Gold prices rose for a third straight session to settle at their highest level since mid-February as the dollar’s decline increased investors’ appetite for the precious metal. The metal's near 2% gain in the previous session was triggered by sluggish U.S. retail sales data. There is a growing perception that the Federal Reserve is likely to hold off hiking interest rates until September or December to ensure the economy is strong enough to withstand an increase in borrowing costs, and this is supporting gold prices at the moment.

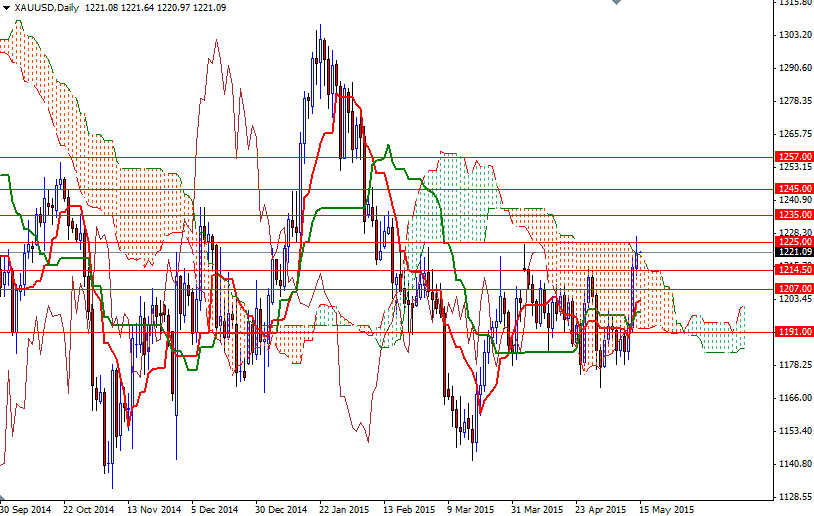

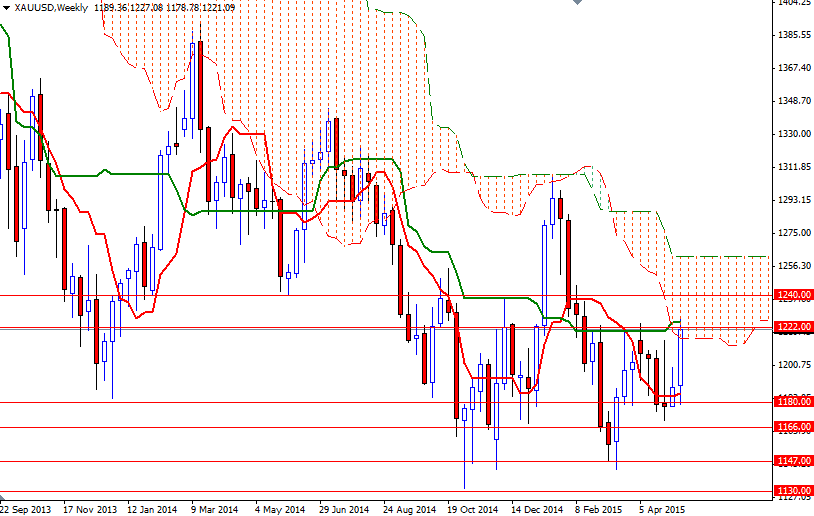

On both the daily and 4-hour charts, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned and the market is trading above the Ichimoku clouds. These factors paint a positive technical picture, however, the daily Chikou-span (closing price plotted 26 periods behind, brown line) still remains below the cloud and the 1225/2 area (50% retracement level based on the distance between 1307.47 and 1142.63) is a significant barrier that can offer resistance. Because of that, it would be reasonable to expect a pull back around the current levels.

If the market climbs and holds above the 1225 level though, we could go as high as 1257, which is the next major resistance. On its way up, there will be hurdles such as 1235, 1240 and 1245. On the other hand, if the bulls run out of steam, the XAU/USD pair will probably head back to the 1214.50 - 1212 area. Dropping through the 1212 level would indicated that prices could fall further to the 1207 level before finding some support.