For over a decade, DailyForex has been the trusted Forex broker authority, establishing an unrivalled reputation for rigorous research and journalistic integrity. With a methodology refined through years of industry experience, we empower traders to make informed decisions, which is particularly important when trading high-risk investments such as penny stocks. Discover more about our comprehensive review process and how we maintain transparency and impartiality here.

Editor’s Verdict

IUX is a decent choice for cost-conscious traders looking for a secure and efficient trading environment. Its standout features are the extremely low $10 minimum deposit, highly competitive trading costs on its Raw ECN account, and the significant advantage of being a swap-free broker across all account types. While it caters well to both beginners and experienced traders with the versatile MT5 platform, its range of assets and educational resources is more limited compared to some larger competitors. Overall, for traders focused on low fees and fast execution, IUX is an excellent and rapidly growing broker.

Overview

IUX is an Mauritius-headquartered Forex broker that has seen impressive growth since its operational start in 2016. It now serves over 650,000 traders globally and boasts a clean history. This broker focuses on providing a low-cost, high-execution speed environment, primarily through the MT5 platform. It operates under a multi-regulatory framework, including oversight from top-tier authorities like ASIC in Australia and the FSCA in South Africa, ensuring a secure trading environment.

Headquarters | Mauritius |

|---|---|

Regulators | ASIC, FSC Mauritius, FSCA |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2016 |

Execution Type(s) | ECN/STP, Market Maker |

Minimum Deposit | $10 |

Trading Platform(s) | MetaTrader 5 |

Average Trading Cost EUR/USD | 0.8 pips |

Average Trading Cost GBP/USD | 1.0 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.18 |

Average Trading Cost Bitcoin | $158.80 |

Retail Loss Rate | Undisclosed |

Minimum Raw Spreads | 0.0 pip |

Minimum Standard Spreads | 0.2 pips |

Minimum Commission for Forex | N/A |

Funding Methods | 15+(bank wires, credit/debit cards, cryptocurrencies, and several online banking solutions for its local Asian markets) |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

IUX Core Takeaways:

- Exceptionally Low-Cost Trading: IUX's primary advantage is its fee structure, featuring a very low $10 minimum deposit and a completely swap-free model on all accounts, which eliminates overnight fees.

- Top-Tier Regulation: IUX markets AU is regulated by the Australian Securities and Investments Commission (ASIC), providing a high level of security and trust.

- Versatile Account Options: With a commission-free Standard account for beginners and a Raw ECN account with spreads from 0.0 pips for advanced traders, it caters to different trading styles.

- Focused but Limited Offering: While strong in its core areas, IUX has a more limited range of tradable assets.

- Micro lots are available to trade, along with high leverage, which makes the broker very accessible for traders with limited capital to deploy.

IUX Regulation & Security

Safety of funds allocation to a broker is paramount when it comes to working with a firm; checking regulation and operational history, as well as other key indicators, can help us to mitigate these risks.

Country of the Regulator | Australia, Mauritius, South Africa |

|---|---|

Name of the Regulator | ASIC, FSC Mauritius, FSCA |

Regulatory License Number | 529610, 53103, GB22200605 |

Is IUX Legit and Safe?

Yes, IUX is a legitimate and safe broker. It is regulated by three authorities globally, providing a secure trading environment. The oversight from the Australian Securities and Investments Commission (ASIC) is particularly important, as it is a top-tier regulator that enforces strict standards for client fund protection.

Note that IUX is also a duly registered company in St. Vincent & the Grenadines under registration number 26183.

