By: YesOption

Many regulators over the past few months have come out in full support of Bitcoin. A member of the Commodity Future Trading Commission stated that regulators should give Bitcoin a fair chance, as many believe the digital currency has the unique ability to change the way the masses conduct their business and will allow people from third-world countries who do not have access to banking systems the ability to perform global transactions at a fraction of the cost.

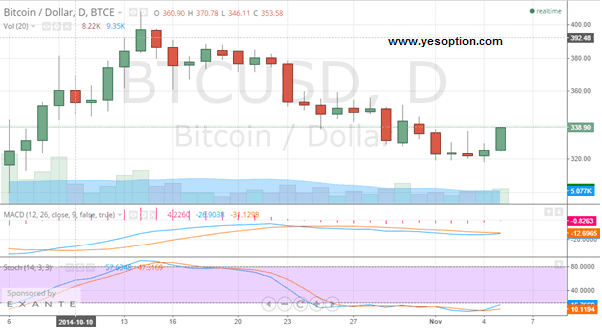

The BTC/USD displayed some strong price-action during today’s trading session. The crypto-currency is forming a bullish engulfing pattern thanks to above average volumes, which suggests that buying interest seems to have returned. The next level of resistance for the BTC/USD comes in at around $345, while support continues to remain near the $321 levels.

Meanwhile, its stochastic oscillator is now providing a fresh buy signal, and is finally indicating that it’s starting to move above the oversold zone, which is a positive sign. Additionally, the momentum indicator for the BTC/USD is showing its first sign of reversing, implying a turn towards the buy side.

However, many analysts have noted that traders should only believe a reversal is occurring if the BTC/USD is able to rise above the aforementioned resistance. It is imperative to state that BTC/USD continues to remain below its important daily moving average.

Actionable Insight:

Long the BTC/USD if it moves above $345 for a short term target at $367 with a strict stop loss below $321

Short the BTC/USD if it moves below $321 for an intermediate target at $280 with a strict stop loss above $338