Most of you will be familiar with that famous Warren Buffett quote about markets remaining irrational longer than you can remain solvent. It is indeed sage advice, however, there’s another side to it. Markets also love stories, and market pundits like nothing more than being able to match what the ticker is saying today with some item in the broader news cycle. It’s a neat way to gloss over the complexities and to provide easy explanations for market scenarios that are actually bewilderingly complex, and remain a constant mystery even to the most grizzled of veterans. What’s been particularly noteworthy this month is just how quickly we’ve been encouraged to jump from one narrative to the next.

Most of you will be familiar with that famous Warren Buffett quote about markets remaining irrational longer than you can remain solvent. It is indeed sage advice, however, there’s another side to it. Markets also love stories, and market pundits like nothing more than being able to match what the ticker is saying today with some item in the broader news cycle. It’s a neat way to gloss over the complexities and to provide easy explanations for market scenarios that are actually bewilderingly complex, and remain a constant mystery even to the most grizzled of veterans. What’s been particularly noteworthy this month is just how quickly we’ve been encouraged to jump from one narrative to the next.

Story #1: US Election

When global markets began soaring off the back of US election uncertainty, the narrative explaining how well stocks were performing, was that a blue President and red senate would mean business as usual for the time being. Biden had ousted the loose cannon that was Trump, but a Republican senate would temper the new commander-in-chief and prevent him from making any of the more extreme changes he promised on the campaign trail.

A government that’s divided in this manner is regarded as good news because it can’t do much to spook the markets. So, no huge tax hikes for the time being, no outsized fiscal spending campaigns, and no attempts to break up the big tech companies.

Traders piled in while seeming oblivious to the fact that the election was in fact being contested, that a week later the full vote count had yet to be tallied, and that it had only ostensibly been called for Biden by the media.

Story #2: Pfizer Vaccine

As if the first week of November wasn’t action-packed enough, Monday, November 9, saw Pfizer and BioNTech, announcing that their vaccine candidate had been shown to be more than 90% effective in conferring test subjects with immunity to SARS-CoV-2. The news added further fuel to an election-inspired rally that was showing signs of running out of steam. The markets piled good news upon more good news and proceeded on a tear that would see the major US indices either breaching their all-time highs in the case of the S&P 500 and the Dow Jones Industrial Average, testing them as in the case of the Russell 2000, or coming within a stone's throw of them as in the case of the Nasdaq 100.

A feature of this second rally was that stocks that had been performing well earlier in the year due to movement restrictions started underperforming when compared to the stocks that had been hit hardest by the pandemic. The heavily tech-weighted Nasdaq fell short of its highs because investors were selling names like Netflix, Alphabet and Amazon in favour of airlines, cruises, movie exhibitors and, of course, pharmaceuticals.

Story #3: Rotation from Growth to Value

What’s perhaps most notable about the recent shift in stock market gains, is the sheer size of the rotation from growth stocks into value stocks that have been hit hardest by the pandemic. According to JP Morgan, November 9 saw the biggest single-day rotation from growth into value since 2008. Goldman Sachs also recently gave its clients a heads-up that the market “might be poised for a temporary rotation out of growth stocks and into stocks more sensitive to upcoming macroeconomic changes.” Add to this the other headline-grabbing news regarding declining numbers of jobless claims in the United States, and you can see why investors are selling the gains they have made since April and subsequently rotating these profits into many of the stocks that have massively underperformed throughout the year.

Caution is Recommended

The one thing you’re not likely to hear very often, especially when the narratives are lining up so convincingly, is to be cautious. However, there are aspects of the above narratives that do warrant caution. Trump is now engaged in a legal battle to prove that election irregularities (if not downright fraud) aided Biden in the attainment of his majority. Even though the media has been dismissing these claims out of hand, this doesn’t mean that his efforts won’t cause friction and uncertainty in US politics, gumming up the works, so to speak, at least in the short term. To say nothing of the growing tensions between pro- and anti-Trump supporters in the streets of US cities.

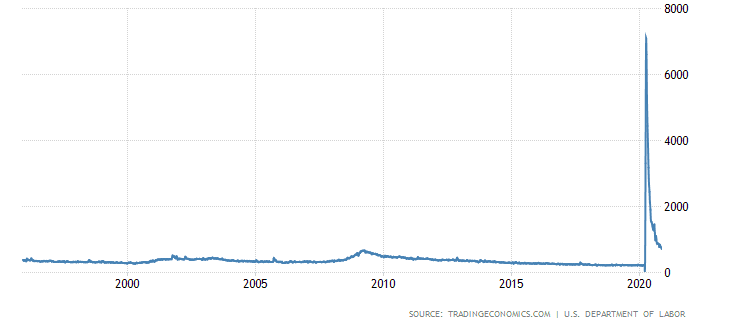

Also, while the vaccine news is tremendously encouraging, markets, as they are often wont to do, may have gotten ahead of themselves here. The details of this novel vaccine suggest that an enormous infrastructure is required to distribute it, including an unbroken cold chain to maintain it at the minus 70 degrees centigrade required. Factoring in the costs of establishing such infrastructures globally, the logistics of producing enough of it, and decision-making in each nation as to which groups are to get access to it first, we may be a way off from seeing the return to some semblance of normality that the markets have been busy pricing in. And even though the decreasing number of US jobless claims is looking good and hint at a possible strengthening of the economy, it’s important to note that even at these reduced levels, they are still well above former crises.

Meanwhile, Europe is re-entering a second lockdown, and civil unrest is on the rise as beleaguered populations suffer the consequences of these measures, while showing signs of losing faith in their respective governments. For our part, at HYCM we’ve been alerting our clients of increased volatility at key times such as the US election and informing them of the risks, especially in cases when leverage is used. Anyone who’s been on the losing end of a catastrophic short trade will tell you that betting against the market is not for the faint of heart, and is mostly not to be advised. However, at this juncture, they might just urge you to settle down, take some profits if you’ve been riding the recovery trade, and wait and see, rather than having your capital jumping from headline to headline.

About HYCM

HYCM is the global brand name of Henyep Capital Markets (UK) Limited, HYCM (Europe) Ltd, Henyep Capital Markets (DIFC) Ltd and HYCM Ltd, all individual entities under Henyep Capital Markets Group, a global corporation founded in 1977, operating in Asia, Europe, and the Middle East.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.

References:

https://www.cbsnews.com/news/stock-market-up-covid-vaccine-pfizer/

https://www.theguardian.com/business/2020/nov/09/stock-markets-covid-vaccine-ftse-100-coronavirus