The EUR/USD pair fell during the session on Friday, as the nonfarm payroll numbers did not come out due to the US government shutdown. That being the case, the US dollar got a little bit of a reprieve as there was no bad news. That being the case though, I feel that it's only a matter time before the jobs number comes out and works in favor the Euro. Quite frankly, I do not see any real chance of the jobs number being strong.

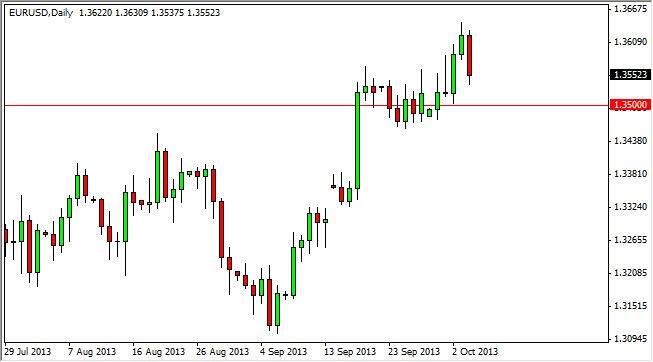

On top of that, I see the 1.35 level as being very supportive, so would not surprise me at all to see the market offer quite a bit of support and buyers stepping in at that point. In fact, I would not hesitate to start buying on some type of supportive candle in that general vicinity as I believe the Euro should continue to strengthen overall. After all, this is the "anti-dollar."

The European Union has exited a recession

The European Union has recently exited a recession, which of course shows that the area should be strengthening economically. Obviously, it's not going to be the same everywhere, but as the economies of Germany and France go, so goes the Euro in general. Because of this, I am bullish on the Euro going forward because Germany and France keep showing strength.

Even if we managed to break down below the 1.35 handle, I believe the 1.34 level would continue to offer support as well, so I'm willing to buy all the way down there as well. If we did get below the 1.34 handle, I would be willing to start selling at that point but would expect some type of choppiness all the way down.

On the other hand, if we managed to break above the recent high from two days ago, I would be more than willing to start going long. I think above there we would more than likely head towards the 1.40 handle, which of course is the next large round psychologically significant number.