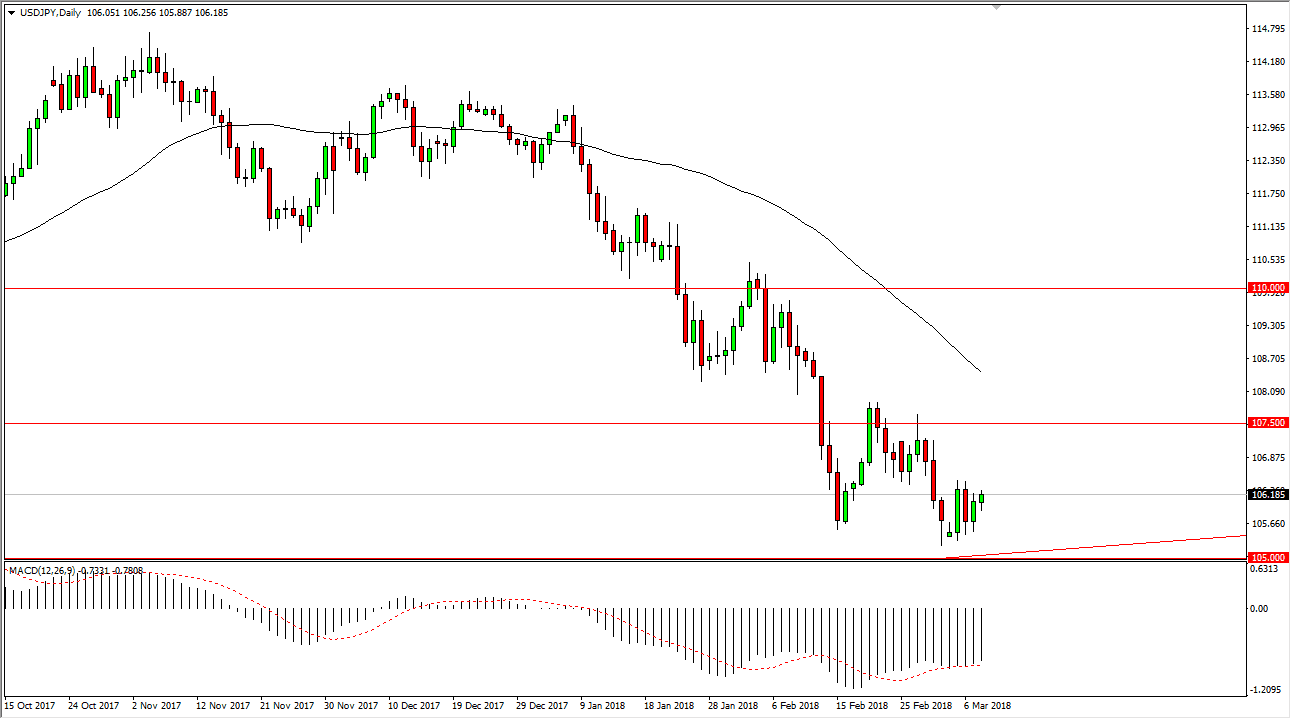

USD/JPY

The US dollar was rather quiet against the Japanese yen during the trading session on Thursday, which of course makes sense as we are awaiting the jobs number today. This pair tends to be very sensitive to jobs numbers, and therefore I think that we won’t do much until then. However, if the jobs number is good, and typically will send this pair higher and I think at that point we will be looking towards the 107.50 level. Otherwise, if we pull back to the 105 handle, that’s an area where there is a coinciding uptrend line that should continue to be supportive, just as well as the large, round, psychologically significant number. If we were to break down below the 105 handle, then the market is probably free to go down to 100 which would be a significantly bearish move, probably coinciding with markets in New York and various stock market centers falling.

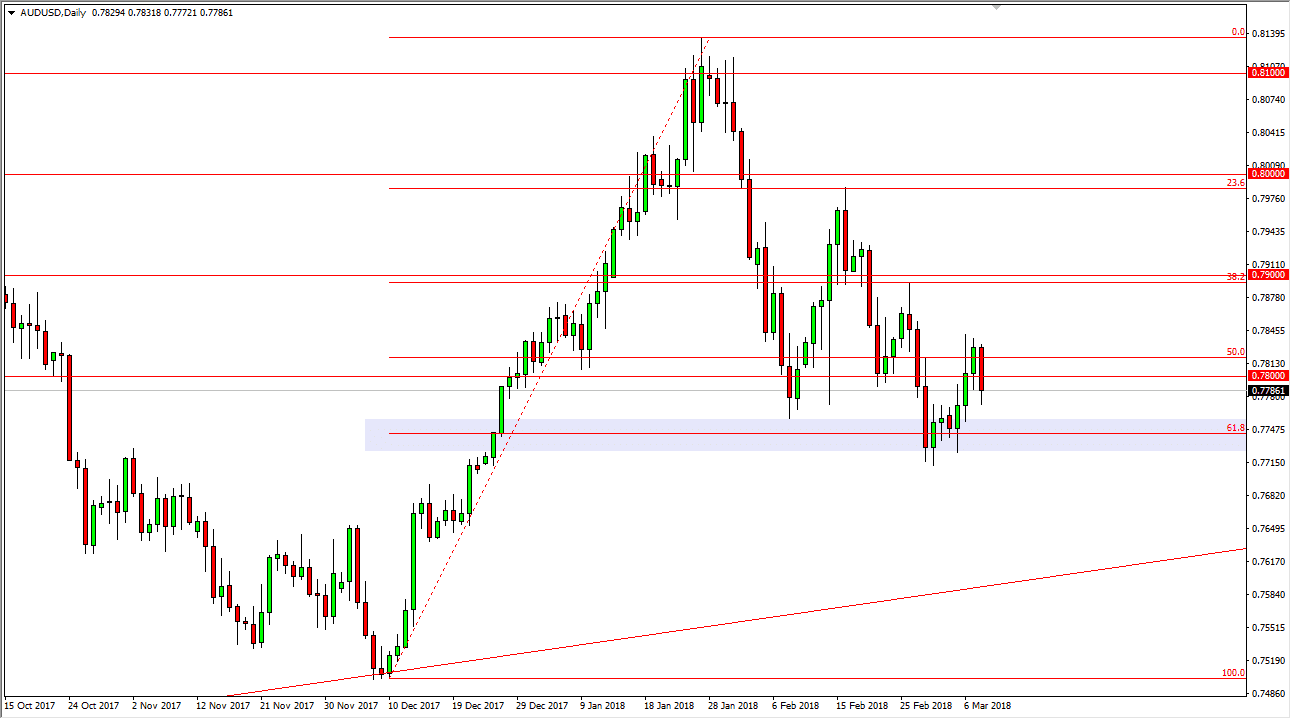

AUD/USD

The Australian dollar fell rather significantly during the day as well, as it looks likely that we are going to see a lot of volatility due to the jobs number. The 61.8% Fibonacci retracement level is just below, as you can see on the chart. I think that the 0.77 level underneath will offer a bit of a floor, and if we can stay above there think it’s only a matter of time before we bounce from there. Alternately, if we turn around and break above the 0.7850 level, the market should continue to go towards the 0.9 level, and then possibly even higher than that. If we are going to break down below the 0.77 handle, at that point I think we would go down to the uptrend line, perhaps even the 0.75 level.