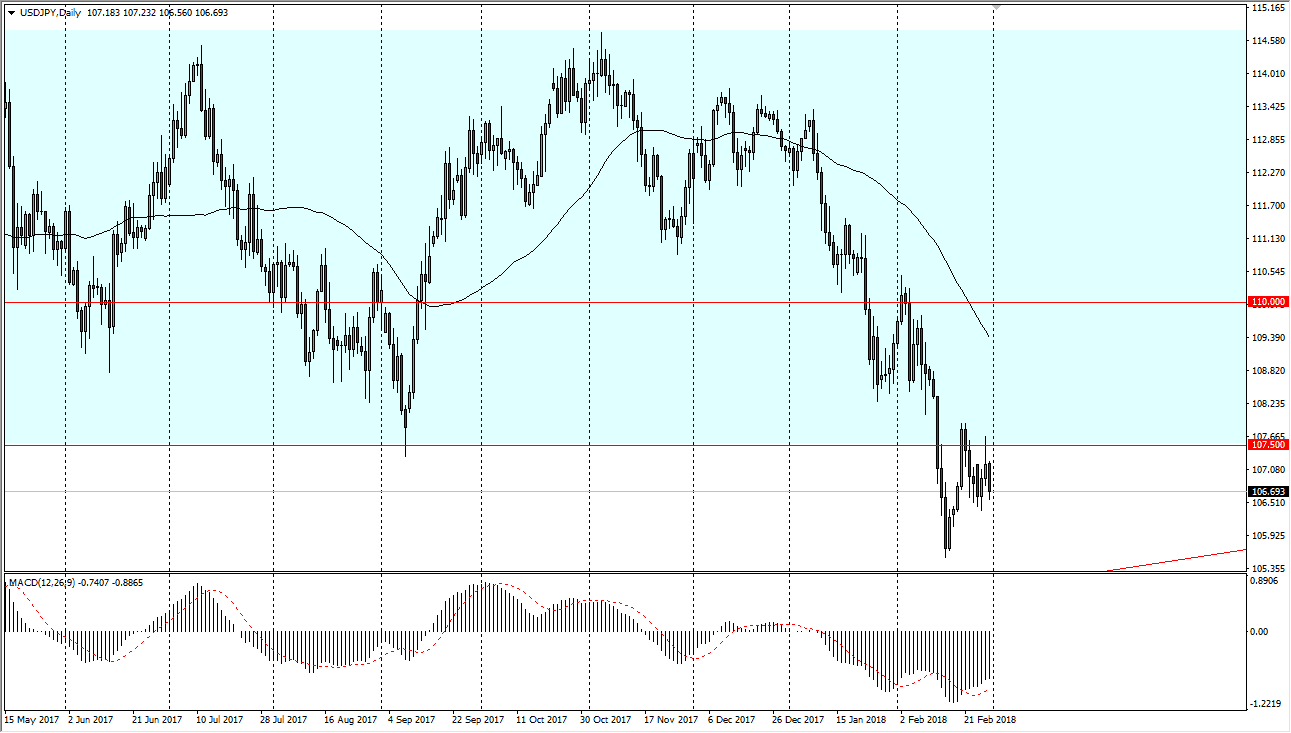

USD/JPY

The US dollar fell again during the trading session on Wednesday, looking towards the 106.50 level. This area has offered support as of late, and it looks as if we are ready to continue to find noise in this area. However, I think that the market breaking down below the 106.50 level should send this market down to the 105.75 level, and then eventually the 105 handle. It’s at the 105 level that I anticipate seeing even more support, and a breakdown below there would be somewhat catastrophic. I believe that we are essentially in an area of accumulation, perhaps going back and forth so that we can build up the necessary momentum to break out. However, it’s not until we clear the 108 level that I feel comfortable buying. In the meantime, anticipate a lot of short-term scalping in both directions.

