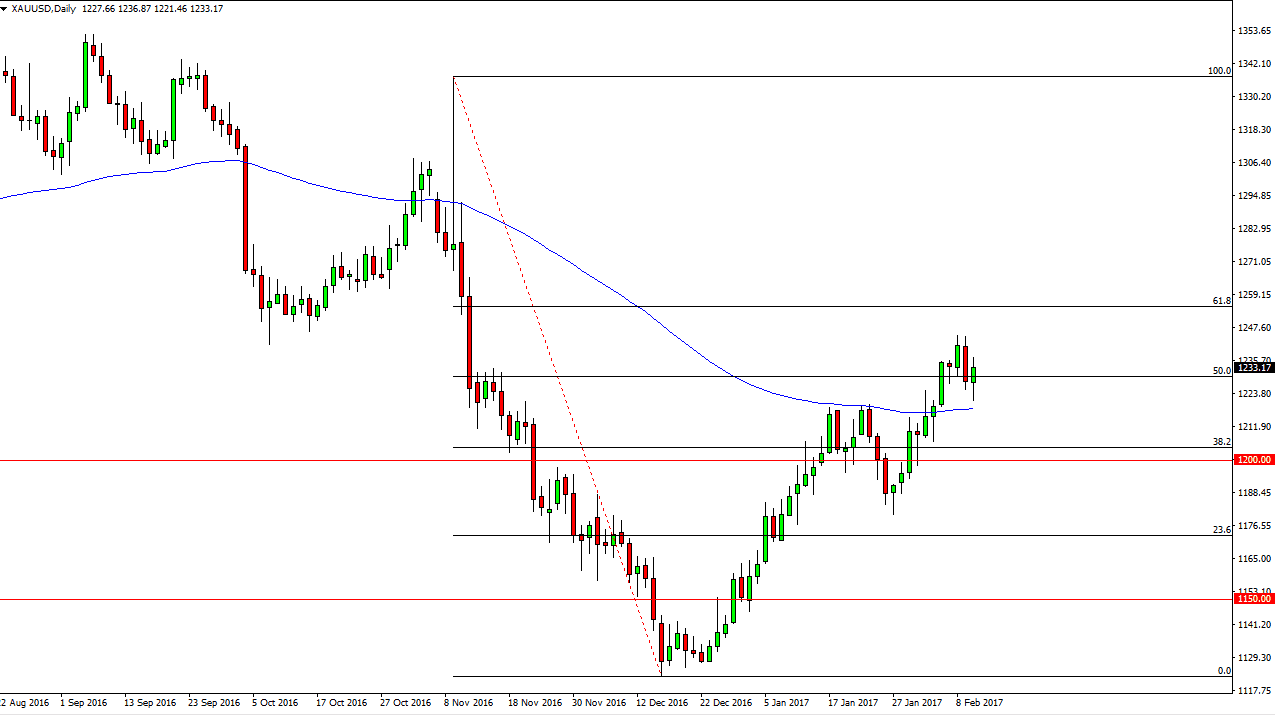

Gold markets initially fell during the session on Friday, but found enough support at the 100-day exponential moving average to turn things around and form a nice-looking hammer. We are right at the 50% Fibonacci retracement level from the Donald Trump shock election result, so it makes sense that there will be a lot of interest in the market currently. If we can break above the top of the hammer, I think we will then reach towards the 61.8% Fibonacci retracement level, which is the $1250 level. In general, it appears that the US dollar is struggling, and the gold markets will continue to show strength due to that. Because of this, if you are diligent enough it’s likely that you will make gains by going long. I think this is a longer-term move just waiting to happen, and as a result if you can pile into the position in small increments, things could turn out quite well for you.

Buy on the dips

I believe that the gold markets are ripe for buying on the dips going forward, and short-term pullbacks should continue to be opportunities to take advantage of what appears to be a very strong trend. I think that the $1200 level will offer a bit of a “floor” in this market, and I believe that we will probably reach race the entire move from the election results, meaning that we could go all the way to the $1340 level. It will take a long time to get there, so I think this is more or less going to be a longer-term move.

It’s possible that the market will continue to be volatile, but there are a lot of different ways to avoid the trouble. You can perhaps take longer-term options out, or perhaps buying physical gold if that’s a possibility. I think of this more as an investment in less as a trade.