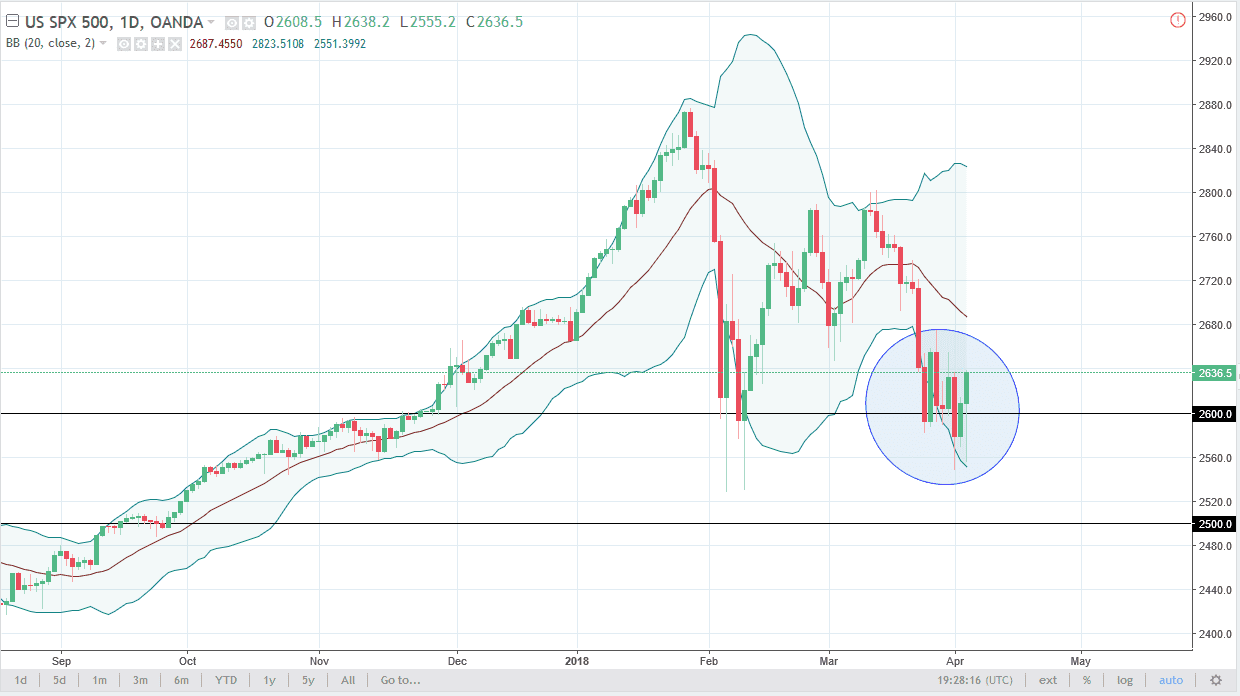

S&P 500

The S&P 500 pulled back initially during the trading session on Wednesday, reaching the bottom of the Bollinger Bands indicator. However, we have rallied rather significantly, and this is a strong sign, considering that we had sold off so drastically. Ultimately, the market that shows this type of resiliency is typically a very good sign for the longer-term uptrend. I think that we may have plenty of buyers underneath, so as we await the jobs number tomorrow, I think short-term pullbacks will be buying opportunities. If we break down below the 2500 level, that could send this market much lower, and send the sellers into a frenzy. It looks as if we are starting to show signs of very significant support, and I think that if we can break above the 2680 handle, that could send the market much higher, perhaps reaching towards 2800 in the meantime.

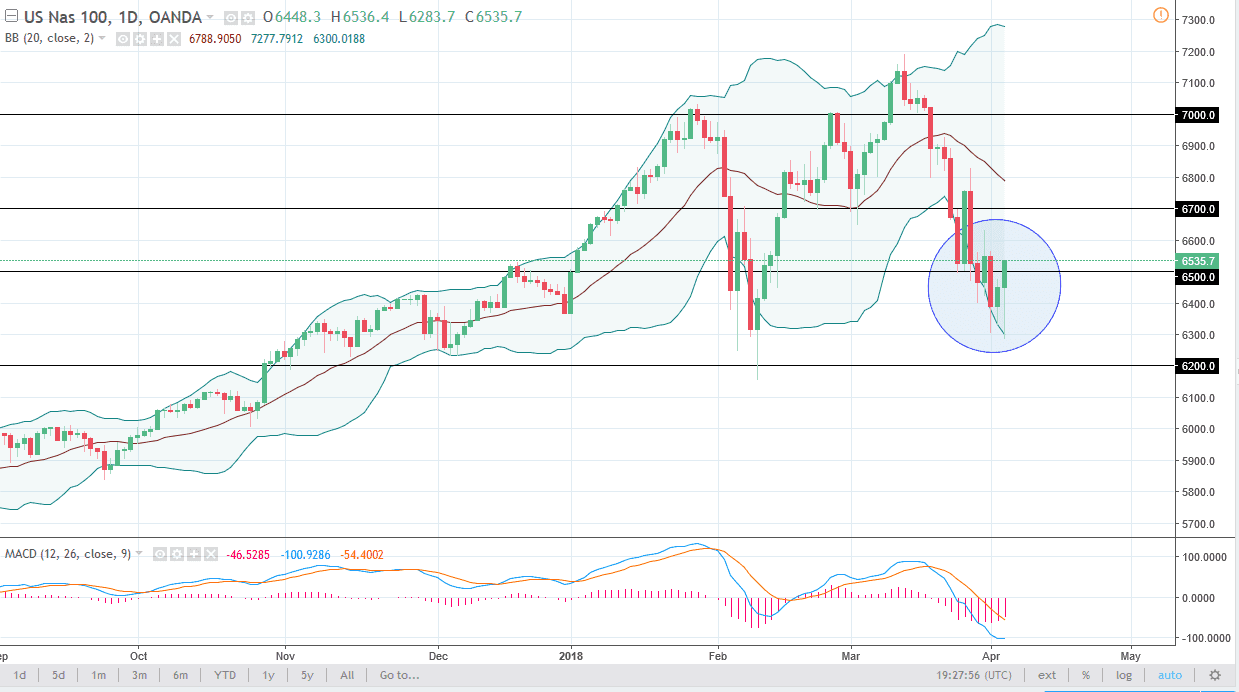

NASDAQ 100

The NASDAQ 100 fell significantly during the trading session on Wednesday, reaching down to the 6300 level. There is a significant amount of support underneath though, and I think that the resiliency that was shown in this market on Wednesday is also a very bullish sign. If we can clear the 6600 level, that could be key to determining where to go next. Ultimately, we could then go to the 7000 handle above, which has been resistance more than once. I think that we are consolidating, and it looks as if we are trying to continue the overall upward trend. If we break down below the 6200 level, that would be a very negative sign, perhaps sending the sellers in a frenzy over here as well. I think that the jobs number could give us an opportunity to go further to the upside if it strong. Ironically, a week jobs number may have traders thinking less tightening from the Federal Reserve, and that could be a bullish sign as well. I think that we are trying to form some type of bottom.