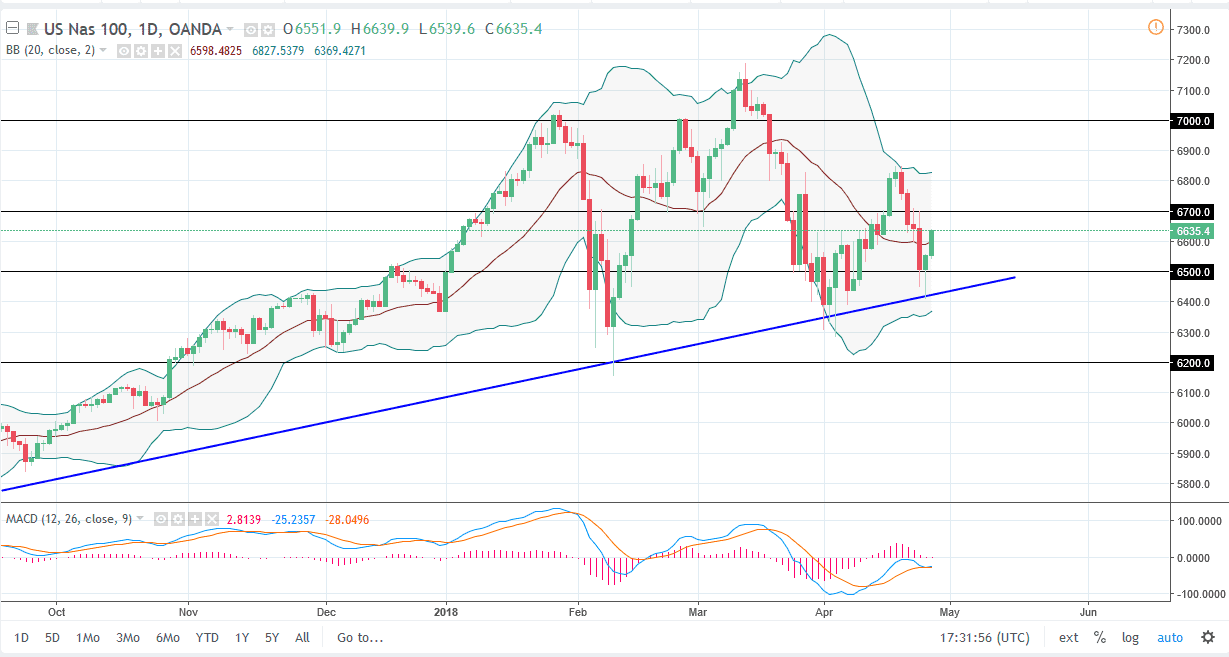

NASDAQ 100

The NASDAQ 100 rallied significantly during the trading session on Thursday, breaking above the 6640 handle during trading. I think the market should then go to the 6700 level after that. I think if we can break above that level, the market is likely to go to the 6800 next, and then eventually the 7000 level. I think short-term pullbacks will be buying opportunities, and I also believe that the uptrend line underneath is one of the main reasons that we are technically sound even though it’s been very noise over the last several months. I think if we break down below the uptrend line, we will probably break down to the 6200 level at the very least. Otherwise, I think we’re trying to build up a bit of a base to go to the 7000 level. NVIDIA, AMD, and Facebook all had great earnings reports to help as well.