Fees

IUX gives traders an obvious choice: simplicity with wider spreads, or raw pricing with a commission. For active traders, the Pro or Raw account is where the real value lies

Average Trading Cost EUR/USD | 0.8 pips |

|---|---|

Average Trading Cost GBP/USD | 1.0 pips |

Average Trading Cost WTI Crude Oil | $0.04 |

Average Trading Cost Gold | $0.18 |

Average Trading Cost Bitcoin | $158.80 |

Minimum Raw Spreads | 0.0 pip |

Minimum Standard Spreads | 0.2 pips |

Minimum Commission for Forex | N/A |

Deposit Fee | |

Withdrawal Fee | |

Inactivity Fee | $0 |

IUX offers a transparent and highly competitive fee structure, primarily based on spreads and commissions that vary by account type. The broker offers 3 account types:

- Spreads: The Raw account offers the tightest spreads, starting from 0.0 pips. The Standard and Pro accounts feature spreads from 0.2 pips and 0.1 pips, respectively.

- Commissions: The Standard and Pro accounts are commission-free. The Raw account has a competitive commission of $6 per standard lot.

- Other Fees: IUX charges no inactivity fees, and deposit and withdrawal fees are limited to those charged by third-party payment providers.

EUR/USD Trading Costs Example:

To illustrate the trading costs, let us calculate the expense of trading one standard lot (100,000 units) of EUR/USD on the two main account types.

Account Type | Average Spread (EUR/USD) | Commission | Total Cost per 1.0 Lot |

Standard | 0.8 pips | $0.00 | $16.00 |

Raw | 0.1 pips | $6.00 | $14.00 |

Noteworthy:

- Swap Fees: A significant advantage of IUX is that all its trading accounts are 100% swap-free.

- Individual & Corporate accounts are available.

Overnight Swaps

A significant advantage of IUX is that when a new account is opened by anyone, the account does not charge swaps or rollover fees. Customers resident in Islamic countries are never charged or paid swaps or rollovers, but if other clients frequently hold positions open over the overnight rollover, fees may be charged or paid based upon the position of IUX’s liquidity provider.

This can make IUX attractive for swing and position traders, whose overnight fees are likely to be better than at most other brokers, even if they are charged.

Range of Assets

IUX provides a solid range of tradable instruments offered as a CFD product, covering the most popular markets. While not the most extensive list I've seen, it's more than sufficient for most traders.

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

IUX Leverage

IUX offers a high maximum leverage, which can be a powerful tool for increasing market exposure, but it also significantly increases risk. The broker offers a maximum leverage of 1:3000 across all account types, which is a standout in the market.

What should traders know about IUX leverage?

- Magnified Risk: High leverage amplifies both potential profits and potential losses. A small market movement against your position can result in significant losses.

- Risk Management is Key: Always use risk management tools like stop-loss orders when trading with high leverage. Never risk more than you can afford to lose.

IUX Trading Hours (GMT -2)