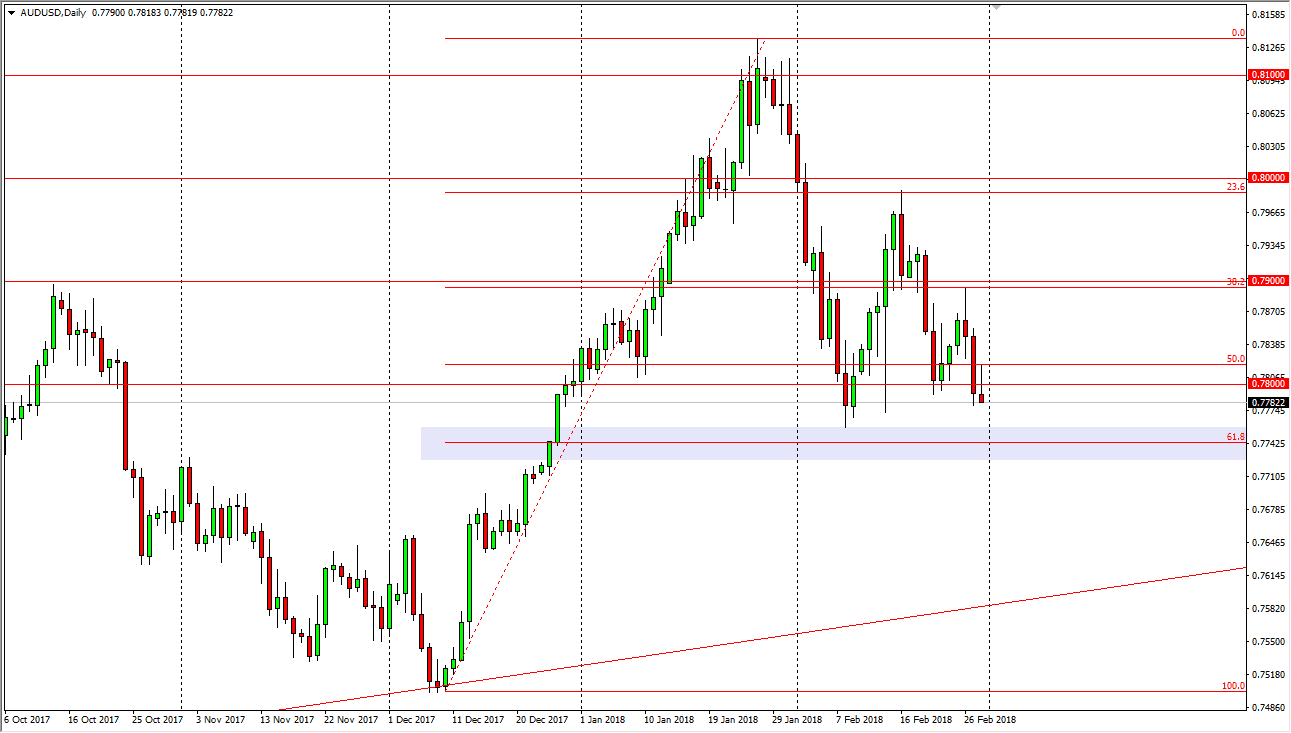

AUD/USD

The Australian dollar initially tried to rally on Wednesday, breaking above the 0.78 handle, but then rolling back over to form a shooting star on the daily chart. I believe we are going to test the 61.8% Fibonacci retracement level just below, and a breakdown below there could send the Aussie even lower than that. I think at that point, but probably looking towards the 0.76 level underneath, looking at even lower levels afterwards, perhaps down to the 0.75 handle. The alternate scenario of course is breaking above the top of the shooting star for the session on Wednesday, which would be very bullish and could send this market looking as high as 0.79 over the next several sessions. A break above that level then frees the market to go to the 0.0 level. Pay attention to gold, if it rallies, the Aussie does as well. Obviously, the exact opposite can be said also.