Gold is going to be the epicenter of a lot of trading during the month of August, simply because there are a lot of different things going on at one time. For starters, late August will see the return of liquidity into several of the markets that tend to lose it during the summer. A lot of large traders will be coming back from summer break, and therefore you often see significant moves towards the end of August, or in the beginning of September.

However, this year is going to be a bit different. This is because there are a lot of people out there focusing on what the Federal Reserve will do. There has been talk recently that the Federal Reserve will taper off of quantitative easing during the month of September. Because of this, the US dollar should appreciate over the next couple of months, driving down the price of many commodities with gold being especially sensitive. However, Ben Bernanke has recently suggested that perhaps the Federal Reserve is rethinking the possibility of tapering off. If that's the case, the US dollar should depreciate, and this of course will drive up the value of gold.

This is where we are currently, and as a result there are a lot of nervous traders out there. Coupling that with liquid conditions can lead to sudden moves in either direction. In other words, you may find the gold market very difficult to deal with over the next several weeks.

Fed watch

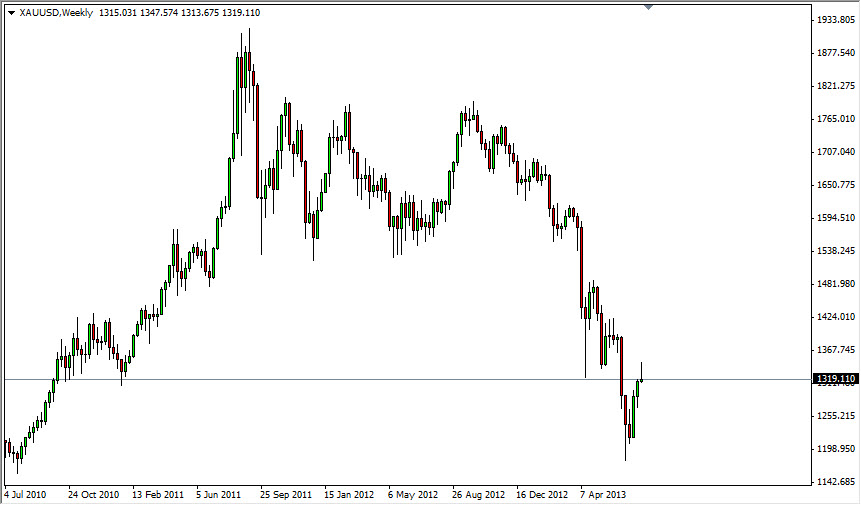

This will all be based upon the Federal Reserve. There are various technical levels to watch of course, such as the $1350 level. I believe that the level is significant resistance, and based upon the chart that you are looking at right now, you can see that the buyers have been thwarted up to this point. If we can get above that level, we could see a move as high as $1500 without breaking the downtrend. However, if the Federal Reserve does in fact taper, you could see a massive reversal in gold. This would have gold selling off drastically, and looking for $1200 for support, and then eventually $1000.

It is in fact very difficult to predict where gold will go without knowing what the Federal Reserve will do. Quite frankly, even though there are technical levels to pay attention to, this is a market that is going to be driven solely upon emotion, and reaction to any announcements of the Federal Reserve. Expect the September meeting to be what the market truly focuses on, and as a result the trading month for August might be a bit shaky at best.