eToro Fees Editor’s Verdict

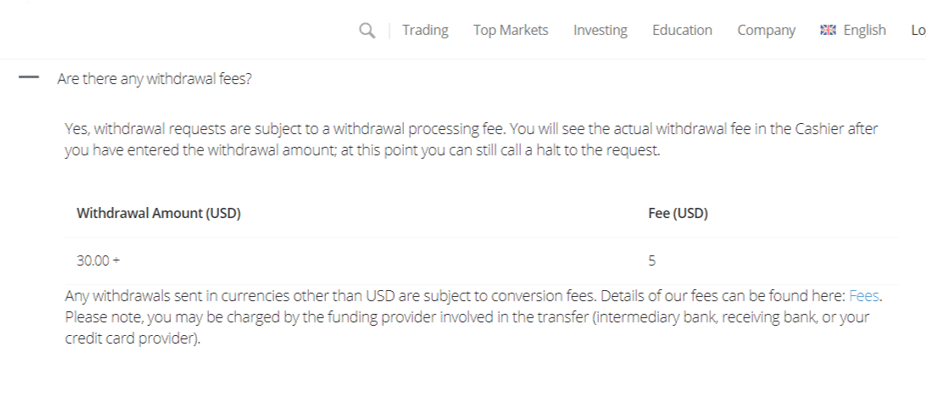

Each time a trader requests a withdrawal from eToro, this broker charges a fee. Unlike many other brokers, eToro charges a flat fee of $5, irrelevant of the payment processors, withdrawal amount, or geographical location.

The content does not apply to US users.

Overview

eToro charged $5 for converting Euros into US Dollars, an important fact to remember the next time you read no deposit fees. While the currency conversion fee is not a deposit fee, it does apply to all traders not using US Dollars.

Besides the failure rate of above 75%, the cost structure at eToro remains elevated as compared to most competitors. The higher trading fees, most dominantly visible in spreads, the difference between the bid and ask price, allow eToro to market their services with no additional costs.

Traders need to be aware than any broker operates a business and needs to ensure revenue growth. Therefore, traders must be cautious of any advertisement for a low-cost or no-cost service, as brokers usually compensate for the absence of visible fees elsewhere. This article will explain the eToro fees, provide examples and comparisons, and offer a conclusion to allow interested traders the ability to adequately assess if the products and services of eToro justify the high pricing environment.

There are types of fees, indirect and direct. At eToro, the indirect costs consist of a controversial withdrawal fee, non-existent at most brokers, a currency conversion cost, also not present at many brokers, and an inactivity fee. While indirect costs do not apply daily, direct trading costs have a more significant impact. They consist of spreads, commissions, and swap rates. Market makers like eToro usually have wider mark-ups between the bid and ask price, their primary source of revenue. Commissions apply on equity, index, and ETF CFDs or direct market access, in other words, not CFD trading. Swap rates are interest payments for leveraged overnight positions on the borrowed capital from the broker to maintain them.

eToro, founded in Israel in 2006 under the name RetailFX before rebranding as eToro in 2007, is a CFD and Forex broker focused on social trading. It is one of a few pioneers in this sub-sector, which remains popular with less-experienced, younger traders. It serves over 11,000,000 traders from 140 countries, making it the largest social trading platform and Forex broker in the market. At the core remains CopyTrader and CopyPortfolios, the social trading features that form the foundation of this broker. Another area where eToro attempts to carve out a leadership position is in cryptocurrencies. After releasing its cryptocurrency wallet in 2018, it acquired Dutch blockchain company Firmo, followed by the 2019 purchase of the Belgian crypto portfolio tracker and app developer Delta.

eToro Fees Explained

Every broker charges fees, which consist of direct costs related to trading like spreads, commissions, and swap rates, and indirect costs like withdrawal fees, currency conversions costs, and inactivity penalties. Traders cannot avoid direct trading costs, but the competitive broker industry offers plenty of choices, reducing the overall cost structure. Traders often ignore the costs and follow popular, regulated brokers with the best marketing team. They ignore the negative impacts on their profitability, fail to educate themselves properly, and rush to make a deposit, chase a bonus, and have not viable strategy to follow. eToro fees are among the highest in the industry, which this social trading broker justifies with its product and services portfolio.

This article will examine the below eToro fees, give examples, and compare them to competing brokers:

- eToro Withdrawal Fee (indirect trading cost)

- Currency Conversion Fee (indirect trading cost)

- Inactivity Fee (indirect trading cost)

- Spread Fees (direct trading cost)

- Commissions (direct trading cost)

- Overnight Fees / Swap Rates (direct trading cost)

Before dissecting the fees, explaining what they are, and comparing them, let us take a quick look at CopyTrader and CopyPortfolios, as they are the primary reason eToro charges significantly higher spreads across all assets. CopyTrader forms the core of operations at eToro. It allows traders to copy others, but while eToro touts no additional costs and management fees, they are included in the difference between the bid and ask price, also referred to as a spread. Since this broker claims over 11,000,000 traders, the pool from where traders can copy is tremendous, representing an invaluable asset for social traders. The drawback is that over 75% of traders operate their portfolios at a loss. While, in theory, this leaves 2,750,000 profitable ones (11,000,000 multiplied by 0.25, representing the 25% not losing money at eToro), most of them lack consistency. On a positive note, the Top 50 copied traders for 2019 averaged a respectable annualized gain of 29.10%.

