According to Germany's Federal Statistical Office, retail sales rose by 5.6% (annually) in November, higher than expectations of 3.9% but lower than the previous month's 8.6% rise. In monthly terms, retail sales rose 1.9% in November, lower than October's 2.6% rise but significantly higher than forecasts of a 2% decline.

The Federal Statistical Office linked the expansion with a surge in online sales and home improvement spending.

Retail sales are set to grow by 4% this year, despite the disastrous effects of the pandemic on economic activity. This is good news for Germany, which currently struggles with the spread of the virus.

In order to curb the spread of the virus, the German government has been considering extending the national lockdown by three weeks. The majority of Germany’s states already agreed to impose this measure, which is set to be announced on Tuesday after a meeting with Chancellor Angela Merkel.

Since mid-December, schools, stores and services have been closed due to COVID-19, which has infected 1,796,216 individuals and killed 35,632. With the new measures, restrictions would end on January 31st instead of January 10th.

According to recently released data, employment ended a 14-year gaining streak as it fell by 1.1% year-on-year, the sharpest decline since 1993. Markit Economics reported a slower expansion in the manufacturing sector in December, as the Manufacturing PMI stood at 58.3 after being at 58.6 in the previous month.

German Chancellor Angela Merkel recently concluded the Comprehensive Agreement on Investment with China, which would further improve the economic relationship between both countries. The decision was made despite President-Elect Joe Biden’s requests, as the agreement would make it harder to align the European Union’s policies with those of the United States.

Economic Calendar

With the New Year holiday last week, there were no data regarding the European economy.

This week, Markit Economics reported that the European Union’s manufacturing sector expanded less than expected, with a Manufacturing PMI reading of 55.2, less than the previous month's 55.5. Predictions were that it would remain unchanged.

Euro Recovers

So far this week, the euro has gained 1.21% against the US dollar, breaking a two-week losing streak. It also managed to recover against the pound sterling, advancing by 1.88 percent and breaking a three-week losing streak.

The euro's recent gains can be linked to the UK's decision to impose another lockdown due to the uncontrolled spread of a recently identified strain of COVID-19. This fall offset sterling's gains from a post-Brexit trade deal.

“Sterling lost ground against the euro yesterday as the market reacted poorly to the prospect of a third national lockdown in England,” explained an analyst at Caxton FX. "With Brexit now out of the way, the economic backdrop will be a more significant driver of the pound both today and in the coming months.”

The European Central Bank, which is now amid an ongoing policy review, provided additional stimulus in December, expanding its emergency bond purchases program by 500 billion euro. ECB Governing Council member Pablo Hernandez de Cos called the Bank’s governing board to explore other options that could help reduce the volume of bond purchases.

“I think yield curve control is an option worth exploring,” de Cos commented. “The experience of these central banks suggests that, if sufficiently credible, yield curve control allows the central bank to achieve a yield curve configuration with a lower amount of actual purchases, hence enhancing efficiency.”

Eurozone Economy Worse Than Expected, Though Improving

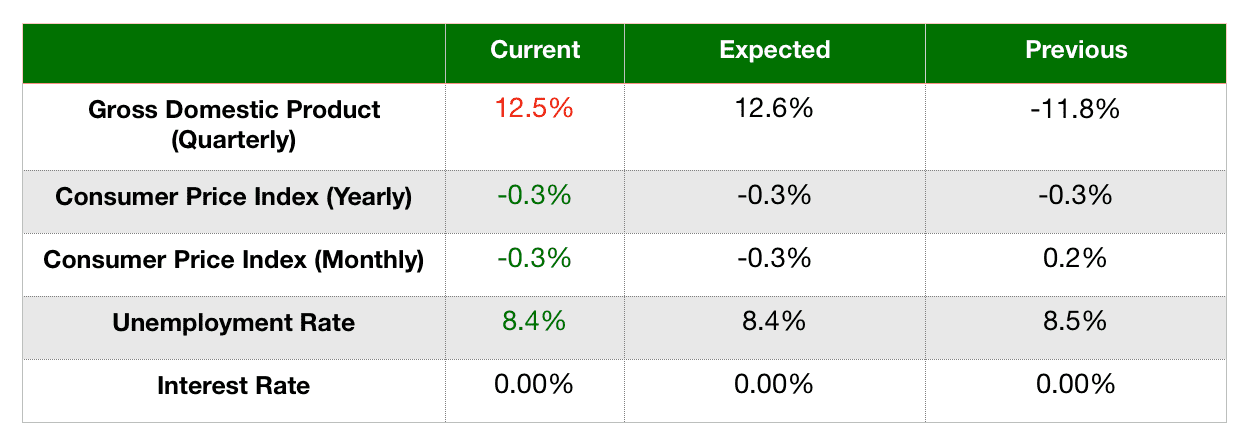

Since our last report, the Eurozone growth data has remained unchanged. Inflation remained in line with analysts' expectations, though way below the ECB's target. The latest unemployment level signals a slight decline in the labor market at 8.4% after being at 8.3% in September.

According to a poll of economists led by the Financial Times, analysts expect the Eurozone economy to rebound by 4.3% this year. This figure heavily contrasts with the International Monetary Fund’s projection, which stood at 5.2%.

In terms of unemployment, analysts are more pessimistic with predictions of over 10%, significantly higher than the last reading.

Upcoming Events

- Tomorrow, IHS Markit will release both the Composite and Service PMIs for the Eurozone.

- On Thursday, retail sales data is expected to be published.

- Also on Thursday, the Consumer Price Index, business climate and industrial confidence data will be released.

- On Friday, November's unemployment data will be released.