Asset Class | From | To |

|---|---|---|

Commodities | Sunday 23:01 | Friday 21:55 |

Crude Oil | Sunday 23:01 | Friday 21:55 |

Gold | Sunday 23:00 | Friday 21:59 |

Metals | Sunday 23:00 | Friday 21:59 |

Equity Indices | Monday 14:30 | Friday 21:00 |

Account Types

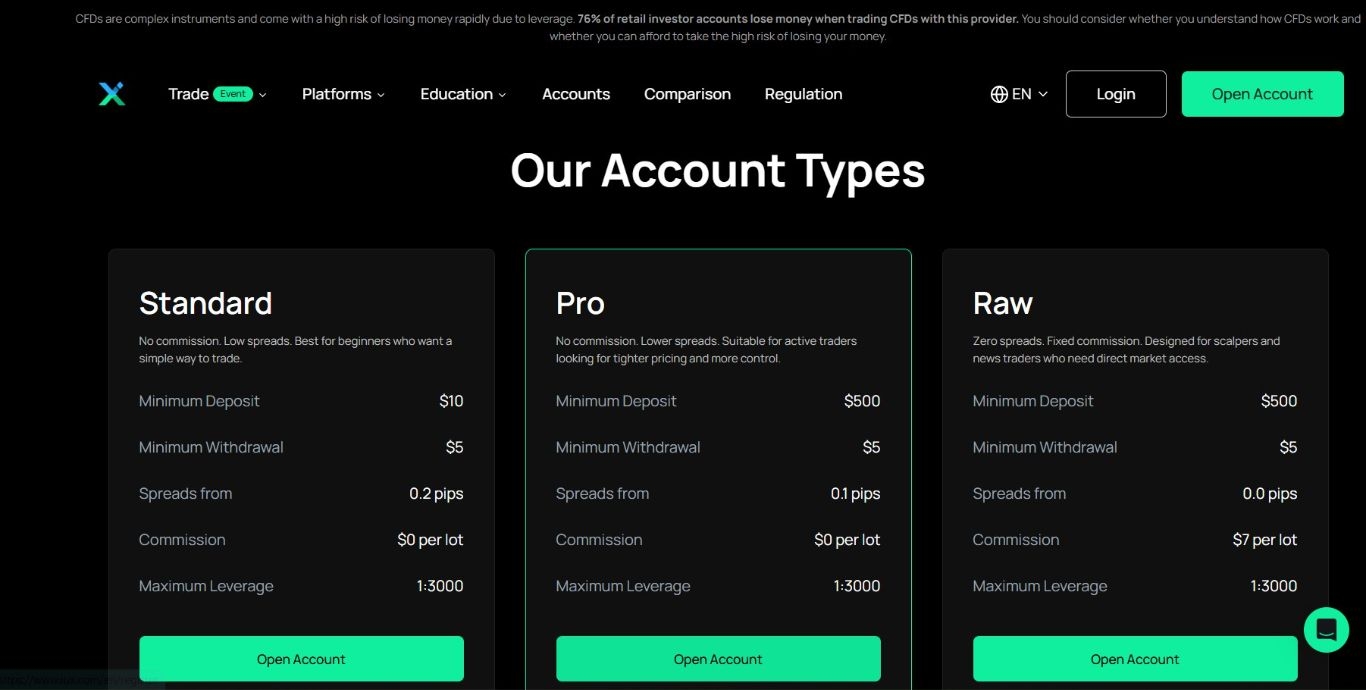

IUX provides three distinct account types to suit various trading needs, all offering a maximum leverage of 1:3000.

- Standard Account: Ideal for beginners with a low minimum deposit of $10, spreads from 0.2 pips, and zero commission.

- Pro Account: Suited for more experienced traders, this account requires a $500 minimum deposit for tighter spreads starting from 0.1 pip and no commission.

- Raw Account: Designed for scalpers and high-volume traders, this account has a $500 minimum deposit, raw spreads from 0.0 pips, and a fixed commission of $7 per lot. This account operates under a DMA (direct market access) model where trades are not executed by IUX but within a separate network of buyers and sellers.

IUX Demo Account

Yes, IUX offers a free demo account that allows new traders to practice their strategies with virtual funds in a risk-free environment. The demo account mirrors the conditions of a live trading account, providing access to the MT5 platform and real-time market data.

Trading Platforms

IUX provides the industry-standard MetaTrader 5 (MT5) platform. MT5 is a powerful multi-asset platform renowned for its advanced charting capabilities, a comprehensive suite of technical indicators, and support for automated trading through Expert Advisors (EAs). The platform is available for Windows desktop, as a WebTrader for browser access, and on mobile apps for iOS and Android.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

OCO Orders | |

Interest on Margin |

What I'd Like IUX to Add

While IUX excels in its low-cost, swap-free offering, there are a few areas where improvements could enhance its overall value and appeal to a broader range of traders

Expand the Range of Tradable Assets: Adding a wider selection of stocks, ETFs, and more exotic commodities would make the platform more attractive to traders looking to diversify beyond the core Forex and indices markets.

Develop In-House Research and Trading Tools: To complement its MT5 platform, providing daily market analysis, integrated news feeds, and proprietary trading tools would add significant value, especially for intermediate and advanced traders.