CopyPortfolios is a similar service but offers theme-based portfolios with copied capital managed by the eToro investment committee. It aims to add professional supervision. The team continuously monitors, analyzes, and rebalances all portfolios, and traders can compare this to asset management at traditional brokers and investment firms. eToro invites strategic partners and professional firms to create their CopyPortfolios with them for traders to follow. Since there are no management or performance fees, successful portfolio managers have no incentive to do so. The minimum investment is $5,000 versus $200 for CopyTrader accounts. Swap rates apply, which accumulate daily, a fact to consider for CopyPortfolios, intended for medium-to-long-term investors. Unleveraged buy positions do not face any costs.

eToro Indirect Trading Cost Overview and Comparison

eToro | NAGA | FXTM | PepperStone | FXCM | Vantae | Markets | |

Withdrawal | $5 | $10 | 3.2% | $0 | $0 | $0 | $0 |

Bank Wires | $5 | $10 | $30 | $20 | $25 - | $20 | $20 |

Currency Conversion | 150 points | o points | o points | 1% | 10 -150 points | o points | o points |

Inactivity Fee | $10 per month | $0 | $5 per month | $0 | $50 per year | $0 | $0 |

eToro Direct Trading Cost Overview and Comparison

eToro | Broker offering 0.01 pips Spread Plus a Commission | |

EUR/USD Bid Price | 1.17850 | 1.17850 |

EUR/USD Ask Price | 1.17860 | 1.17851 |

Spread | 1.0 pips | 0.01 pips |

Pip Value | $10.00 | $10.00 |

Loss After Opening Position | $10.00 | $1.00 |

Commission | $0 | $3.00 |

Total Loss Without Price Movement | $10.00 | $4.00 |

eToro Withdrawal Fee

The withdrawal fee is one of the easiest ones to understand. Each time a trader requests a withdrawal from eToro, this broker charges a fee. Unlike many other brokers, eToro charges a flat fee of $5, irrelevant of the payment processors, withdrawal amount, or geographical location. While this may sound like an excellent and fair approach, traders need to understand that third-party costs still apply, as they are beyond the control of eToro. Another essential fact to consider is that most well-established brokers do not charge any internal withdrawal fees, except for bank wires, where costs usually range between $20 to $30. At eToro, they are $5, an advantage at this broker.

Given the high costs of bank wires, most traders do not use them, diminishing the sole payment processor where eToro offers a lower fee, but only if evaluated on a stand-alone basis. Upon completion of the assessment of the entire withdrawal environment, eToro has the most expensive one. The minimum withdrawal is $30, and only verified accounts may request one. Traders with an account balance below $30 are unable to withdraw funds, unless they wish to close it, as a minimum of $35 is required, the $30 withdrawal request plus the $5 eToro withdrawal fee.

Some argue that withdrawing small amounts should be avoided, but it depends on personal circumstances. Over 75% of traders are not profitable, and most of those who are, ignore the importance of portfolio building. Generally, repetitive small withdrawals are not beneficiary, especially not at eToro due to excessive and unnecessary internal fees. The situation materially worsens if the currency of the payment processor account differs from the trading account base currency, which is always US Dollars at eToro. In that case, eToro charges a currency conversion fee explained below.

eToro charges a $5 flat fee for withdrawal, a cost non-existent at most brokers.

Here is an example of a US Dollar to US Dollar withdrawal.

eToro Account Balance Before Withdrawal | $1,163.50 |

eToro Internal Fee | $5.00 |

eToro Account Balance After Fee | $1,158.50 |

EUR/USD Ask Price | 1.1786 |

eToro Currency Conversion | 0.0050 (50 pips) |

eToro EUR/USD Exchange Rate | 1.1836 (1.1786 + 0.0050) |

Withdrawal Amount | €978.79 ($1,158.50 / 1.1836) |

eToro Currency Conversion Fee

eToro only offer trading accounts in US Dollars, which adds to their indirect trading cost revenue stream. Each time a trader makes a deposit or requests a withdrawal fee, a currency conversion fee applies. Some brokers charge for this service, others do not and exchange the funds at the Forex markets spot rates without additional costs. A growing number of brokers also offer accounts in multiple currencies to make it easier for international traders to manage their capital.

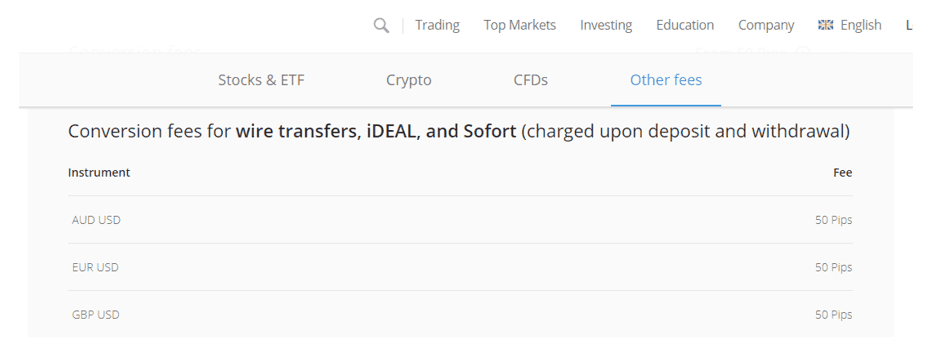

There is a two-tier conversion fee structure at eToro. The first one is for bank wires, iDEAL, and Sofort. All three are bank-related, and most international traders do not use bank wires, as the overall costs are high, while it can take up to ten business days for funds to arrive. eToro optimized its services for bank transactions, where a 50.0 pips currency conversion fee exists for transactions in Australian Dollars, Euros, and British Pounds. A pip is the fourth decimal for most currencies except the Japanese Yen, which has only three decimals in its quote. Therefore, 1.0 pip equals 0.0001. For example, if the GBP/USD bid price, the price at which you sell Euros for US Dollars, equals 1.1785, a move to up to 1.1786, or a move down to 1.1784 is equivalent to a 1.0 pip move. For your information, the fifth decimal quoted is a pipette, where ten pipettes equal one pip.

eToro charge a 50 pips currency conversion fee for deposits and withdrawals made via bank wires, iDEAL, and Sofort in Australian Dollars, Euros, and British Pounds.

Here is an example of depositing €1,000 into an eToro account via bank wire.

Deposit Amount | €1,000.00 |

EUR/USD Bid Price | 1.1785 |

eToro Currency Conversion | 0.0150 (150 pips) |

eToro EUR/USD Exchange Rate | 1.1635 (1.1785 - 0.0150) |

Deposit Amount | $1,163.50 (€1,000.00 * 1.1635) |

eToro charged $5 for converting Euros into US Dollars, an important fact to remember the next time you read no deposit fees. While the currency conversion fee is not a deposit fee, it does apply to all traders not using US Dollars. Assume you change your mind and ask for a withdrawal. When selling US Dollars for Euros, the ask price of the EUR/USD applies, which is always higher. At eToro, the spread is 1.0 pips, and the currency conversion fee 0.0050 pips.

