Editor’s Verdict

Hantec Markets, founded in 2008, is a well-regulated UK-headquartered broker offering the MT4/MT5 trading platforms, its in-house Hantec Mobile App, and its Hantec Copy Trading App. The well-balanced asset selection exceeds 2,650 trading instruments, and the Hantec Markets Pro account features ultra-low trading fees from a $10 minimum deposit. Therefore, I consider Hantec Markets ideal for beginners and advanced traders, and my Hantec Markets review evaluated the competitiveness of its trading conditions. Should you trade with Hantec Markets?

Overview

Review

Headquarters | United Kingdom |

|---|---|

Regulators | ASIC, FCA, FSA, JFSA, VFSC |

Year Established | 2008 |

Execution Type(s) | No Dealing Desk |

Minimum Deposit | $10 |

Trading Platform(s) | MetaTrader 4, MetaTrader 5, Proprietary platform |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Hantec Markets, domiciled in London, UK, has been a market leader in Forex trading services for two decades. It is regulated by the Financial Conduct Authority (FCA) and the Financial Services Compensation Scheme (FSCS) on losses of up to $50,000.

Traders at Hantec Markets can trade either Forex or CFDs. CFDs are leveraged products which can be traded by paying only a fraction of the total contract value. The ability to go long or short gives maximum market agility, making CFDs popular amongst speculative traders who want to be able to adapt their strategy quickly.

In addition, gold and silver bullion are also traded at Hantec Markets and are offered with very low spreads.

Accounts

Hantec Markets offers three account types. All have identical trading conditions except for trading fees. I am missing volume-based rebates. A swap-free Islamic account and a demo account are also available.

My observations about the Hantec Markets account types:

- A $10 minimum deposit for all Hantec Markets account types.

- The Global and Cent accounts have high trading fees.

- The Pro account features competitive trading fees.

- All account types have a maximum leverage of 1:100 leverage with negative balance protection.

- The minimum trade size is 0.01 lots.

- PAMM accounts for traditional account management are available.

- Fund protection with insurance coverage of up to $500,000.

- Negative balance protection

Hantec Markets Demo Account

Demo trading does not grant exposure to the full range of trading psychology and can create unrealistic trading expectations. Therefore, I want to caution beginner traders against using demo trading as a full simulation tool. It is better used as an educational tool, to familiarize yourself with trading and a particular broker’s offering.

What stands out about the Hantec Markets demo account?

- MT4/MT5 demo accounts have a $10 default balance

- Demo accounts expire after 90 days

Unique Features

Hantec Markets offers its in-house Hantec Copy Trading App and PAMM accounts for traditional account management services. The Hantec Partnership programs include an IB program with up to 70% rebates and advanced withdrawals and an affiliate program with up to $1,000 CPA and bi-weekly payouts. Hantec Markets entered the retail prop trading scene with its Hantec Trader service, offering funded accounts between $2,000 and $200,000 with a maximum profit share of 90% and one-time evaluation fees between $39 and $999. Hantec Markets is also a prime liquidity provider for other brokers and financial firms.

Research & Education

Hantec Markets offers market research, including actionable trading recommendations with InsightsPro. It is an intuitive, data-backed tool trading companion featuring real-time insights, top trading signals, market sentiment analysis, and asset insights from within the Hantec Markets client portal. Traders can act on the AI-powered trading signals directly from the client portal if they enable one-click trading in MT5 or receive them via Telegram. The deep market insights include opportunity ranking and real-time charts. Therefore, I rank the research capabilities at Hantec Markets among the best in the industry.

What about education at Hantec Markets?

The Hantec Markets Learning Hub features dozens of articles divided into four courses. It also has dedicated sections for macroeconomics and risk management. The Hantec Markets blog includes additional educational content, while the Hantec Markets YouTube channel offers video tutorials, covers educational topics, and other market-relevant content.

My conclusion:

- Beginners should start with the quality Hantec Markets Learning Hub.

- Traders should also seek in-depth education from third parties, starting with trading. psychology and the relationship between leverage and risk management.

- Avoid paid-for courses and mentors.

Bonuses/Promotions

Bonuses and promotions are not offered by Hantec Markets.

Deposits/Withdrawals

The secure Hantec Markets client portal handles financial transactions for verified clients.

What are the key takeaways from the deposit and withdrawal process at Hantec Markets?

- The minimum deposit is $10 or a currency equivalent.

- Select payment processors have minimum and maximum transaction amounts.

- The trader’s geographic location determines payment processor availability, which includes bank wires, e-wallets, and cryptocurrencies.

- A minimum withdrawal amount depends on the payment processor.

- Hantec Markets does not list internal deposit or withdrawal fees.

- Third-party payment processing costs and currency conversion fees may apply.

- Hantec Markets claims internal processing times of five minutes.

The name on the payment processor and the trading account must match in compliance with AML regulations.

Customer Support

Customer Support Methods |    |

|---|---|

Support Hours | 24/5 |

Website Languages |          |

Hantec Markets offers 24/5 customer support via e-mail, phone, and live chat. Regrettably, an FAQ section is unavailable, but Hantec Markets explains its products and services well.

Conclusion

I like the trading environment at Hantec Markets for its competitive trading fees in the Pro account, low minimum deposit requirement, deep liquidity, well-balanced asset selection, and industry-leading market research backed by data and AI. The Hantec Copy Trading App is ideal for copy traders, and Hantec Trader is a competitive retail prop trading firm. Therefore, I rank Hantec Markets among the best Forex brokers for all traders.

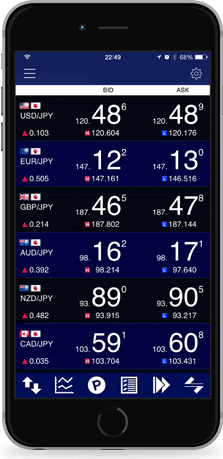

Trading Platforms

Traders get MT4/MT5 as powerful desktop clients and popular mobile apps. Traders may upgrade MT4 with 25,000+ custom indicators, templates, and EAs and MT5 with 10,000+. MT4/MT5 fully support algorithmic trading, and the cutting-edge research service from Hantec Markets, InsightsPro, integrates with MT5. Traders can also use the in-house developed Hantec Mobile App and Hantec Copy Trading App, which are available for Android and Apple devices.

MT4 MT5 cTrader Proprietary Platform Automated Trading Guaranteed Stop Loss Scalping Hedging OCO Orders Interest on Margin

FAQs

Is Hantec Markets regulated?

The FCA, ASIC, VFSC, FSA (Seychelles), HKGX, FSC, FSA (Japan) regulate Hantec Markets.

How long does it take to withdraw money from Hantec Markets?

The Hantec Markets finance department processes withdrawal requests within five minutes, but the processing time for funds to arrive depends on the payment processor. Some have instant to near-instant processing times, while others can take between one and ten business days.

Where is Hantec Markets located?

The Hantec Markets headquarters is in the UK. Hantec Markets also has offices in each of the countries where it has a regulatory license, plus St. Vincent and the Grenadines, where it operates an unregulated but duly registered brokerage, and Nigeria.

What is the minimum deposit for Hantec?

The Hantec Markets minimum deposit is $10 or a currency equivalent.

Who are Hantec Market’s competitors?

IG Markets, BlackBull Markets, IC Markets, RoboForex, Pepperstone, Exness, and Alpari rank among the Hantec Markets competitors.