The European Central Bank recently released its monetary policy meeting minutes, showing that the bank’s policymakers supported the decision to continue with an accommodative monetary policy stance until March 2022.

The committee also expressed concerns regarding the future of the Eurozone economy, as they expect the economy to return to pre-crisis levels by the middle of 2022.

European Central Bank President Christine Lagarde recently warned against stopping stimulus measures now that economic recovery is in sight.

“Any kind of tightening at the moment would be very unwarranted,” she commented, adding that doing so could lead to “very serious risks”.

The Eurozone continues to struggle with inflation and the effects that exchange rates are having on it. The recent appreciation of the euro is a matter of concern for policymakers, since it is making exports more expensive and hurting local producers.

“It was pointed out that the nominal effective exchange rate currently stood at an all-time high and that the recent appreciation could contribute significantly to the subdued inflation outlook,” stated the ECB Monetary Policy Committee in its minutes.

The Eurozone economy is expected to rebound by 5.3% this year, as many expect the economy to return to normalcy now that a vaccination campaign is underway.

The ECB Monetary Policy Committee is expected to meet next Thursday.

Economic Calendar

This week, the markets learned some relevant information about the state of the European economy. On Wednesday, Eurostat reported that industrial production stood at 2.5%, against October's 2.3% and expectations of 0.2%. In yearly terms, it fell by 0.6%, higher than expectations of 3.3% and the previous month's 3.5% drop.

Euro Loses Ground Against the Dollar

So far this week, the euro has dropped by 0.63%, breaking a two-week gaining streak.

Many link this sudden weakness of the euro with the recent strength of the US dollar, as the markets expect President-elect Joe Biden to announce a very ambitious fiscal stimulus package. Those expectations made traders rush from bonds to stocks and the dollar.

“With labor really struggling, there’s an argument that we could push for a higher stimulus number,” commented an analyst at OANDA. “In the end, markets are anticipating that we’re going to see more stimulus than what is expected in Biden’s first 100 days and that’s why we’re seeing the dollar holding up.”

As we already mentioned, European policymakers have been very concerned regarding the recent appreciation of the euro, as it poses a problem for exporters. Many speculate that this opens the doors for a Forex intervention, though it’s not clear if such a step is likely at this point.

Eurozone Inflation Data Worsen

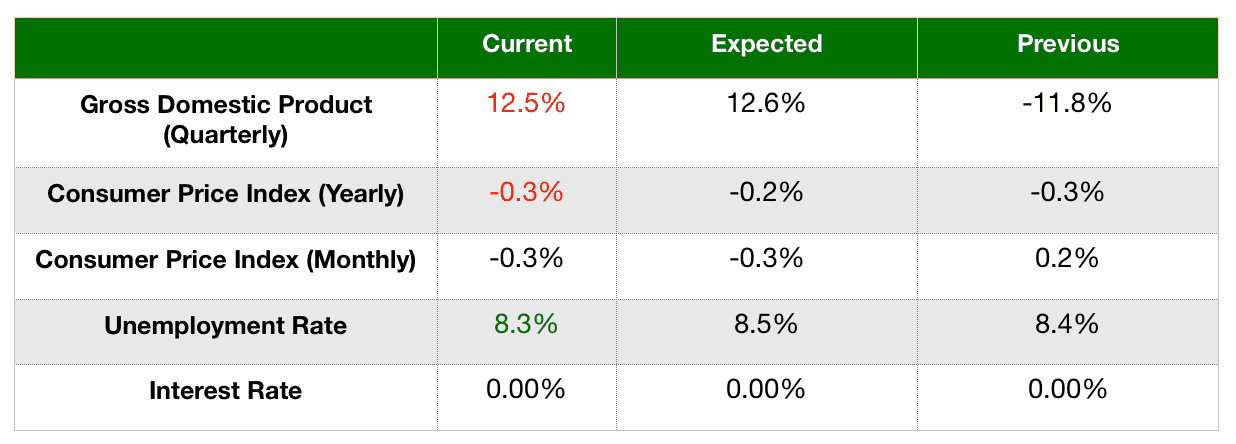

Since our last report, inflation data have worsened. In yearly terms, the Consumer Price Index fell by 0.3%, higher than expectations of -0.2%. In monthly terms, the Consumer Price Index remained in line with expectations at -0.3%.

Inflation remains too low, taking into account that the European Central Bank aims for a 2% inflation level.

The unemployment rate has improved at 8.3% according to the last reading, and better than expectations of 8.5%.

Gross domestic product data have remained unchanged until now.

Upcoming Events

On Friday, Eurostat will publish the trade balance data.