So, if the bid price is 1.1785, the ask price is 1.1786, since eToro lists a 1.0 pip spread. In our example, when you withdraw funds, eToro will sell your US Dollars and buy Euros. Do not forget the $5 withdrawal fee and the 50.0 pips currency conversion cost. You will have to add the 0.0050 pips to the ask price of 1.1786 to reflect the additional charges, then divide 1.1836 by the US Dollar amount for conversion.

Here is an example of the process.

eToro Account Balance Before Withdrawal | $1,173.50 |

eToro Internal Fee | $5.00 |

eToro Account Balance After Fee | $1,168.50 |

EUR/USD Ask Price | 1.1786 |

eToro Currency Conversion | 0.0050 (50 pips) |

eToro EUR/USD Exchange Rate | 1.1836 (1.1786 + 0.0050) |

Withdrawal Amount | €987.24 ($1,168.50 / 1.1836) |

One round trip at eToro will cost you €12.76 if using €1,000.00 via bank wire. It includes a deposit and withdrawal assuming no change in the exchange rate, which is nearly impossible to time, and without bank fees.

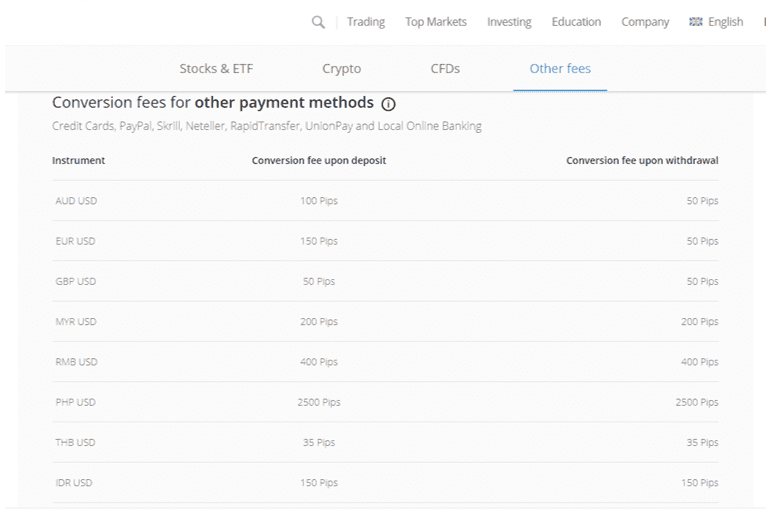

eToro charges higher fees, depending on the currency, with all other payment options, resulting in higher costs.

Below is an example of the same deposit and withdrawal procedure as above. The only difference is using a credit card instead of a bank wire. Note that even local online bank transfers face the same costs and do not fall into the bank wire category. Regrettably, eToro maintains an unnecessarily intricate structure, which can confuse inexperienced retail traders before placing their first trade with this market-leading social-trading broker.

Here is an example of depositing €1,000 into an eToro account via a credit card.

Deposit Amount | €1,000.00 |

EUR/USD Bid Price | 1.1785 |

eToro Currency Conversion | 0.0050 (50 pips) |

eToro EUR/USD Exchange Rate | 1.1735 (1.1785 - 0.0050) |

Deposit Amount | $1,173.50 (€1,000.00 * 1.1735) |

Here is the withdrawal process.

eToro Account Balance Before Withdrawal | $1,000 |

Withdrawal Amount | |

eToro Internal Fee | $5 |

Total Amount Deducted | $35 |

eToro Account Balance After Withdrawal | $965 |

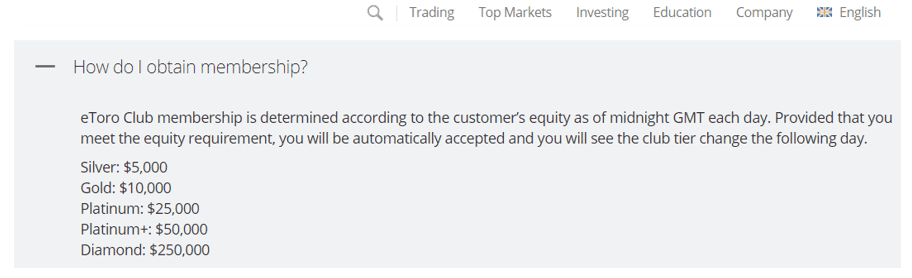

The costs for the same transactions increased from €12.76 to €21.21 by using a credit card rather than a bank wire. Active traders with Platinum membership in the eToro club are exempt from currency conversion and withdrawal fees.

Platinum membership requires a minimum equity balance of $25,000, out of reach for the majority of retail traders.

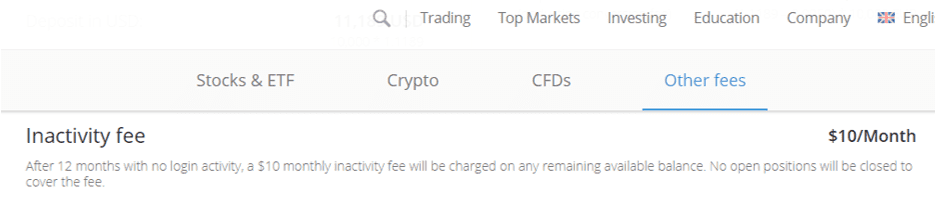

eToro Inactivity Fees

After twelve months of inactivity, eToro levies a $10 inactivity fee per month until the trader logs into the account, or the balance reaches $0. Most traders are unlikely to keep a funded trading account inactive for twelve months, avoiding this unnecessary cost. No open positions will be closed to cover this fee.