Clarify Client Protections: The broker should provide a clear, easily accessible statement on its website detailing its policy on Negative Balance Protection (NBP) and clarifying the differences in protection offered to clients under its ASIC and FSA-regulated entities.

Research & Education

IUX has significantly improved its offering for beginner traders by adding a dedicated Education and Academy section to its website. This new resource hub addresses a previous service gap and provides valuable learning materials for new clients. I like their courses dedicated to various levels of trading experience, from basics to trade and more in-depth lessons on advanced trading techniques and specific assets classes.

IUX has also added useful trading tools and data via integration with the popular TradingView platform, allowing traders to access detailed charts and up-to-date financial news.

Customer Support

Customer Support Methods |  |

|---|---|

Support Hours | 24/7 |

Website Languages |        |

Customer support is available 24/7. The service has been expanded to include English, Spanish, Bahasa Indonesia, Portuguese, Thai, Vietnamese, and Chinese. Support is primarily available via email and a live chat function on the website.

Bonuses and Promotions

Currently, IUX does not offer any bonuses or promotions.

Opening an Account

The account opening process is fully digital and follows industry standards.

What should traders know about the IUX account opening process?

- Register: Complete the online application form with your personal details. Traders can register as individuals or a company.

- Verify: Submit KYC (Know Your Customer) documents. This typically includes a government-issued ID (like a passport or driver's license) and proof of address (like a utility bill or bank statement).

- Fund: Once verified, you can fund your account using one of the available methods.

The online application takes less than 20 seconds, where IUX asks for the country of residence, name, e-mail, and desired password. E-mail verification is mandatory to complete the registration process. I like that IUX does not collect unnecessary data.

Minimum Deposit

The minimum deposit is $10 for the Standard account type, and $500 for the Raw and Pro account types.

Payment Methods

IUX supports a range of modern and traditional payment methods, including the following list.

Withdrawal options |      |

|---|---|

Deposit options |      |

- Deposit & Withdrawal Methods: Mobile money, bank transfer, credit cards, QR, e-wallet, Cryptocurrencies, virtual bank.

Accepted Countries

IUX accepts clients from many countries around the world. However, due to regulatory restrictions, they do not accept clients from the United States and other large OECD/Western economies like the UK, the EU, and Canada. Depending on the trader’s location, you will face a different regulated entity.

Deposits and Withdrawals

The process is straightforward, with a good range of modern funding options

What are the key takeaways from the deposit and withdrawal process at IUX?

- Deposit & Withdrawal Methods: Mobile money, bank transfer, credit cards, QR, e-wallet, Cryptocurrencies, virtual bank.

- Fees: IUX does not charge any internal fees for deposits or withdrawals. However, be aware that third-party payment processors or banks may charge their own fees.

- Withdrawal Speed: While the broker aims for timely processing of transfers.

Is IUX a Good Broker?

IUX is an excellent broker. It is particularly well-suited for beginners, due to its extremely low $10 minimum deposit, and for any trader who is sensitive to costs. The combination of competitive ECN spreads, zero-commission options, and being a completely swap-free broker makes its fee structure highly attractive. While its range of assets and in-house academy tools are not as extensive as some market leaders, its strong ASIC regulation, high leverage, and solid MT5 platform provide a secure and powerful trading environment. If your priority is minimizing trading costs in a regulated ecosystem. Yes, IUX offers mobile trading through its MT5 mobile application. The IUX minimum deposit is $10 for the Standard account, and $500 for the Pro and Raw accounts. No, IUX does not currently offer any no deposit bonus. IUX operates as a regulated legitimate Forex broker in a tier 1 regulatory jurisdiction, Australia, where it is regulated by ASIC. IUX is also regulated in South Africa and Mauritius, giving further credence to its legitimacy.FAQs

Does IUX offer mobile trading?

What is the minimum deposit at IUX?

Does IUX offer a no deposit bonus?

Is IUX a scam or legit?