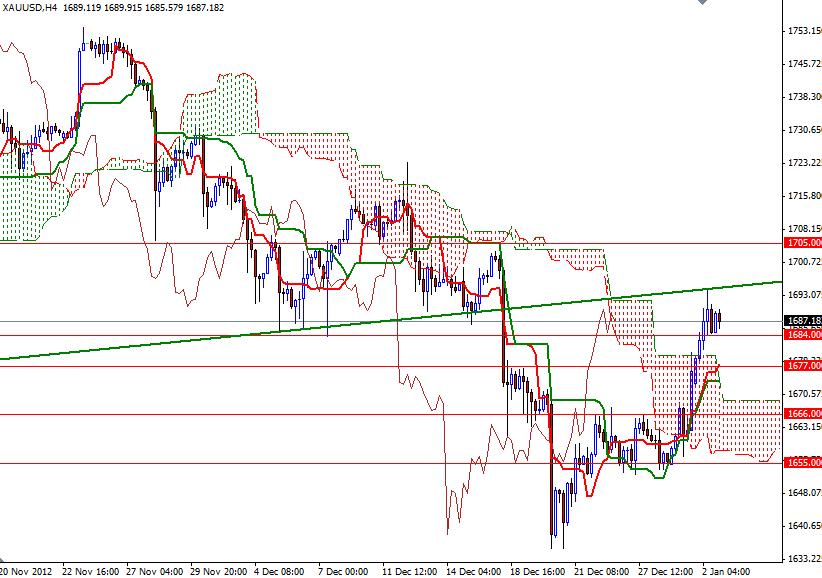

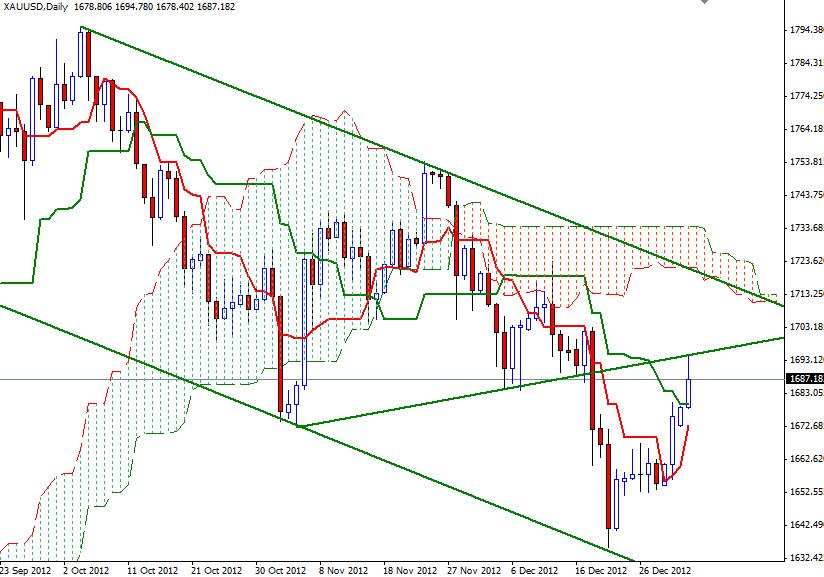

XAUUSD rose to its highest level in two weeks after the fiscal package passed by both houses of Congress prevented the United States from slipping into a recession. Gold traded as high as 1694.92 but pulled back to the 1686 level, which was the previous resistance, after the report released from the Institute for Supply Management showed the manufacturing index rose to 50.7 from 49.5. Although U.S. lawmakers reached a (last-minute) deal, I don't think the drama has ended. Now the Republicans will play the debt ceiling card to force the White House to accept deeper spending cuts. Probably this will be another drama as the Republicans won't agree to raise the debt ceiling unless the Democrats agree to reduce spending. Of course, in the meantime, the rating agencies won't waste the opportunity to say negative comments. Moody's Investors Service said “lack of further deficit reduction measures could affect the rating negatively. Notably, yesterday's package does not address the federal government's statutory debt limit, which was reached on December 31” in its statement earlier today. From a technical point of view, today the key levels to watch will be 1695 and 1684. If the XAU/USD pair breaks through the 1695 barrier, I think the bulls will gain enough momentum to reach the 1705 level. Above 1705, the real challenge will be waiting the bulls at the 1713 level. This level maybe tough to pass as the Ichimoku cloud and the upper band of the descending channel coincides in this area. If the downward pressure increases and the pair breaks below the 1684 support level, prices may pull back to the next support level at 1677 which is also the Tenkan-sen line (nine-period moving average, red line) on the 4-hour time frame. Below 1677, expect to see more support at the 1666 level. Today sees release of several important economic reports from the United States such as ADP Private Jobs, Weekly Unemployment Claims and FOMC Meeting Minutes, so expect volatility.

Gold Price Analysis - Jan. 3, 2013

By Alp Kocak

Subscribe Sign up to get the latest market updates and free signals directly to your inbox. *By registering you agree to receive communications.

Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

- Labels

- Gold