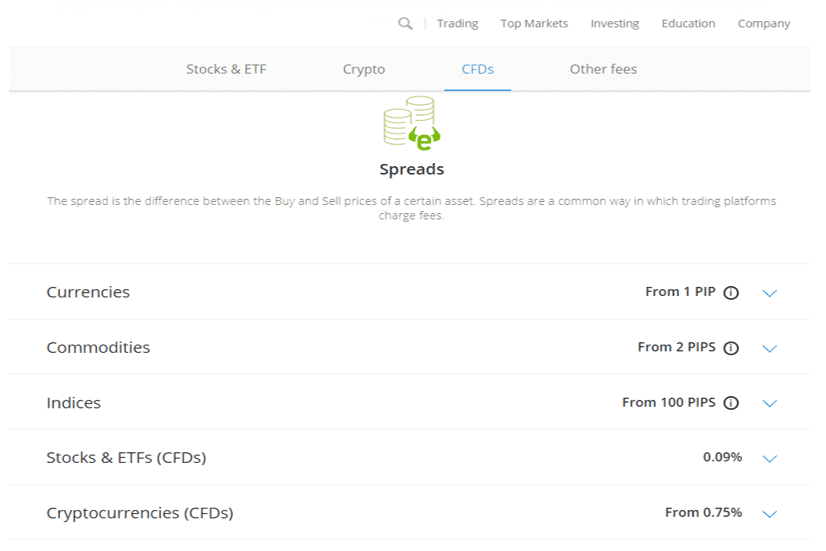

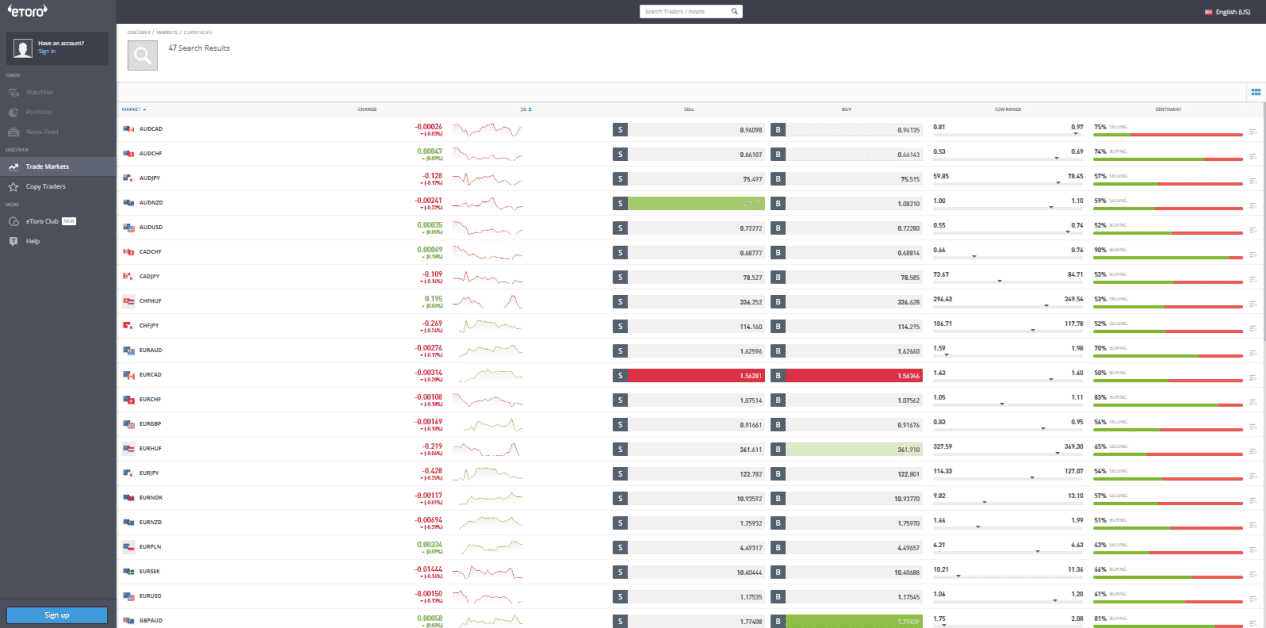

eToro Spread Fees

A spread refers to the difference between the bid (sell) and ask (buy) price in any quote. For example, the EUR/USD quote is 1.1785 / 1.1786. It is the most common way for brokers to earn money and will have a significant long-term impact on your portfolio. The ask price is always above the bid price, and by default, when you enter any trade, you start with a loss without any price movement. There are two types of spreads, a fixed one that does not move per market conditions, and a variable one, which fluctuated according to supply and demand. eToro is a market maker and decides how much it wants to charge traders. The EUR/USD is the most liquid currency pair and generally commands the lowest price difference between bid/ask. eToro quotes this pair with 1.0 pips spread, while the raw spread, as set by the market, is between 0.00 pips and 0.01 pips.

eToro Forex mark-ups are average as compared to other market makers, competitive ones would be between 0.4 pips to 0.6 pips, and raw spreads of 0.0 pips generally come with a commission cost. Other assets like equity and index CFDs, commodities, and cryptocurrencies carry an excessive mark-up, placing traders at a distinct disadvantage as compared to other brokers. For example, eToro quotes chip maker AMD with a $0.15 spread, while competitors offer the same CFD for $0.03. Gold at eToro is as low as 45.0 pips versus 1.0 pips or the S&P 500 at 75.0 pips versus 0.60 pips. Cryptocurrencies, like Bitcoin, are displayed as percentages, with Bitcoin at 0.75%, or if the BTC/USD trades at 11,000, the spread equals 82.5 pips versus 5.00 pips at competitive brokers.

eToro lists minimum spreads, but under Stocks & ETFs (CFDs), it notes 0.09%, which is not the spread but the commission, explained in the next section.

Here is a snapshot of spreads on equity CFDs, differing per asset. A smaller difference between the bid and ask price generally suggests higher liquidity.

Forex spreads at eToro are average, but generally above 1.0 pips, a typical mark-up for a market maker.

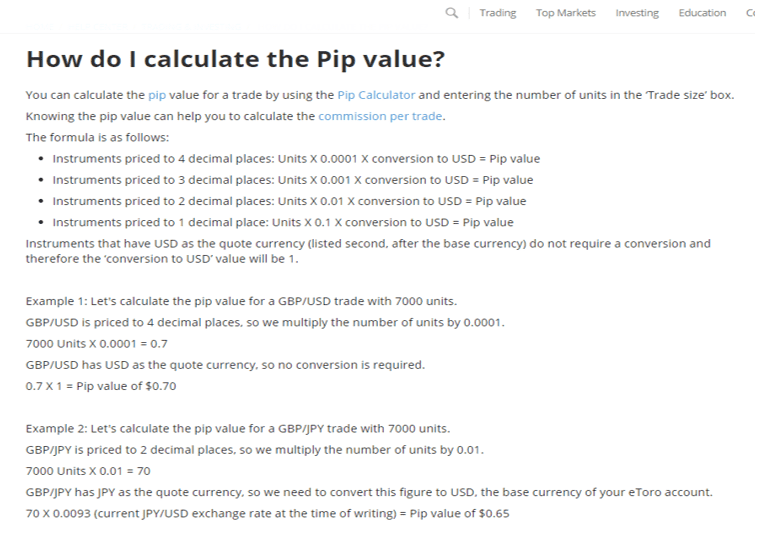

Knowing the pip value is essential for proper risk management. eToro explains how to calculate the pip value on its website.

Here is an example of 100,000 units (1.0 standard lot) of the EUR/USD versus a broker offering raw spreads with a commission charge.

eToro | NAGA | FXTM | Pepper Stone | FXCM | Vantage | Markets | |

(EUR/USO) | 1.00 p•ps | 1.20 p•ps | 0.01 p•ps | 0.00 p•ps | 1.4 p•ps | 0.00 p•ps | 0.00 p•ps |

Commodities (GoId) | 45.00 p•ps | 35.00 p•ps | 9.00 p•ps | 0.60 p•ps | 0.81 p•ps | 1.00 p•ps | 0.00 p•ps |

Equity CFDs (Commission) | 0.09% | 0.20% | $4 - $20 per 1М | Free | $10 рег ticket | Free | |

Index CFOs (S&P 500) | 75.00 p•ps | 0.80 p•ps | 10.00 p•ps | о.ао p•ps | 0.45 p•ps | 0.00 p•ps | 0.60 p•ps |

Crypto (Bitcoin) | 0.75% | 62.50 p•ps | 200.00 p•ps | 10.00 p•ps | 26.75 p•ps | 5.00 p•ps |

The pip value per 1.0 standard lot is usually $10 or all currency pairs where the US Dollar is the quote currency, the second on in a currency pair. The higher the spread, the higher the initial loss when opening a position. The above table illustrates the difference between a market maker model and an ECN (electronic communication network) commission-based model, where traders receive raw spreads as dictated by supply/demand. ECN brokers charge a fee for access, but even with the additional cost, the overall trading cost is lower.

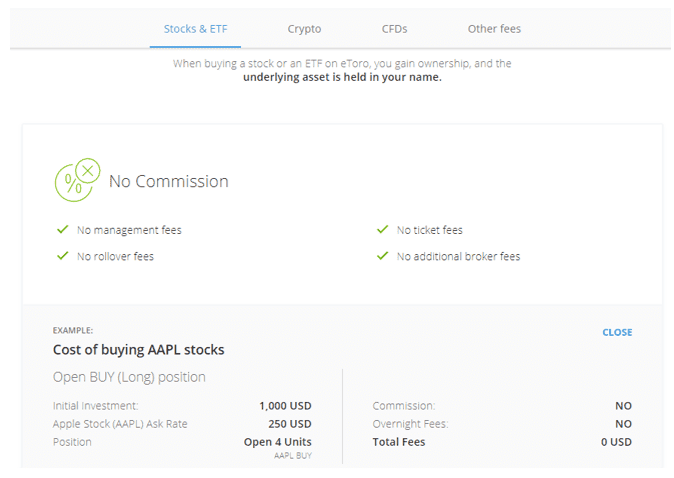

eToro Commissions

eToro advertised commission-free equity trades, but they apply to unleveraged buy orders only. While this sounds appealing on paper, the absence of costs is countered by excessive spreads, which can make the overall cost higher, following the example above with the EUR/USD. On leveraged positions, buy and sell, eToro charges a 0.09% commission. It is lower than many other brokers if evaluated on a stand-alone basis, but due to the high mark-up on assets, trading costs remain at the top-end as compared to competitors.

Stock trading for unleveraged buy orders is commission-free, but excessive spreads make it more expensive than commission-based brokers.

CFDs trades face a 0.09% commission, which applies to the total value of the order. The more you trade, the more you will pay in fees. High-frequency traders feel a more severe impact than low-frequency ones. Trading commissions exist at most brokers and often carry a minimum if the percentage-based cost is below a certain threshold. Over the years, the fee structure has decreased, with more brokers advertising commission-free trading. Make sure to take a look at the spreads and compare it to a commission-based broker, do the math, and then determine if you are getting a more cost-effective offer or end up paying more.

Here is an example of a commission-based trade at eToro.

Traded Asset | Microsoft tMSFT) |

eToro Ask Price | $202.51 |

Volume | 10 CFDS |

TotaI | $2,О25.Б1 (10 CFDS * МК расе) |

eToro Commission | 0.09%0' $1.дд (92,025.51 * 00009) |

While the commission is low, when the high spread applies, the opening loss without price movement magnifies. The MSFT spread at eToro is $0.32. Since the ask price is $202.51, the bid price is $202.19. Therefore, the opening loss of this trader without any price movement would be $3.20, the unit size multiplied by $0.32. Together with the commission cost, it is $5.03. MSFT will need to advance by $0.51, added to the bid price of $202.19, for this trade to reach break-even at $202.70. It does not account for the commission when closing the position, and if you keep it open overnight, swap rates, also knowns as overnight rates, will apply, as discussed in the next section.

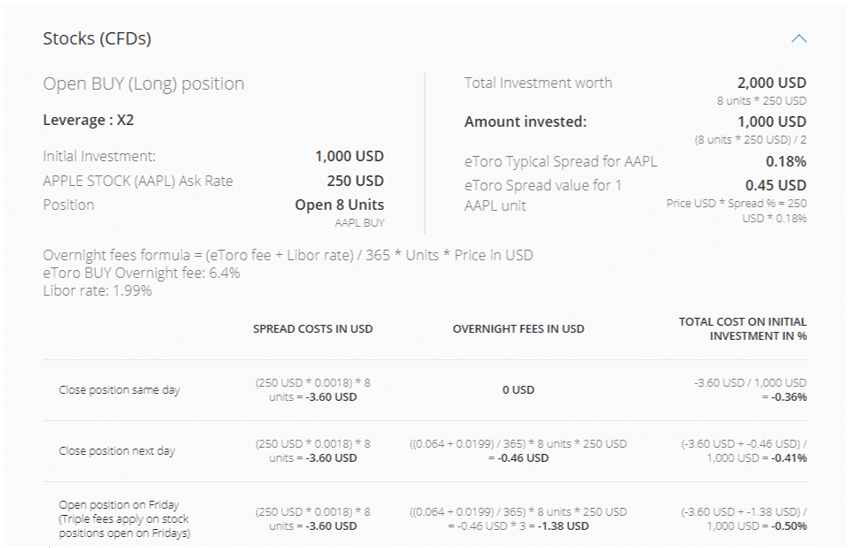

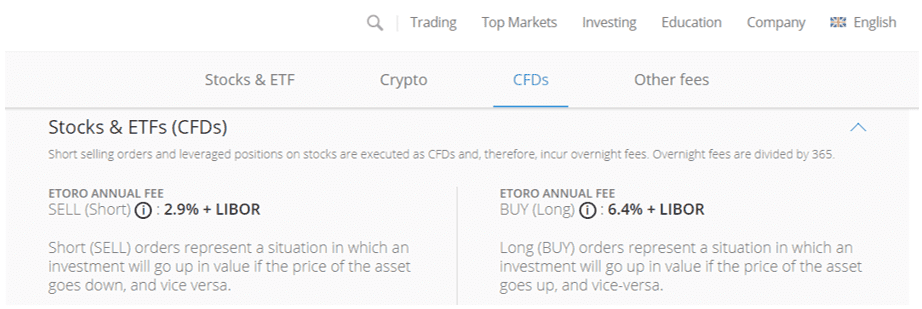

eToro Overnight Fees

Swap rates, also referred to as overnight fees or rollover costs, apply to leveraged overnight positions. They are interest rate charges for the money you borrow from your broker. For example, if you want to trade $1,000 on eToro and leverage it 1:5, you will control a position worth $5,000. On the $4,000 you borrowed; you will pay a daily fee. It is a typical cost at all brokers and a staple of leveraged trading. eToro lists all charges on their website, which can change as they include LIBOR, the London Inter-Bank Offered Rate, which is what banks charge each other to borrow funds overnight.

eToro uses LIBOR and the levies its cost on top of that, a different one for long and short positions. It may sound confusing at first but is very straightforward.

Here are the items you need to be familiar with to understand swap rates:

- A different fee exists for buy and sell orders, set by the broker, and applied to LIBOR.

- Except for cryptocurrencies, on Saturdays and Sundays, no costs are debited from your account. A weekend fee is deducted either on Wednesday or Friday, for most assets, at three times the daily charge. Some assets like Saudi Arabian equities face this on Thursdays.

- The eToro fee is an annualized one, so the daily is divided by 365 days.

- Swap rates apply to the borrowed amount only, not the total investment.

- The longer you keep your position open, the more you pay in fees. Leveraged trading is ideal for short-term strategies, while long-term traders need to consider the costs of borrowing money.

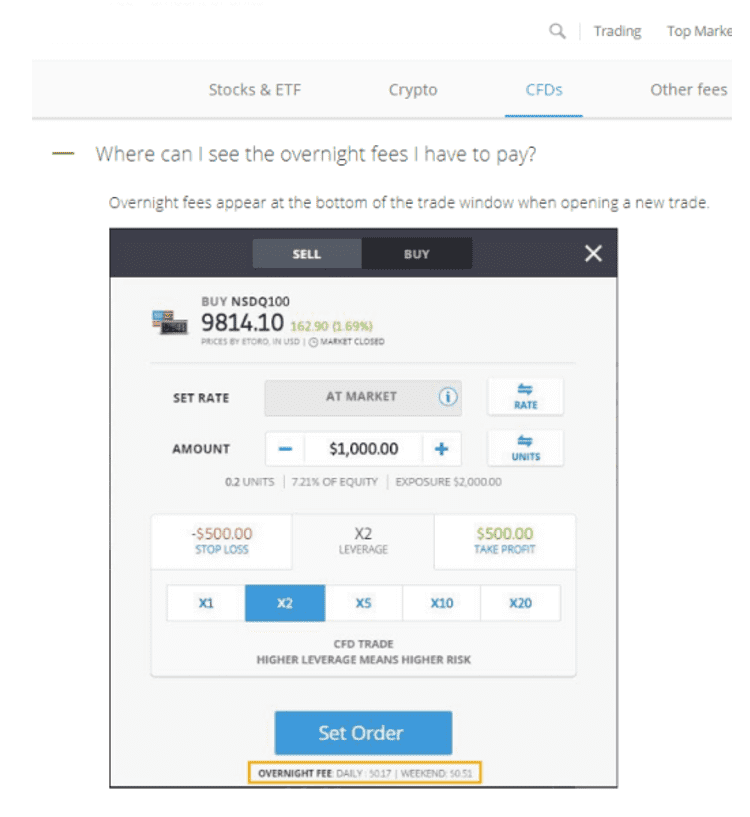

eToro displays the daily and weekend swap rates on the deal ticket. The history tab of the portfolio page lists all paid fees.

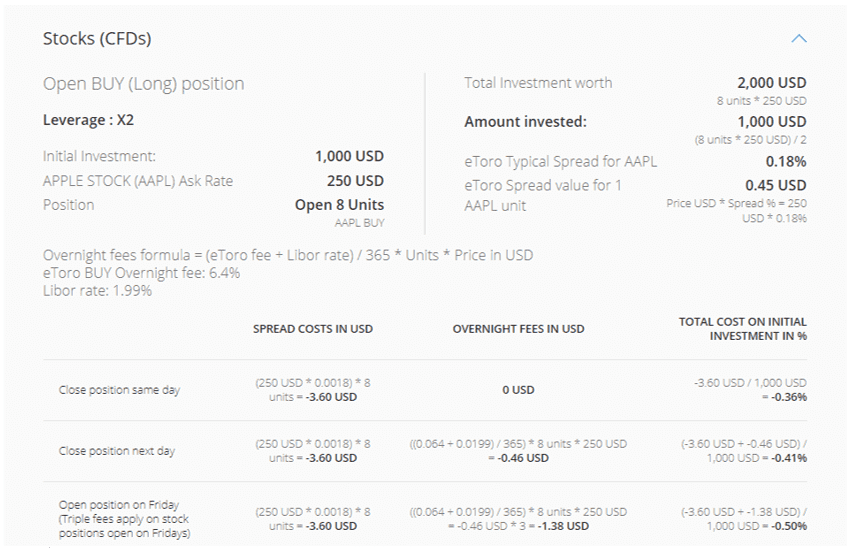

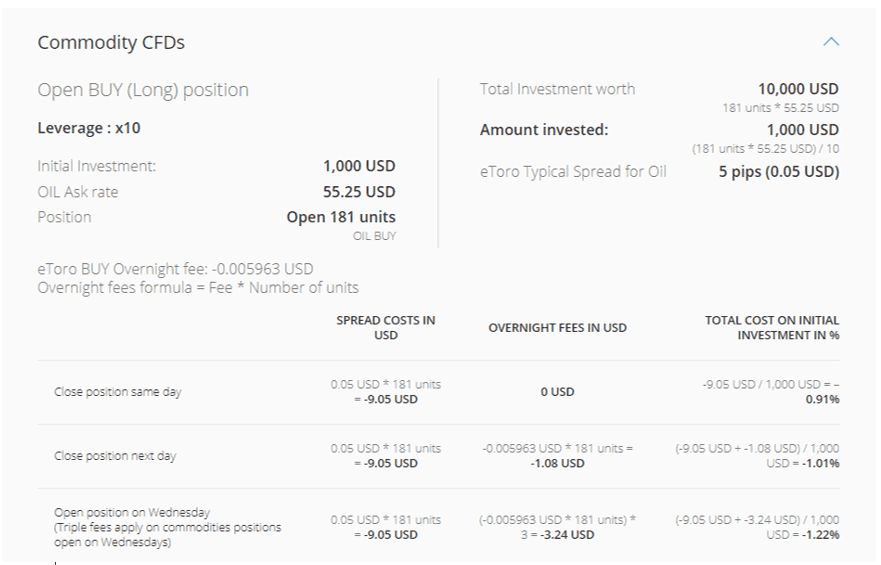

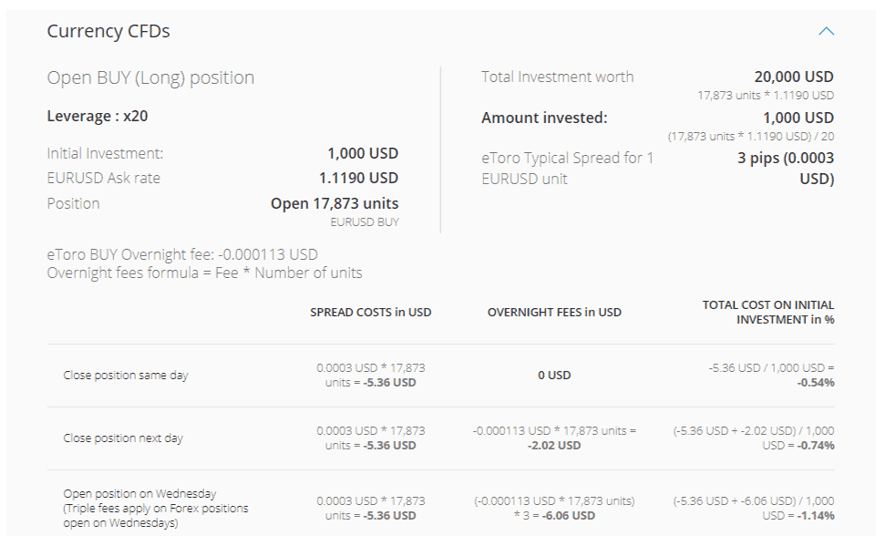

Below are six well-described examples from eToro to ensure you fully understand how swap rates can impact your bottom line. The first example is for equity CFDs.

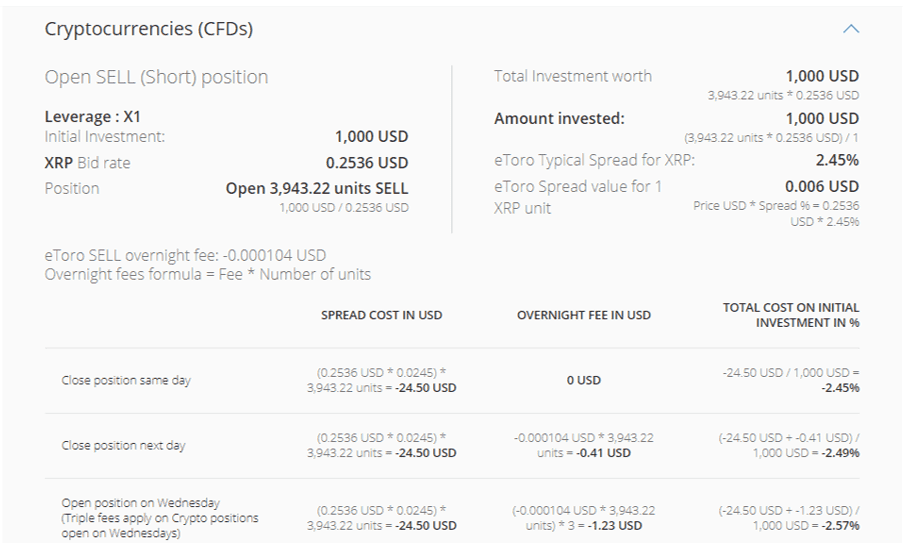

The second one for cryptocurrencies.

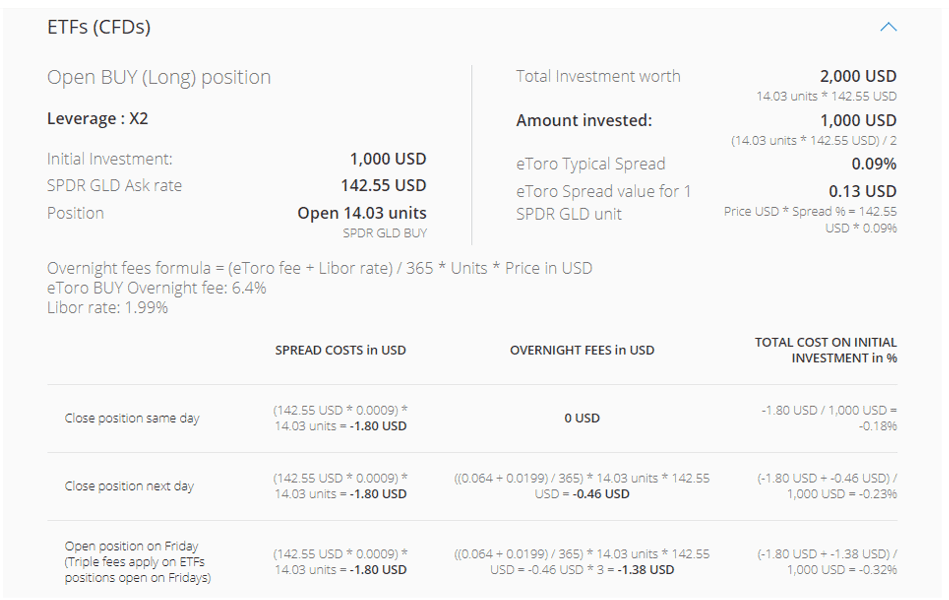

The third one for ETFs.

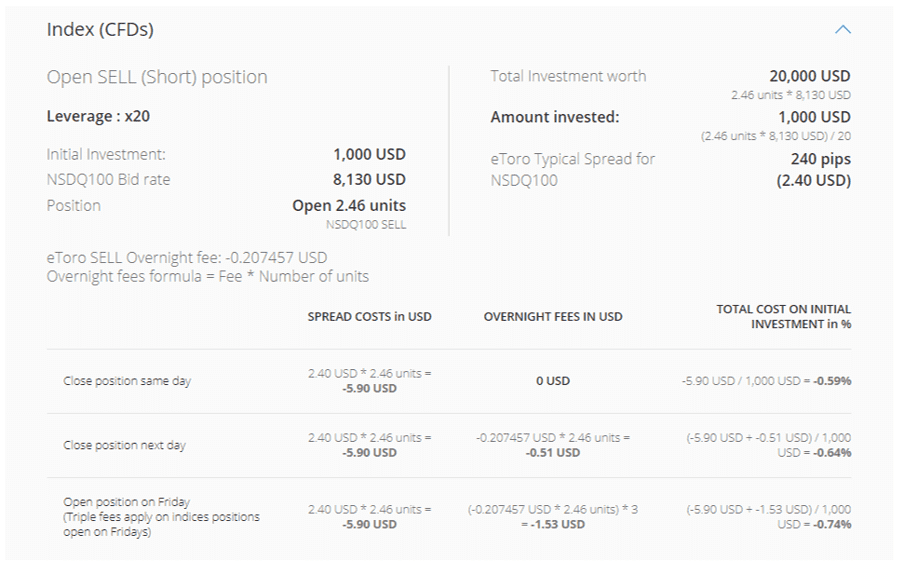

The fourth one is for index CFDs.

The fifth one for commodities.

The final one for currencies.

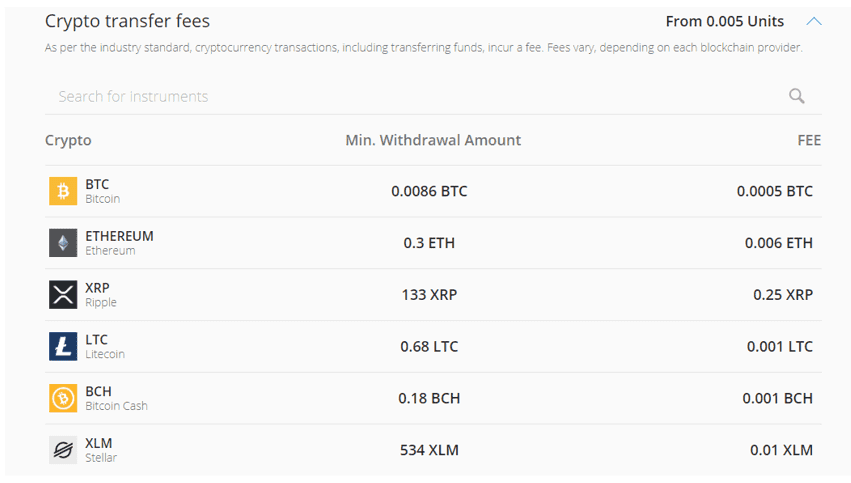

Cryptocurrency traders must also consider transfer fees for using the applicable blockchain.

eToro Fees Calculator

eToro does not provide any fees calculator but explains all costs in detail. Traders can easily create one in a spreadsheet if they like, using this article as a guide together with the eToro website, providing some insight on what to expect.

eToro Fees Conclusion

eToro remains one of the most expensive brokers, but trading costs are not the only thing to consider. Various types of traders require a different infrastructure, and eToro provides a market-leading service for social trading. CopyTrader and CopyPortfolios represent the core at eToro, the asset selection above 2,000 is excellent, while the trading platform is easy to use, even for new traders. Signal providers may qualify for the Popular Investor Program and earn additional income if they meet given metrics.

Social traders have access to the deepest pool of traders at eToro, but over 75% do operate their portfolios at a loss. Numerous tools exist to help identify the right trader to follow, and eToro continues to improve on its overall product and services portfolio, acquires relevant companies, and expands into new markets. When evaluating this broker, make sure that you require the social trading services provided by eToro. Otherwise, you pay for something that you will not use. Traders who are not interested in social trading will find a significantly better-priced broker elsewhere. Those who favor copying others with a few simple clicks will find eToro a suitable market-leading choice.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest.

This is a high-risk investment and you should not expect to be protected if something goes wrong.

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.